Mexico is part of the USMCA (US, Mexico, Canada Agreement).

Both the USA and (to a lesser extent) Mexico heavily regulate their sugar market to ensure cane and beet farmers are profitable.

This is done by limiting imports that avoid duties (Mexican Quota, Tariff Rate Quota, CAFTA programs) and having high barriers for entry outside of these regulated programs (import duty nears 360 USD/mt).

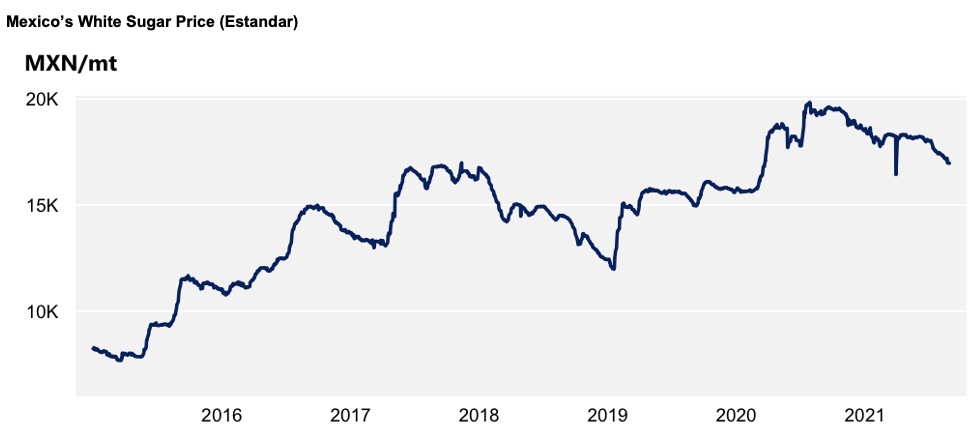

This means a high domestic price in the USA, which in turn means a high domestic price in Mexico.

The dynamics of the trade agreement mean import duty is very high and there’s a very strong export market that has demanded lots of sugar in the last two years.

As the US suffered from a poor beet crop in 2019/20, it’s been more reliant on imports. Mexico is the most important quota holder for the US and benefits from a right of ‘first refusal’ on an increase in quota access to the US.

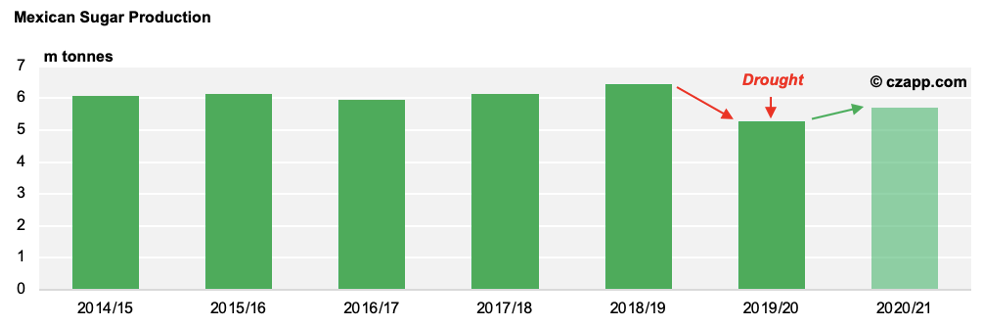

On top of this, the Mexican crop suffered from a dramatic drought in 2019/20, from which the cane has struggled to recover.

Strong demand from the high-priced US Market and poor domestic supply have pushed Mexican prices to record highs.

Other Opinions You Might Be Interested In…

- Our Colombian Road Trip: On the Road Again

- Our Colombian Road Trip: Into the Cane Fields

- Our Colombian Road Trip: Onto the Mills

- Our Colombian Road Trip: Rocky Roads

Explainers You Might Be Interested In…