Insight Focus

- Pakistan made a record amount of sugar in 2022.

- Sugar stocks are high but so are prices.

- The government has finally approved 500k tonnes exports.

Pakistan Makes A Record Amount of Sugar

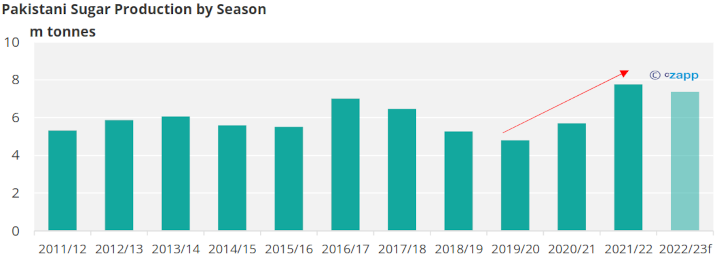

Pakistan had a wonderful cane crop in 2022. It produced 7.8m tonnes of sugar, the most on record.

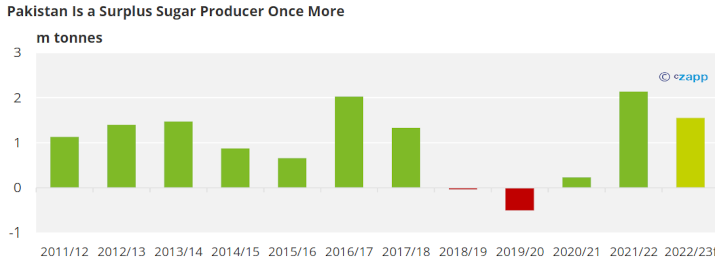

This was also 2m tonnes more than it consumes each year, the first major domestic surplus since 2018.

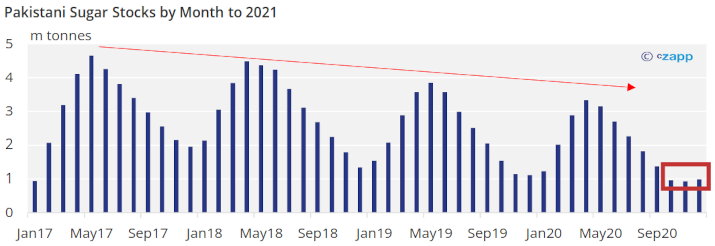

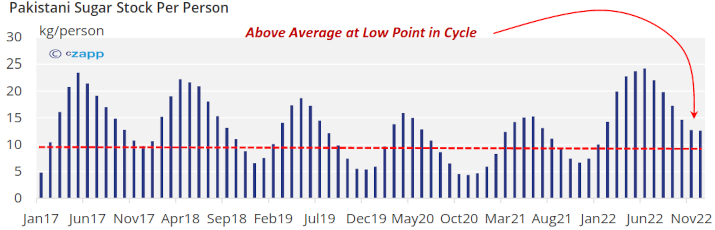

The large sugar production has been excellent for rebuilding domestic stocks.

These had been in decline between 2018 and 2022, thanks to a run of poor crops, culminating in a low of around 1m tonnes in November 2020 and 400k tonnes of sugar imports in 2020/21.

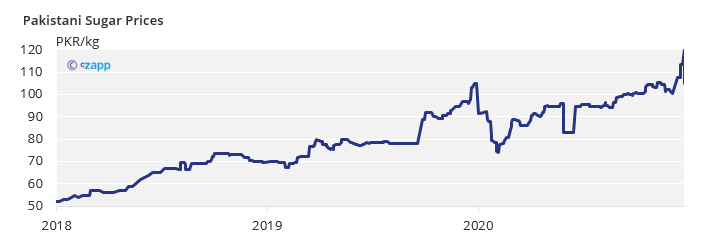

The 1m tonne stock low point is just 4.4kg per person, versus a world average of 9.5kg per person. Not surprisingly, domestic sugar prices had rocketed higher given the shortfall.

But now, following the large cane crop, stocks have risen again to 2.75m tonnes in-country. This is 12.2kg per person, far above what’s needed in storage and pipelines.

Moves To Export Excess Sugar

For months the Pakistan Sugar Mills Association (PSMA) has been asking for permission to export the excess sugar. International sugar prices have been firm all year. India has made sales of higher colour white sugar into the Indian Ocean region, and as far afield as West Africa. But Pakistani exports have been delayed.

One reason is food security, which is important to all governments. Following the supply chain disruption of COVID, governments need food to be plentiful, available and cheap. At first glance it seems like sugar availability isn’t a problem. Our stats indicate that stocks are high.

But sugar production estimates are just that: estimates. The PSMA provides the government with estimates of sugar production, but the government was being super-cautious and decided to try to confirm sugar stocks for itself before allowing exports.

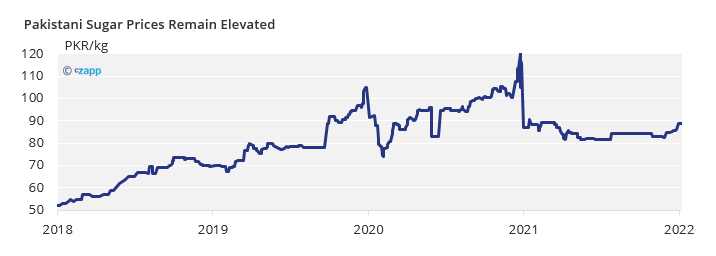

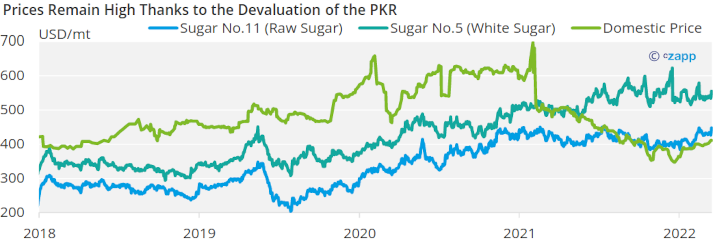

The other reason for the government’s caution is that domestic prices aren’t falling even though stocks are high.

In fact, prices have been flat in Pakistani Rupee (PKR) terms for the past 12 months. Ordinary people aren’t feeling the benefit of plentiful sugar through cheaper prices.

A closer look reveals that while Pakistani sugar prices are indeed falling in US Dollar terms, they are static in PKR terms because of the devaluation of the Rupee. This t is little comfort for those struggling to afford food.

This week the Pakistani government has finally approved 500k tonnes of sugar exports, to be done in tranches of 100k tonnes to try to ensure the country doesn’t over-export.

This should help Pakistan’s balance of payments by bringing in much-needed foreign currency. It will also help relieve some of the sugar stock burden on the mills just as the new cane crushing season begins.

The sugar will flow from January onwards. It will therefore be in direct competition with new crop Indian supply. Better late than never.