Opinion Focus

- Despite a slowdown in the interest rate hikes, officials now expect to raise them beyond original expectations.

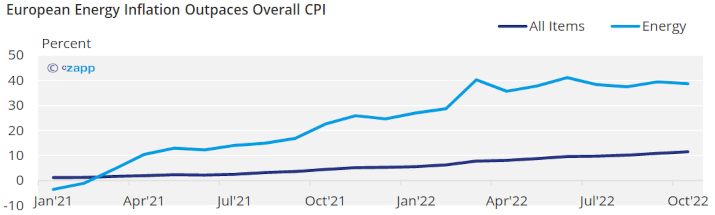

- Ongoing strikes and wage disputes could stoke inflation, but the biggest upward pressure is from energy prices.

- The target 2% interest rate is not expected to return until at least 2027.

The global economy is stuck between a rock and a hard place. Central Banks are desperately trying to keep spending low to rein in inflation but the huge rises in the cost of living have prompted wide scale industrial action from workers demanding wage rises that keep pace with huge additional expenses. One thing is for sure though: the biggest inflationary factor by far is energy, and for Europe the situation is only set to get worse entering winter.

Supply Chain Pressure Will Continue to Ease

Let’s start off with the good news. Pressure on the supply chain is markedly lower than it was at this time last year.

Source: Federal Reserve Bank of New York

According to the New York Fed, it was Chinese delivery times that pushed the index up just slightly in November compared with September and October. But the situation in China has now generated some optimism.

In the past week, testing requirements have been relaxed, those infected have been allowed to quarantine from home and domestic travel restrictions have been lifted. Most recently, the nation deactivated its Covid tracking app.

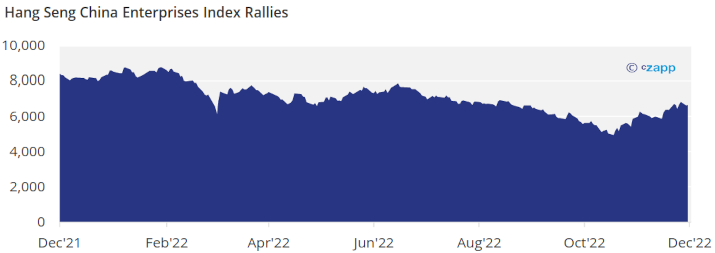

The Hang Seng China Enterprises Index – a benchmark indicating the overall performance of Chinese securities – has rallied to its highest point for three months.

Source: HKEX

Freight Will Get Worse Before It Gets Better

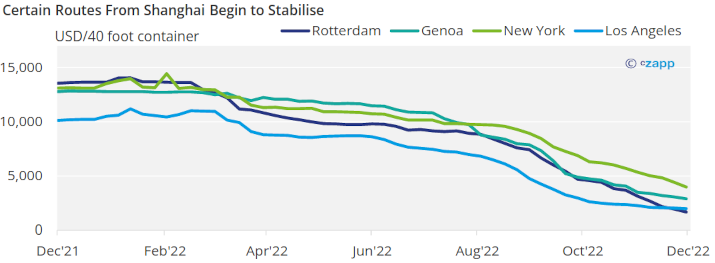

But this has not yet trickled down to the freight market. Rates have continued to fall, although the Shanghai to Los Angeles and Shanghai to Genoa container rates have begun to plateau.

Source: Drewry Container Index

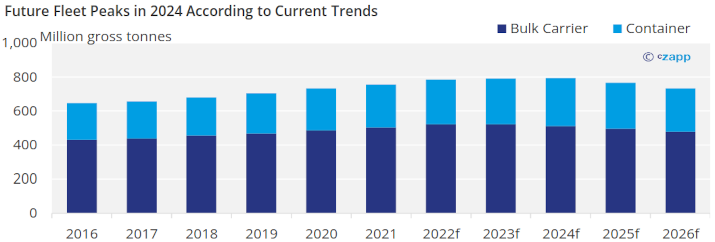

In 2023, rates could become tighter though. The combined effect of the Chinese reopening coupled with stricter environmental requirements coming into force, an ageing fleet and a plateau in new vessel orders.

Source: UNCTAD

Rate Rises to Slow – But Higher Peak Forecasted

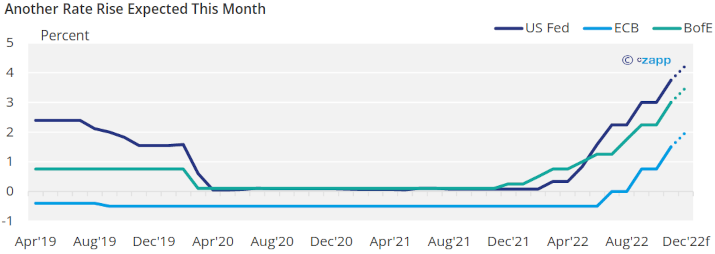

After a string of 75-basis-point interest rate rises by the Bank of England, the Fed and the European Central bank, this month’s round of hikes looks to be more reserved at 50 bps.

Source: US Federal Reserve, European Central Bank, Bank of England

The Fed is predicted to make its announcement at its final Federal Open Market Committee meeting of the year this week, while the Bank of England and the ECB’s announcements are due on Thursday.

While there is room for positivity given the slower rate of hikes, Christine Lagarde cautioned last month that further rate hikes should be expected in 2023 since the bank is “not close to pausing” its current policy.

The Fed also said monetary tightening will continue next year. The peak of rate rises, which was expected at 4.75% is now widely expected to be revised upwards to 5.25% and any cuts are highly unlikely before the end of 2023.

Energy Pressure Will Continue

For European nations, the greatest factor pushing up inflation has been energy prices.

Source: Eurostat

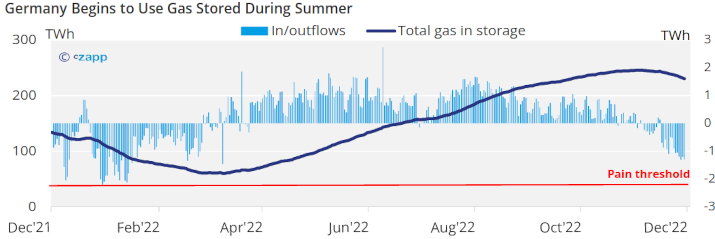

The war in Ukraine has exacerbated the situation as Russian gas supply has been cut off. As a result, countries such as Germany attempted to store energy this summer in anticipation of a cold winter. Now, as the cold weather bites around Europe, there are large outflows.

Source: Aggregated gas Storage Inventory

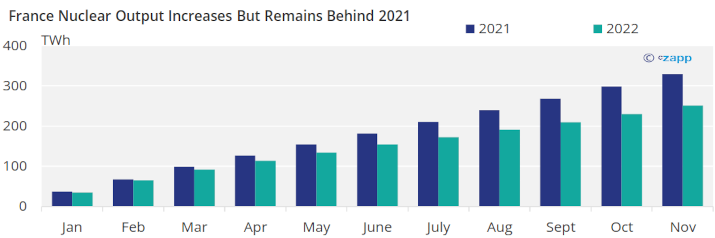

The situation has been exacerbated by outages at France’s nuclear plants. Nuclear production is beginning to pick up now after disruptions but is still behind 2021 levels.

Source: EDF

According to Eurostat, in 2020 Russia accounted for 39% of the EU’s gas imports, 23% of oil and 46% of coal. This means that while supply and demand are likely to fluctuate into 2023, without a resolution on the situation in Ukraine, it is likely that energy prices will remain elevated through 2023.

Employment Stalemate to Rage On

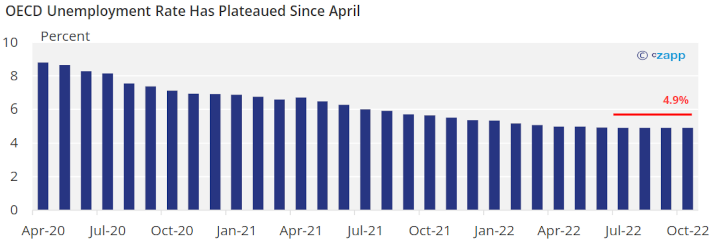

The low unemployment rate around the OECD shows no sign of rising.

Source: OECD

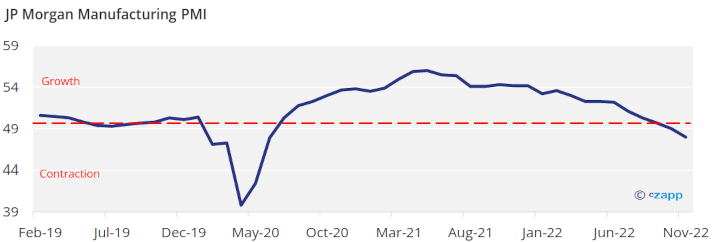

But business confidence has been falling amid rising costs. New business contracted for the fourth consecutive month and international trade remained weak.

Source: IHS Markit

And although unemployment remained low, the rate of new job creation began to slow, which could indicate a turnaround in the employment market.

Higher costs in 2023 as interest rates rise and new business slows is likely to lead to rising rates of unemployment.

Retail Sales on a Knife’s Edge

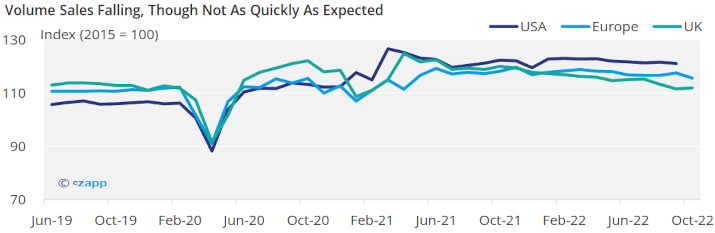

Despite negativity, the full impact of the slowdown has not fully been felt yet since consumer spending remains stronger than expected.

Source: OECD

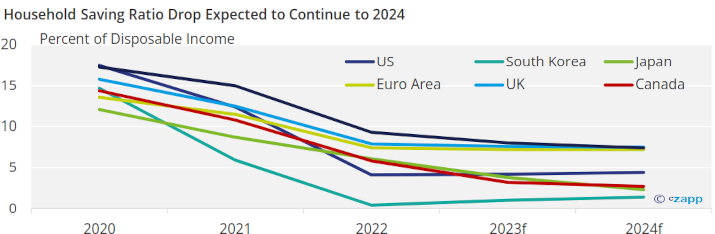

But savings are depleting, and credit limits are being reached, suggesting that spending could soon slow as household budgets become more and more stretched.

Source: OECD

In 2023, continued pressure on purse strings is likely to cause a contraction in spending, in turn impacting business demand, global trade and employment.

Concluding Thoughts

- 2023 is set to be a much more conservative year for governments in Europe and the US.

- Rising energy prices are currently fuelling inflation and show little sign of abating in the absence of a Russia-Ukraine deal.

- Europe will face challenges in ensuring plentiful energy supply during the coming months.

- Retail sales are hanging by a thread during the holiday season but are likely to dip sharply in 2023as cost rises bite.

- Continued interest rate rises into 2023 will put further pressure on businesses and employment.

- Many countries are facing the prospect of a tough 12 months ahead.