Insight Focus

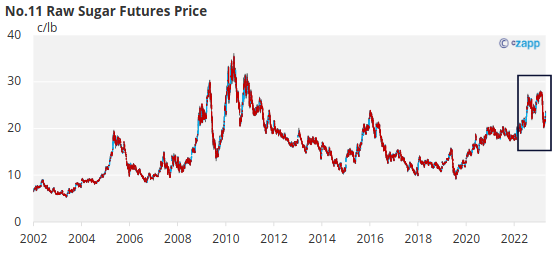

- Sugar prices remain high.

- Lower demand from China, Indonesia and Bangladesh.

- Some evidence of demand destruction.

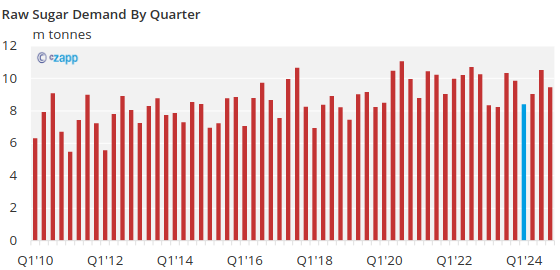

We expect raw sugar demand in Q1’24 to be one of weakest quarters of the 2020s so far. Even with this poor demand, the sugar market remains very stressed.

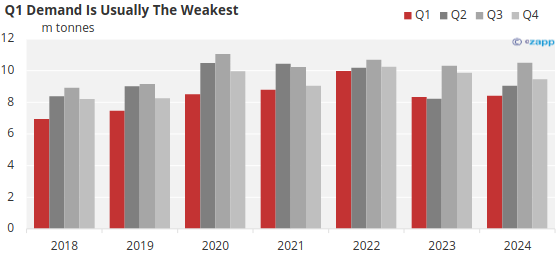

Before we dive into the details, we note that Q1 demand is usually the weakest period of each year. Since 2005 the average demand in Q1 is over 1m tonnes below the next best quarter.

From this perspective, Q1’24 demand doesn’t seem quite as poor; at 8.4m tonnes its almost identical to the same period in 2023, when prices had just started their move above 20c.

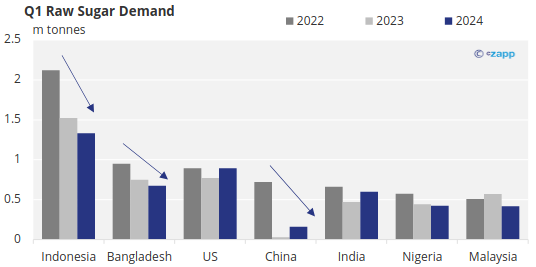

A large part of the reduction in Q1 demand from 2022 to 2024 comes from Indonesia, China and Bangladesh, which together made up almost 30% of demand in 2023.

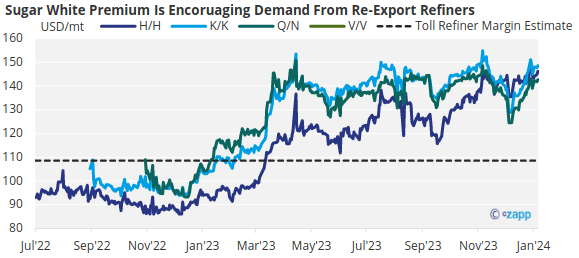

The reduction in raw sugar buying from these countries is much larger than any potential increase in demand from re-export refiners due to the strength in the white premium.

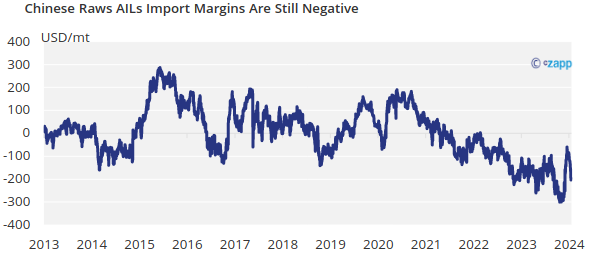

So what’s going on with these countries? In China, import margins for out of quota imports are still very negative. AIL licenses to import out of quota sugar are usually allocated on a calendar year basis which encourages refineries in China to wait until later in the year in the hope margins approve. These refiners still haven’t priced most of their 2024 demand.

We think prices need to fall towards the breakeven level at 19c/lb (refineries have imported at a small loss previously) for their demand to increase in Q1.

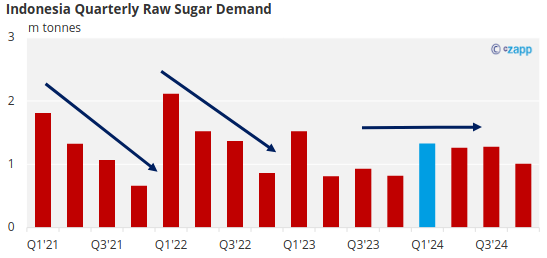

In Indonesia, it’s a similar picture. Refiners still have import volume for H1’24 left to hedge, indicating that physical shipments in Q1’24 may be slower. Indonesia’s raw sugar buying has been much more evenly split between quarters since 2023 when sugar prices rallied above 20c; previously their demand was concentrated towards the start of the year, when their licenses were issued.

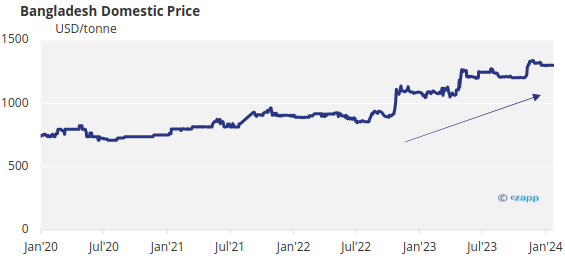

Bangladeshi demand is being hit by a shortage of USD, making it difficult to pay for commodity imports. As a result, in Q4’23, letters of credit for all commodity imports more than halved. This makes buying raw sugar particularly challenging. Even though domestic prices have been climbing and import duties have been halved, we still expect weaker than normal demand.

We think this is a strong indication that there is demand destruction occurring in sugar and other commodities in Bangladesh. It’s also possible that smuggling into the region has increased, replacing traditional imports.