Insight Focus

- India’s sugar production to reach 31m tonnes in 2023/24.

- Cane price increases for 2024/25 season.

- Mills face poor returns due to flat domestic sugar market and export restrictions.

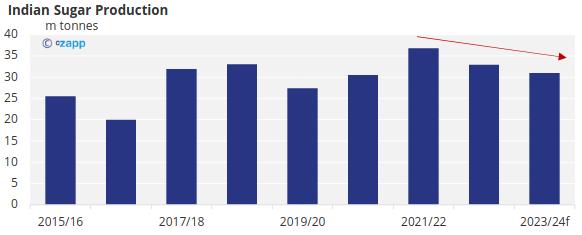

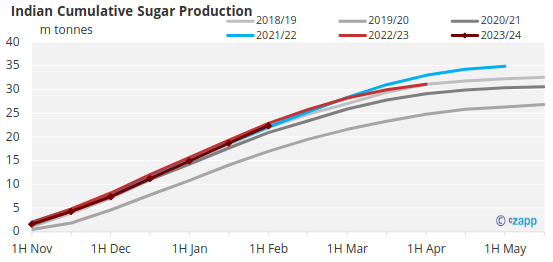

India’s sugar production is set to reach around 31m tonnes (net of ethanol) in the 2023/24 season. This would be the second successive year of sugar production decline, but better than the industry feared back at the start of cane crushing.

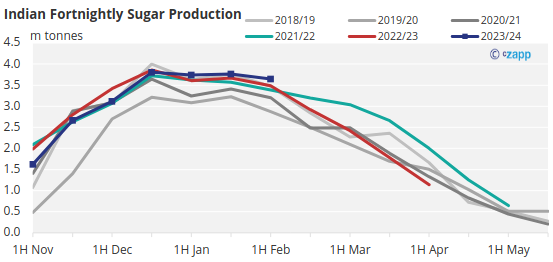

Indian sugar production has now peaked and cumulative output to the middle of February was 22.4m tonnes.

While the increased sugar production should be good news for mills, it’s instead brought challenges.

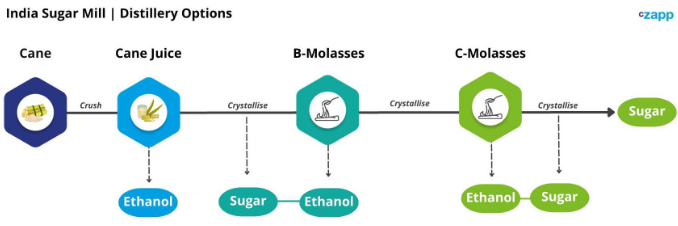

Concerned by reports that this year’s sugar production could be extremely low, the government brought in new restrictions on the sector. New export approvals have stopped, meaning mills can’t ship sugar to the world market. Mills also face restrictions on the amount of sucrose they can divert to ethanol production; no more than 1.7m tonnes, with C molasses preferred over B molasses and cane juice.

Worse, the government has just announced a further increase to cane prices in 2024/25 to INR 34/mt from INR 31.5/mt. Yet the Indian domestic sugar market remains flat. This all amounts to a squeeze on Indian mills cash flow, if not now then in the coming months. We understand that they are seeking an increase in the minimum domestic price for sugar, which has been unchanged at INR 31/kg for nearly 5 years.

This will need to come quickly. There’s a general election in India in April/May and the model code of conduct will come into force in at some point in March. This means no new laws can be enacted to ensure the fairness of the elections.