Insight Focus

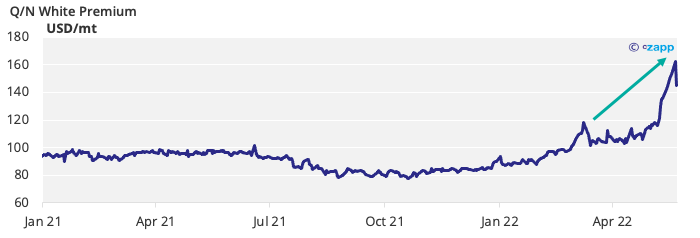

- The sugar white premium had recently broken above 160USD/mt.

- In this week’s Ask the Analyst, we ask why it is so high?

- If you’d like us to answer one of your questions in an upcoming edition, please email will@czapp.com.

The Aug/Jul white premium remains extremely strong, recently moving above $160/mt.

There are plenty of reasons behind this.

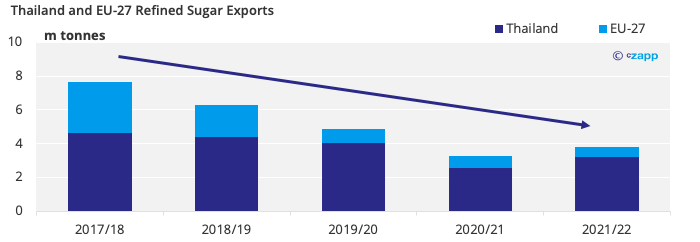

In the short term there is not much surplus refined sugar in the world:

- Algeria recently banned sugar exports, limiting supply from the refineries there.

- Supply from the Dubai refinery is still being affected by the fire that damaged crystallisation units in December.

- Refined sugar production from major low-cost growers like Europe and Thailand is lower than previous highs.

- Pakistan has banned white sugar exports.

- India has recently restricted sugar exports.

Refiners’ costs have also increased. Higher energy prices make it more expensive to convert raw sugar to white sugar, while more expensive ocean freight makes it more expensive to secure the raw sugar feedstock in the first place.

Meanwhile, refined sugar demand has remained robust despite prices exceeding $600/mt. We’ve not seen any hints of demand destruction yet. In fact, it’s possible that the opposite is happening: one of the lessons of the covid pandemic has been that stocks can be valuable and over-reliance on just-in-time logistics can make you vulnerable to adverse events.

On top of the routine flow of sugar around the world, Turkey has recently sought 400k tonnes of refined sugar imports. This is a huge volume for the market to accommodate; only around 14m tonnes of refined sugar is traded in a typical year.

It’s also possible Cuba and the Philippines seek refined sugar imports in the near future.

Finally, the raw sugar market is oversupplied in the short term now that new season Centre-South Brazilian supply is available. This means that the refined sugar market is accelerating higher while the raw sugar market is drifting lower.

Firm demand and constrained supply: an explosive mix for the white premium.

Other Insights That May Be of Interest…

SE Asia-US E Coast Spot Container Rates Drop 13.8%

Brazil Faces Choice of Higher Prices of Diesel Shortages

Explainers That May Be of Interest…