Insight Focus

- Our analysis points to a possible shortage of raw sugar at the end of 2023.

- Yet the world’s two largest sugar exporters, India and Brazil, are both having strong crops.

- Has rising sugar consumption finally caught up with the market?

There is a Large Raw Sugar Deficit at the End of 2023

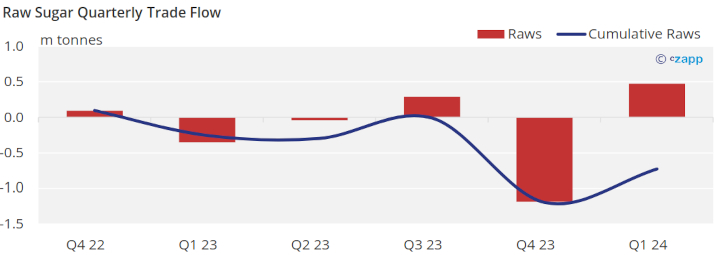

There is very little spare raw sugar on the world market at the moment, particularly at the end of next year where we think a deficit over 1m tonnes will form.

The trade flow analysis shows our expectations for each quarter of how much raw sugar can be supplied to the world market, with our forecast for global demand subtracted. We therefore think world sugar demand will outstrip supply in Q4’23.

What’s Causing the Deficit?

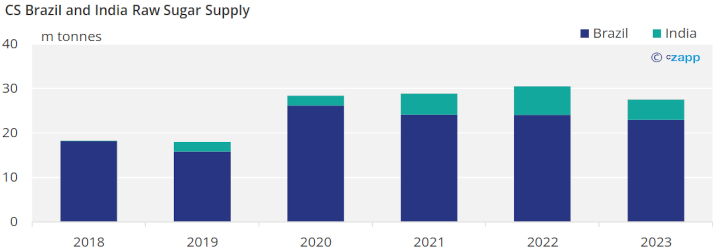

The world market has become more reliant on Brazil and India in recent years, combined they now supply 70-75% of raw sugar globally.

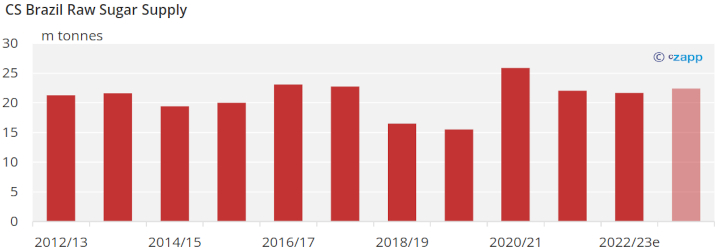

We expect Centre-South Brazil to produce almost 35m tonnes of sugar in 2023/24 starting next year, over 2m tonnes more than this year. This should equate to similar growth in export availability.

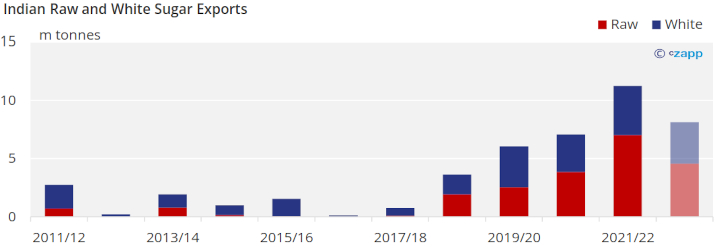

Yet, Indian sugar exports are regulated by the government in 2022/23 and will almost certainly be lower than they were in 2021/22.

This means supply from the world’s two largest producers in 2023 is likely to be smaller than in 2022. We think by 3m tonnes.

The CS Brazil cane crop winds down by November yet India’s cane harvest won’t have fully begun. This could lead to a gap in raw sugar supply.

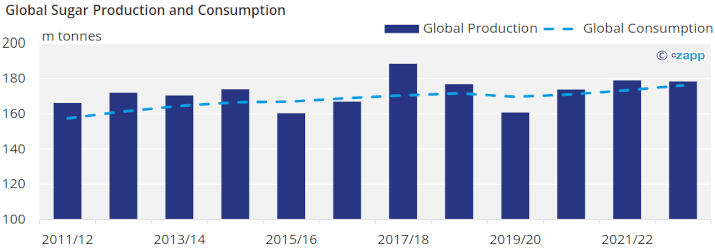

Meanwhile, global sugar demand continues to grow. This is thanks to ever-increasingly sugar consumption, which is growing at around 1% a year alongside growth in global population.

Though we expect a similar volume of sugar to be produced globally in 2022/23 as in 2021/22, there will be almost 3m tonnes more consumption than in 2021/22. It is becoming harder to keep every country well supplied with sugar, increasing the likelihood of short-term deficits occurring.

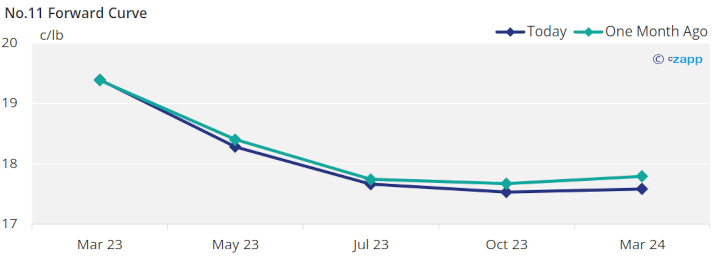

Additionally, the backwardated raw sugar futures curve currently encourages supply to be advanced earlier in 2023 to capture better prices, this means producers will likely front load exports to earlier in 2023, leaving Q4 of next year comparatively worse supplied than normal.

If you’d like us to answer one of your questions, please get in touch: Will@czapp.com.