Insight Focus

- In this week’s Ask the Analyst we answer some of the questions posed during our recent global sugar market webinar.

- If you would like to watch the webinar recording, please follow this link.

- We plan to run our next webinar in Q4 and look forward to seeing you there.

Who Was Behind the Recent No.11 Rally Toward 27c/lb?

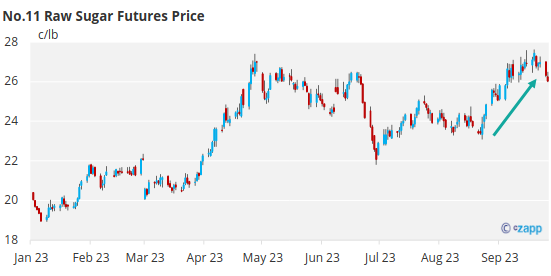

No.11 raw sugar futures prices rallied toward the end of August and into September from around 23.5c/lb to over 27c/lb, a new high point for the year. This rally was likely in part helped by rumours that India would maintain an export ban throughout their upcoming 2023/24 season.

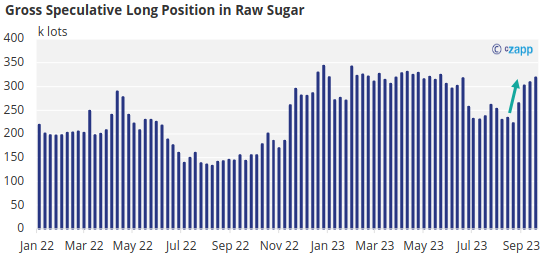

We think that speculators were involved in this move upwards, latching on to the bullish news story. In the weeks corresponding to sugar’s rally toward 27c/lb, the speculative long position in raw sugar increased by almost 100k lots.

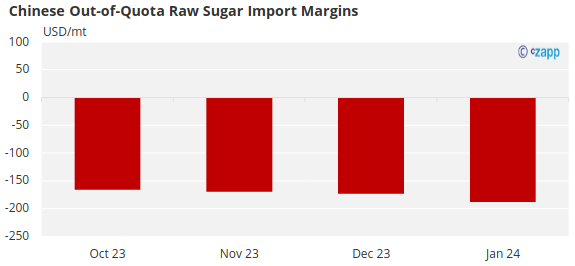

As well as this, there have been persistent rumours that COFCO were given 1m tonnes of additional A quota allocation for use in 2023, if true this would make importing raw sugar easier for the Chinese refiner.

We have been saying throughout 2023 that import margins for Chinese refineries for Out-of-Quota sugar have been extremely negative. Additional allocation for A quota sugar (which faces a much lower import duty) would mean it would be much easier to import.

In theory trade houses may have bought hedges against the expectation of this physical business, either triggering the rally, or building on momentum started by the speculators, it is hard to tell.

Where Do You Expect Raw Sugar Prices to Move into 2024?

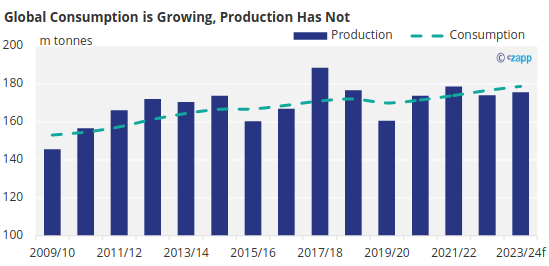

Global sugar consumption has now reached the same level that global production has been stuck at for the last decade, and will continue to rise in coming seasons

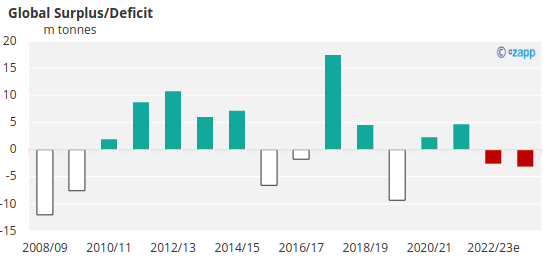

We think sugar prices still need to move higher and sustain into 2024 to help encourage more investment in sugar production outside of Brazil, and to encourage investment into internal logistics in CS Brazil so sugar can be exported at a faster rate.

Otherwise, apart from in exceptionally good crop years, the world will begin to consistently consume more sugar than it produces.

Will there be an Export Ban in India for 2023/24?

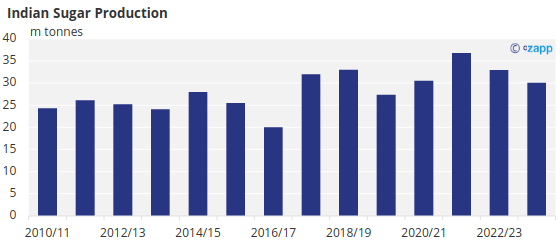

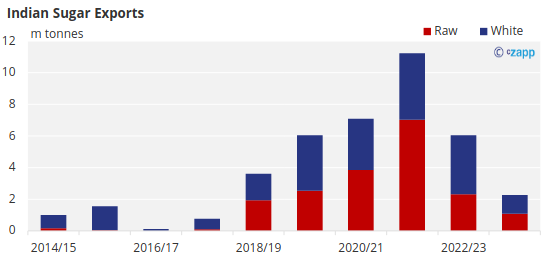

We have recently downgraded our forecast for sugar production in India to 30m tonnes in 2023/24 due to the disrupted monsoon rains.

At this level we think the stock situation could be sufficient to allow for some exports, though there isn’t much room should production forecasts fall further.

However, the situation is more complex than this. The Indian government needs to be assured that the cane crop for the 2024/25 crop will be enough to keep stocks from dropping too low before they will consider permitting exports for 2023/24. We don’t think a decision on this will be reached until at late Q1 next year.

What we do know is that monsoon rains affect both the crop immediately proceeding, and the one after that. This and news that plantings for 2024/25 have been behind schedule means preliminarily we think that the 2024/25 crop will be smaller than 2023/24.

As a result, our forecast of just over 2m tonnes of exports, commencing toward the end of Q1 2024 is likely much closer to a best-case scenario, other trade houses currently forecast production at sub-30m, at this level the stock situation make exports less likely.

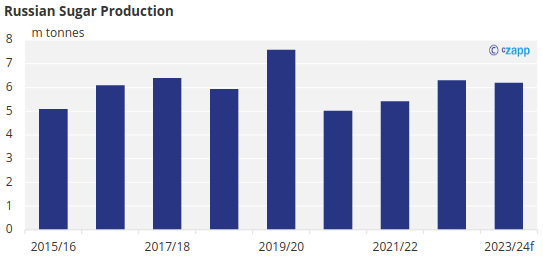

How is the 2023/24 Russian Beet Crop Looking?

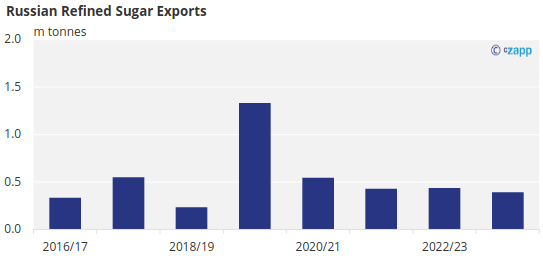

We think the 2023/24 Russian sugar beet crop looks similar to the previous season. Currently we forecast 6.2m tonnes of production, down slightly from 6.3m in 2022/23.

However, there is uncertainty in this figure, the Russian government forecast is as low as 6m tonnes, whilst others forecast as high as 6.5m.

This should still mean around 400k tonnes of exports for the upcoming season. Though we have heard that a lack of wagon availability could impact logistics.