Insight Focus

- The EU will export at least 800k tonnes in 2023/24.

- Stock pressure easing with extended Ukrainian duty free imports.

- Production still well below consumption.

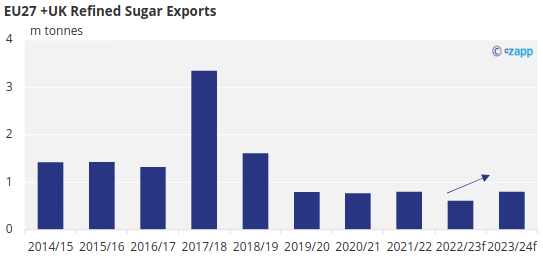

In the last 4 seasons, Europe has not been exporting much sugar. Exports haven’t exceeded 1m tonnes since 2018/19. Stocks have been quite tight leaving limited export availability whilst a large EU premium to the world market reduced any incentive to export.

However, over this coming season (2023/24) we think export availability could start to increase due to higher imports and slightly better than expected production.

We think exports will increase slightly on the previous year to 800k tonnes.

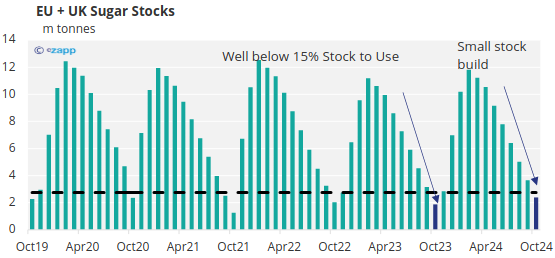

Any extra availability is likely to be carried as stock given the large EU premium. This should allow a small stock build by the end 2023/24 but stocks will remain below 15 % stock to use, used as a guide for a comfortable level of stock.

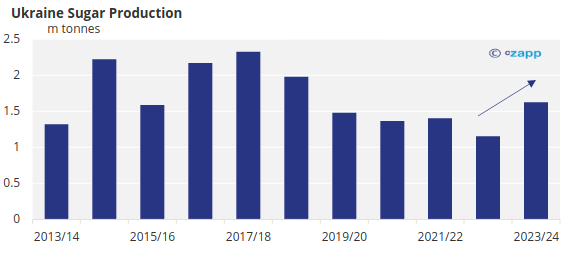

The extension of Ukraine’s duty-free access into European markets will mean that Ukrainian sugar continues to flow into the EU, especially as their next crop could be the largest in 5 years.

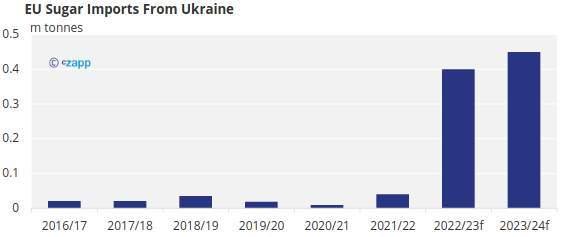

As much as 450k tonnes of sugar could enter the EU from Ukraine in 2023/24 in addition to 400k tonnes in 2022/23.

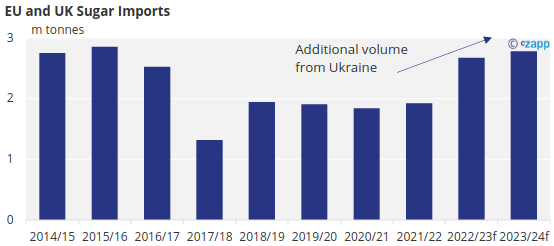

This flow from Ukraine is not displacing imports from other origins, rather it’s additional volume which is helping to ease the long-lasting tightness in the EU sugar market. When combined with the large EU premium, we think imports could total 2.8m tonnes for EU-27 + UK, the largest in several years.

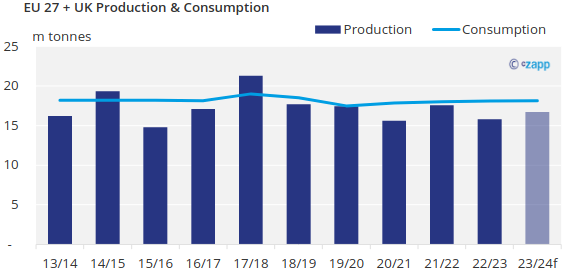

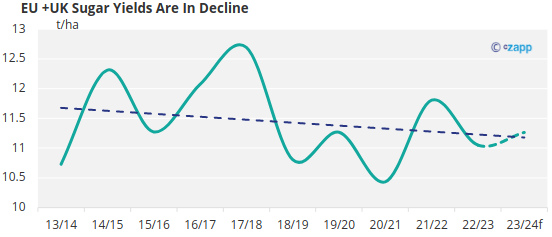

Moving onto production, every season since the record 2017/18 crop has seen a shortfall compared to consumption and 2023/24 will be no different.

However, since we now forecast production to reach 16.7m tonnes the shortfall will be only 1.4m tonnes, one of the smallest in recent years.

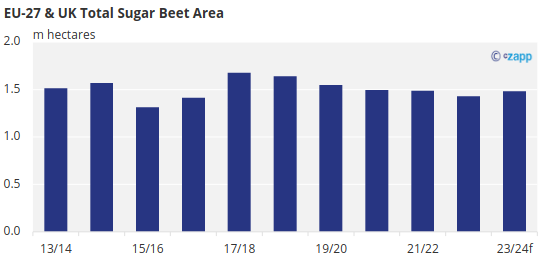

Production is up over the previous season in part as beet area increased by a very modest 4% given that farmers were offered up to 50% more for their beet.

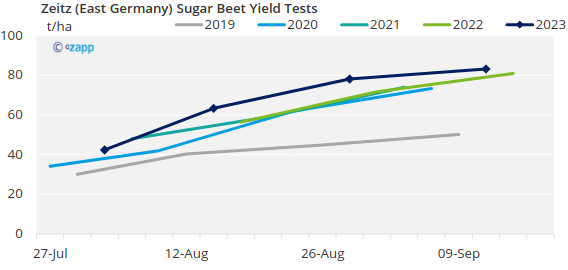

Yields also plays a role. At this stage before the harvest starts, we forecast yields to be very close to average and slightly above the longer term downward trend in yields.

In comparison to previous years there has been very little talk about the crop being affected by beet yellow virus (as a result of the ban of neonicotinoids to protect the crop from disease), whilst beet development in most places hasn’t been affected by such extreme weather as in previous years such as drought and prolonged heat.

Beet tests across Germany (a good indicator for the rest of the EU) point to very good beet yields (beet harvested per hectare). However, the tests also show that the bigger beets will have reduced sugar content which means final sugar output will be about average.