Insight Focus

- White sugar demand is still strong.

- Supply is struggling for many reasons.

- This is pushing the white premium to unusually high levels.

Up, Up and Away

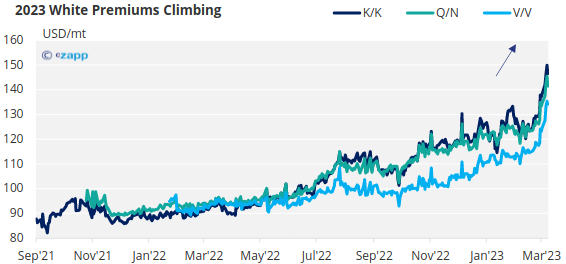

Sugar’s 2023 white premiums, which represent the difference between raw sugar and refined sugar prices, have been climbing for several months. In recent days this has accelerated and the K/K (May’23/May’23) has reached over 145 USD/mt.

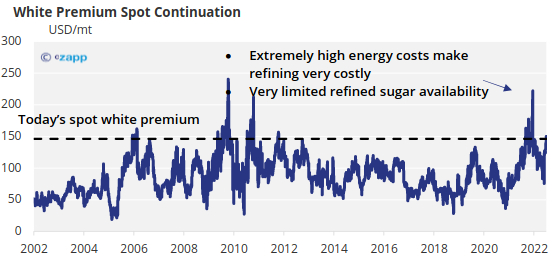

This is higher than the spot white premium has traded for much of the last 20 years. The only occasions it has been higher were just before a futures contract expiry.

What’s Happening This Time?

Refined sugar prices are now the highest since July 2012, up more than 15% in 11 weeks and look to have broken above their 2022 sideways channel.

We think this is because demand for white sugar is robust, yet supply is struggling due to many different factors. We also want to flag the potential for a squeeze of the May’23 futures expiry, which occurs in the middle of April. With such limited deliverable sugar, it’s possible that one or more parties are forced to buy back open futures if they don’t have the physical sugar. This happened ahead of the October’22 expiry and pushed the white premium briefly over 200 USD/mt.

Source: Refinitiv Eikon

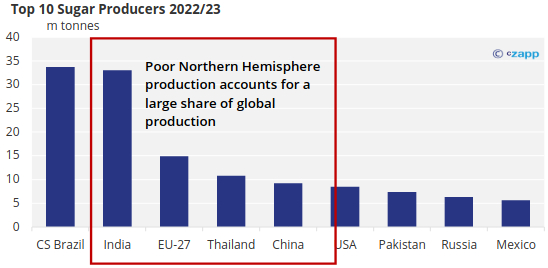

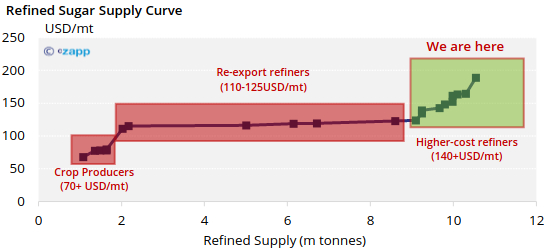

The cheapest source of refined and higher colour white sugar comes from crop producers including Europe, Thailand India and China. These Northern hemisphere crops, which account for almost 40% of global production, are coming to an end and it’s now clear that production is worse than initially expected.

Worse still for market sentiment, we don’t think supply from these key producers will be any better next year:

European farmers aren’t planting more beet despite much higher prices;

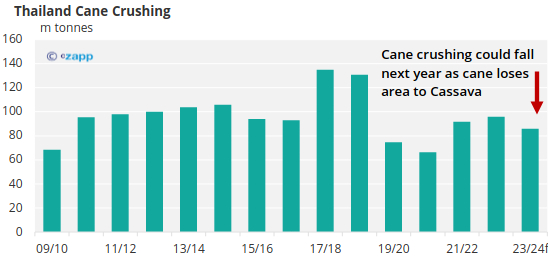

- Thailand’s cane area is likely to fall next year as there is strong competition from Cassava;

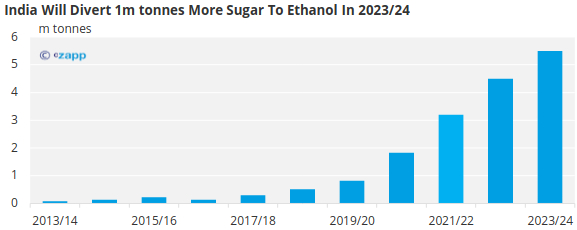

- India will divert an additional 1m tonnes of sugar next year.

Normally, limited supply from crop producers creates an opportunity for the world’s re-export/toll refiners to boost their output. This signal comes from a stronger white premium (above 110 USD/mt at todays’ prices). But what happens when these refiners can’t react?

That’s the situation we find ourselves in today. The largest refinery in the world in Dubai is only operating at about 40% capacity for a variety of reasons whilst export bans have been preventing Algerian refiners from selling to the world market. A similar export ban may soon affect Egyptian refiners.

With more supply needed, the last option is for prices to incentivise discretionary (“higher cost”) refiners. These are part time refiners who don’t usually re-export white sugar, hence the higher cost of doing so. Typical examples include China, Bangladesh, Malaysia, Indonesia, and EU refineries. However, many of these origins are unlikely to look to export given high prices and limited supply in their domestic markets.

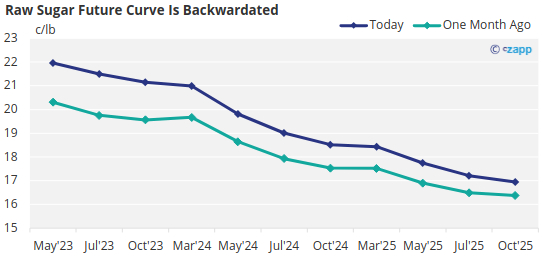

For refiners still operating, the backwardation of raw sugar prices makes life difficult – in simple terms buying raw sugar today is more expensive than at a later date. This is an incentive for re-export refineries to defer their raw sugar demand and subsequent refined sugar availability which is only adding to problems.

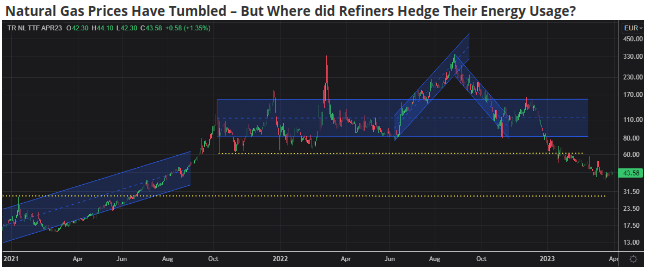

A final point to consider: whilst energy prices have thankfully fallen significantly, it’s still possible that some refineries bought energy at more expensive prices as part of their energy hedging which would make their costs (and white premium required) higher than we are estimating on a spot basis.

Source: Refinitiv Eikon