- Fertilizer demand has been resilient in 2020, despite the COVID-19 pandemic.

- Sales have been underpinned by robust agricultural market fundamentals, supportive weather conditions and favourable fertilizer affordability levels.

- A key feature has been a rally in crop prices, which should continue into 2021 and support fertilizer affordability levels and, ultimately, demand in 2021.

Why Are Crop Prices Rising?

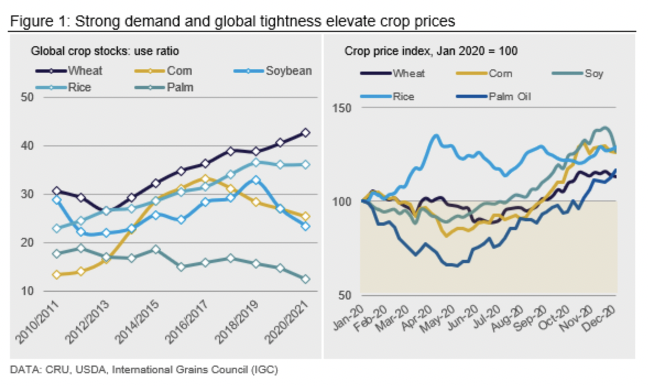

All major grain and oilseed prices have rallied in 2020, due to tightening global stocks-to-use (STU) ratios, strong international demand, and some regional weather concerns.

Some notable drivers include:

- Downward revisions to US production estimates for corn and soy following Storm Derecho.

- Exceptionally strong Chinese import demand for corn and soy.

- The La Niña weather event prolonging dry conditions in South America, adding further upside to corn and soy.

- Weather concerns in the Northern Hemisphere and lower supply availability ex-China and India have strengthened wheat.

- Stockpiling, export restrictions and logistical disruptions caused by COVID lockdowns boosted rice prices in Q1’20. Rice markets continue to find support from firm demand and tighter supply.

Palm Oil prices have strengthened due to firmer Brent Crude Oil prices, improving demand as countries come out of lockdown and lower production.

Chinese Demand: A Key Driver of 2020 Crop Price Strength

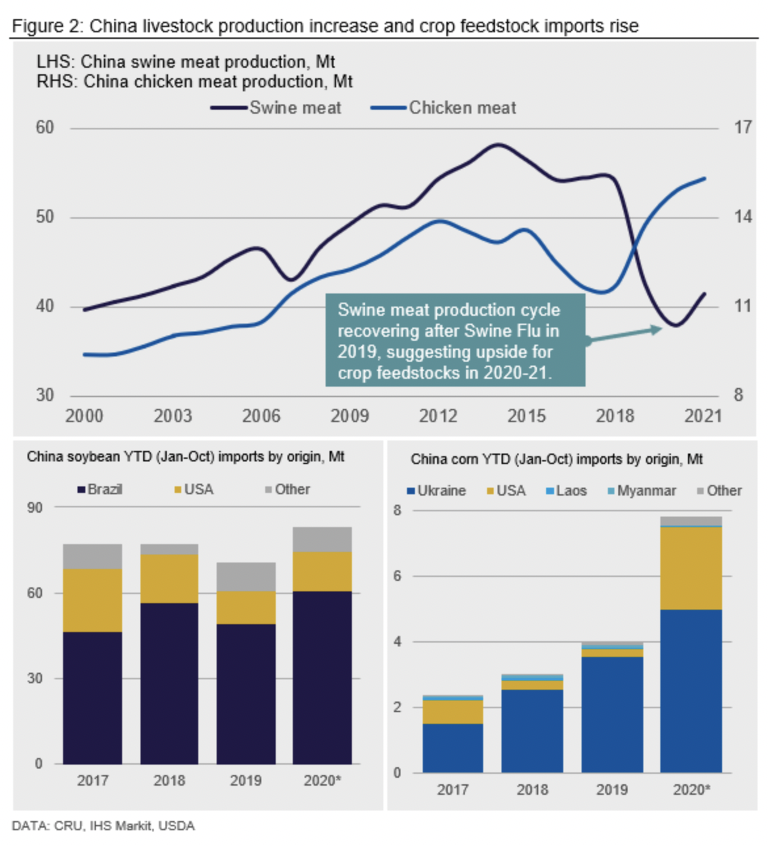

China is rebuilding its swine herd following the African Swine Fever outbreak in 2019. This has spurred imports of both corn and soy in 2020, as livestock production (particularly swine) increases, and production systems become more sophisticated (increasing the use of compound feed).

China’s year-to-date (YTD) soybean imports from January to October 2020 total around 83.2m tonnes, compared to 70.8m tonnes in the same period last year. This is an 18% increase year-on-year.

China’s corn imports from January to October 2020 stand at 7.m tonnes, almost double those of the same period in 2019. Strong corn demand is also being driven by stock drawdown, with domestic production likely to have been hit by the adverse weather conditions seen this year. Another factor to consider is China’s Phase 1 Trade Agreement with the US, which included a substantial increase in the volume of agricultural trade.

China is still in the early stages of recovery, with swine meat production still far lower than pre-swine flu levels. This suggests that swine meat production will continue to increase in 2021, offering further upside for grain imports.

China’s demand for corn and soybean has helped boost international prices in 2020. We think the price of both crops will stay high in 2021, but with more upside for soy, due to greater tightness in supply and demand fundamentals.

With China’s hunger for grains forecast set to persist in 2021, this offers opportunities for crop exporters, such as Brazil, the US, Argentina, and Ukraine. Strengthening crop prices and Chinese demand could support area intentions and hence nutrient demand in these countries, and China, in 2021.

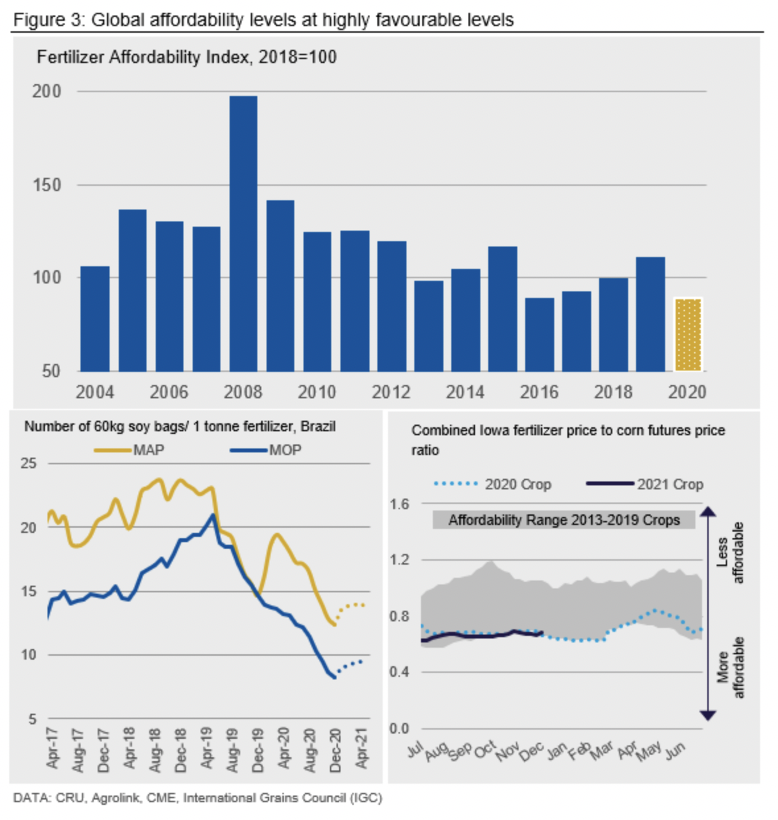

What Has This Meant for Global Affordability Levels?

The rally in global crop prices has been a key driver of improving fertilizer affordability in 2020. Global fertilizer affordability is at its most favourable level in 17 years, whilst in key markets (Brazil and the US), levels are trending at five-year and seven-year lows respectively.

While fertilizer prices are now beginning to move higher, it comes from a low base – N, P and K remain cheap compared to historic levels. Continued favourable affordability is set to support fertilizer demand in 2021. Furthermore, farmers around the world have benefitted from COVID-19 economic support programmes. This has helped to bolster farm margins even further, and farmers in key regions like the US and Brazil will not be hesitant to invest in inputs, along with other long-term capital requirements.

What Does This Mean for Fertilizer Demand in 2021?

Agricultural fundamentals and farm economics all point to robust fertilizer demand in 2021. We must consider potential downside risks such as tighter credit lines, currency fluctuations and a slower than expected economic recovery. But momentum is fiercely on the upside, and this is already starting to flow through to higher fertilizer prices and short term returns for producers.

Here’s Another Opinion You Might Be Interested In…

Here’s Some Interactive Data You Might Be Interested In…