Insight Focus

- Sugar prices tend to move with other Ags.

- These Ags all face the same macro/external pressures, such as USD strength.

- But sugar is also related to energy via ethanol.

Sugar As Energy Or A Soft Commodity

Sugar prices are related to both agricultural commodities (Ags) and energy. The link between Ags is quite clear but the link between energy is less apparent.

Ags

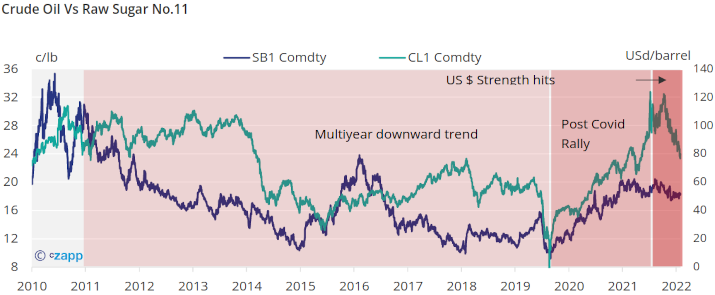

All Ags face the same macro/external pressures regardless of their fundamentals. Today the big talking point is the strength in the USD. All other things being equal, a stronger Dollar is negative for commodities.

Exporters earn more revenue in local currency terms, while imports become more expensive, which can hurt demand. Cheaper supply and lower demand are negative for commodity prices.

Source: Refinitiv Eikon

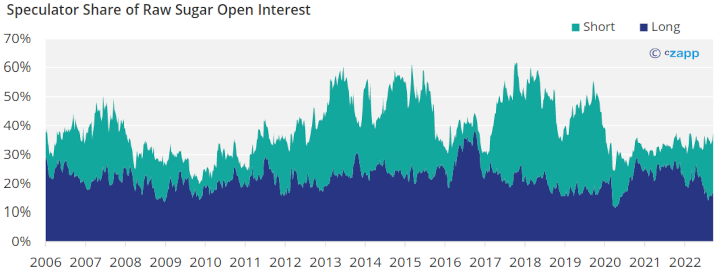

Prices of similar commodities are also more likely to move in parallel because speculator involvement is so high. For example at any one time, speculators can account for 40% or more of sugar’s open interest. Many speculators will hold positions based off their wider outlook for commodities rather than focusing on an individual commodities performance.

Energy

This link comes via sucrose’s role as a feedstock for ethanol and then through ethanol’s competition against gasoline.

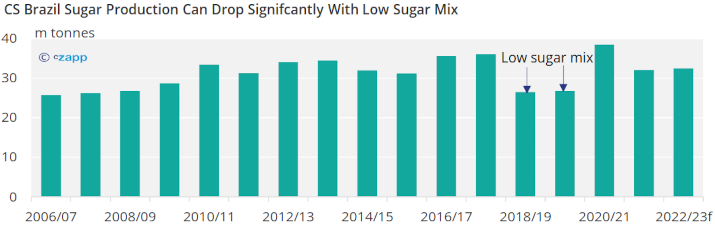

Although several countries now produce ethanol from sugar beet or sugarcane, CS Brazil remains the most important for sugar prices; their sugar production can swing by as much 10m tonnes in a season depending on relative ethanol and sugar prices.

To learn more about Brazil’s ethanol industry, read our explainer.

In CS Brazil, motorists can fill their cars with either ethanol or gasoline: when ethanol prices are more than 70% of gasoline they should choose gasoline; when ethanol prices are less than this they choose ethanol.

This means that rising oil prices are likely to increase ethanol demand (and prices). Sugar prices then need to adjust higher to remain competitive against ethanol.

Price data over 10 years shows that there is a moderate positive relationship (correlation of 0.6) between raw sugar futures and oil prices.

Graphically, this is a lot more visible since 2019.