Insight Focus

- Indian sugar exports are unlikely before May 2024.

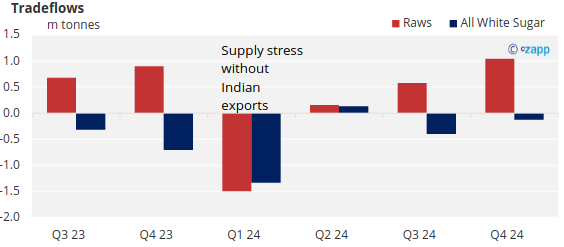

- This puts global sugar supply under severe stress in H1’24.

- We think India may be able to export 2m tonnes in 2023/24.

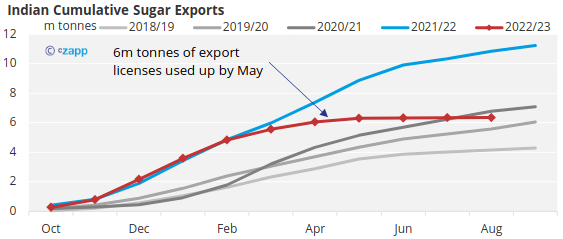

Sugar are mills in India are not able to export sugar today. This season’s export licences (6m tonnes) have already been used and the government is not issuing more.

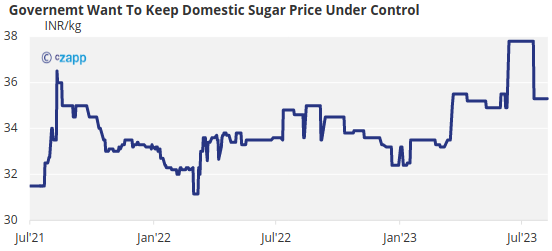

Food security is a very important issue for the government, especially in the run up to elections in April/May 2024: they need to ensure that there is enough sugar in the domestic market and keep prices under control. Domestic prices have been creeping higher in recent months as concerns about the next cane crop emerged.

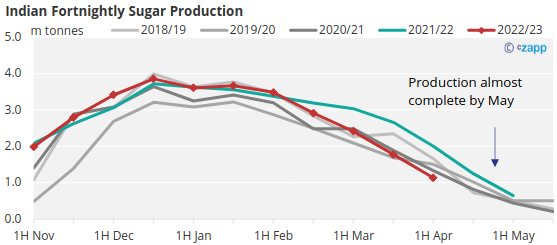

There are rumours of an export ban for next season (2023/24) which in effect means that no licenses would be issued for mills to export. We think it’s more likely that the government delays any decision on export licenses until at least May, after the election and once production is nearly complete.

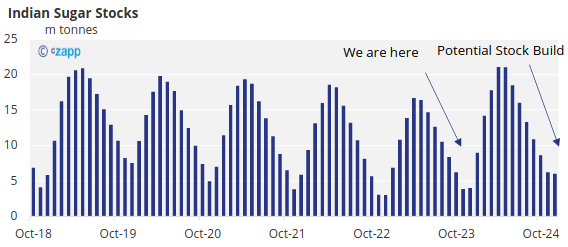

By then, the government will have a much better idea about sugar production and how much sugar (if any) could be exported without domestic stocks falling too low. We estimate that stocks could be as low as 4m tonnes in November 2023 (15% of annual consumption or less than 2 months of consumption) before the new crop starts. This means the government may want to build stocks during the next season, to reduce the risk of a poor crop in the year following (2024/25).

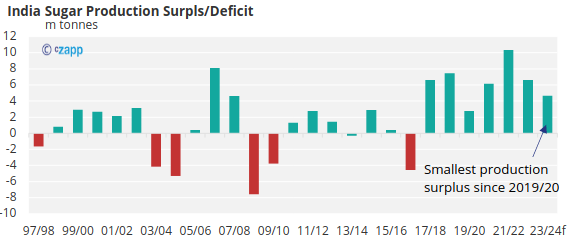

If sugar production reaches our current estimate of 31.5m tonnes, this leaves about 2m tonnes of potential exports, once some sugar has been added to stock.

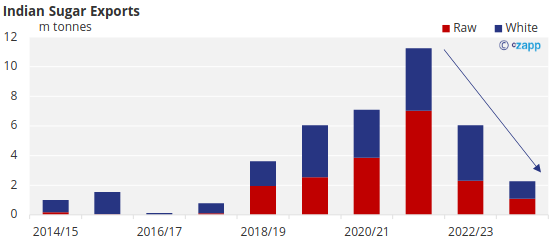

Exports of just 2m tonnes would be the smallest export volume since 2018/19 and represent a 9m tonne reduction in 2 seasons.

However, we believe there is downside risk to our estimates as the weather forecast suggests the dry period that’s been impacting cane development could continue until cane harvesting starts.

If production falls, then export availability will fall accordingly. If sugar production falls to 30m tonnes then we believe the government wouldn’t issue any export licenses in 2023/24. If things are even worse and production falls towards 29m tonnes the government may need to look at other measures to ensure food security. This could include lowering India’s ethanol blend targets or even importing sugar. As with any export decision we don’t think this would happen until well into 2024 at the earliest.

What is clear is that the sugar market won’t be able to rely on Indian sugar to bridge the supply gap in CS Brazil’s offseason (December – April). This is a big change for the sugar market and one that is creating a lot of supply stress in Q1’24 and puts the pressure back onto CS Brazil to keep performing.