Insight Focus

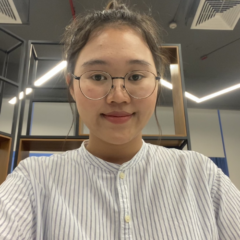

- We estimate Thailand can export 4.7m tonnes in 2024.

- Surge in domestic and export sugar prices due to poor crop and strong demand.

- High cane prices should incentivise more planting for 24/25.

Thailand’s Sugar Exports

We still think Thailand can export 4.7m tonnes of sugar during 2024. With the tightness of global sugar supply this year, any fall in export availability would only add more pressure to the market.

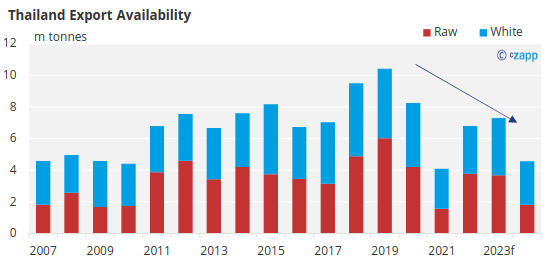

With 80 % of the cane crush complete, we think Thailand will produce 8.1m tonnes of sugar, which is sufficient for 4.7m tonnes of exports.

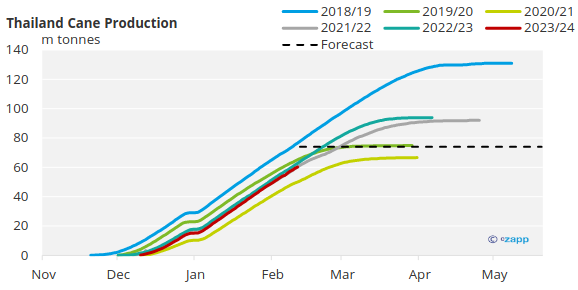

Cane crushing is continuing well and should reach 74m tonnes.

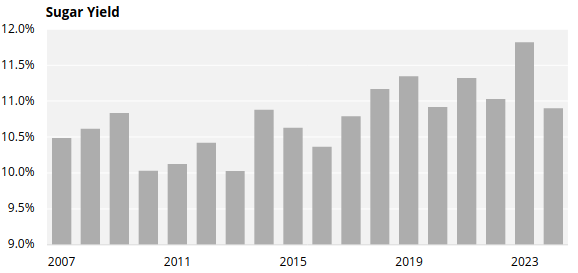

Whilst the pace of cane crushing is normal, the quality of the cane (how much sugar it yields) is the poorest since 2016 at 10.9%.

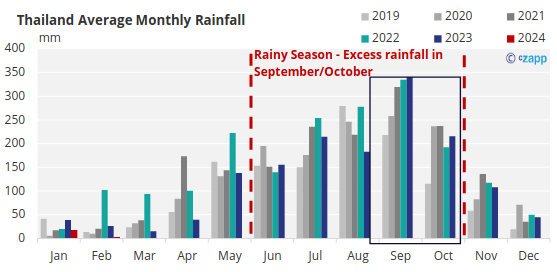

Cane is being delivered with more contaminants such as mud and leaves; higher than normal rainfall in the months before crushing (September, October) also reduced the sugar content of the cane.

Looking further ahead, we are optimistic that the cane area could grow in 2024/25 as provisional cane prices remain high and competitive against other crops such as Cassava.