Insight Focus

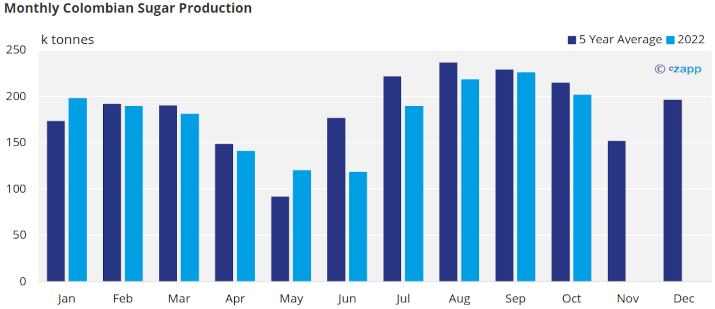

- Colombia is the 15th largest sugar producer in the world, producing around 2.2m tonnes annually.

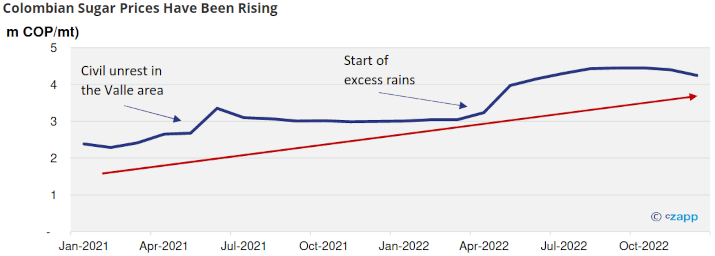

- Since 2020, prices have been rising, by 50% in 24 months.

- This has been a result of political disruption followed by heavy rains.

Colombia has seen a significant and sustained rise in sugar prices since the pandemic, but this has been made worse by two factors: civil unrest in the Cauca valley in March 2021 and excess rains since April 2022.

The civil unrest lasted for three months and was centred around the sugar producing hub of Colombia, the Cauca valley. Strikes and blockades saw workers incapable or reaching fields or mills, and transport unable to leave the mills.

After this, prices never really returned to pre-unrest levels, and in 2022 the country started seeing excess rain levels. As sugar is harvest year-round in Colombia there are few domestic stocks and delays in production can have a very strong impact on short term supply.

As the below chart shows, Colombia is falling behind consistently in sugar production since June 2022, leading to a 30% surge in the domestic price.

If you’d like us to answer one of your questions, please get in touch: Will@czapp.com.