Insight Focus

Biofuel production is ramping up, and this is set to counter any demand losses stemming from Chinese consumption drops. This means soybean prices are likely to soar again in the future.

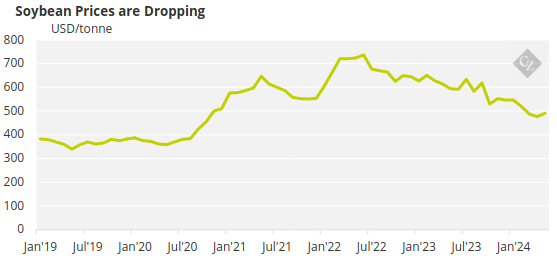

Lately, soybean prices have been declining. After a peak in 2022, the market has lost ground due to oversupply. Now, as Chinese pork demand wanes, so too is its soybean demand.

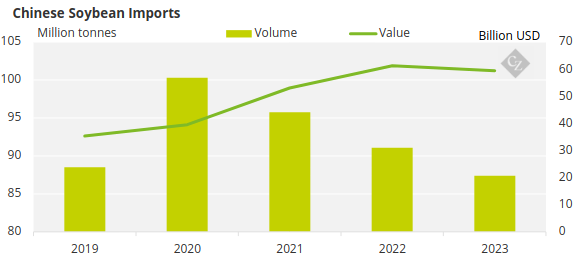

Soybeans are a key source of animal nutrition, which is why the country is the world’s biggest soybean importer.

Source: UN Comtrade

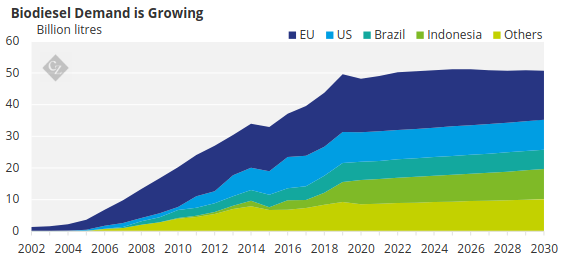

But although the demand issues in China look like they may be here for the long term, another pocket of demand is opening for biofuels in the form of biofuels. And it doesn’t look like the market will be in oversupply for much longer.

Why is China So Important?

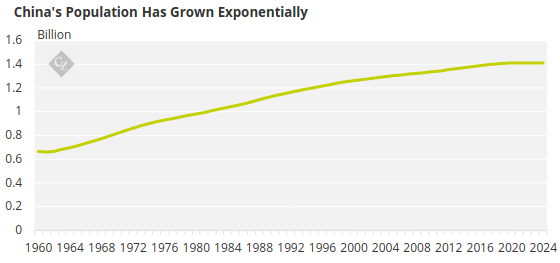

China is generally hugely important when it comes to global consumption trends. This is because its population – particularly its middle-class population – has grown hugely over the 20th century. As of 2024, its population accounts for about 17% of the world total.

Source: World Bank

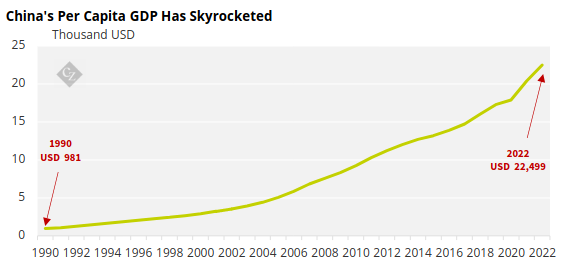

And as the population and economy grows, so too does consumption. China has rapidly urbanised and per capita income has risen during this time. In 2022, it had reached USD 22,499 – almost 23 times more than in 1990.

Source: World Bank

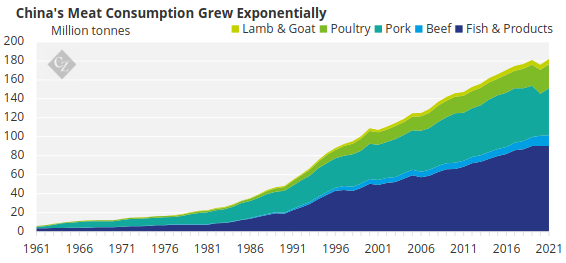

And due to rising incomes, meat consumption has also increased. In 1961, China consumed about 6 million tonnes of meat and fish, but by 2021, this had risen to over 180 million tonnes.

Source: FAOSTAT

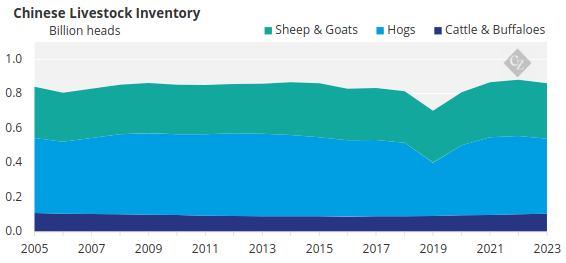

This means that China needs to provide many more animals for slaughter than it once did. According to data from China Statistics, the country has about 860 million heads of cattle, buffaloes, hogs, sheep and goats.

Source: China Statistics

Chinese Pork Demand Declines

Famously, China’s ruling party is attempting to create food self-sufficiency for the Asian superpower. The USDA estimates that in 2022, China was responsible for 69% of global corn processing, 6% of rice processing, 51% of wheat processing and 37% of soybean processing.

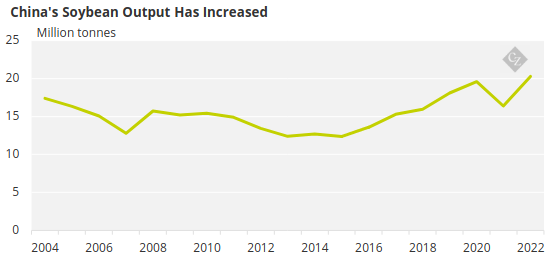

Huge investments have been made in farming subsidies, R&D and stockpiling to ensure domestic production can cater largely to the huge demand of the Chinese population. As a result, the country’s soybean output has increased – perhaps explaining some of the losses in imports in the past few years.

Source: Statistics China

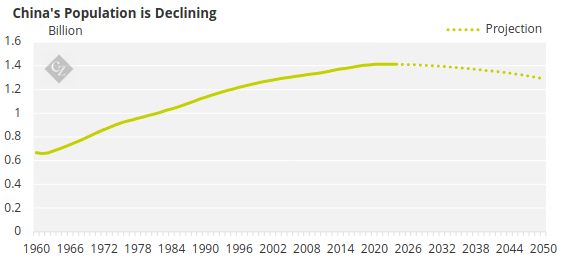

At the same time, the population has begun to plateau in China. Economists estimate that the population will begin to decline going forward.

Source: World Bank

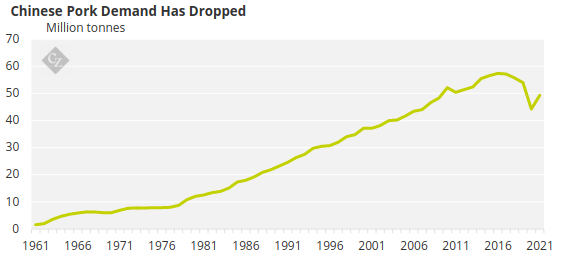

This means that consumption will likely dip. Already, pork consumption has begun to decline from its peaks around 2017/18.

Source: FAOSTAT

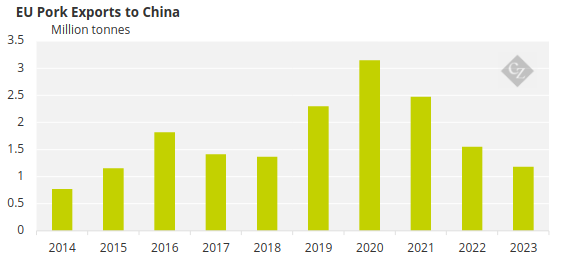

As a result of an oversupply of pork, China even recently began an investigation that could lead to anti-dumping duties being imposed on pork meat originating from the EU.

Note: HS Codes 0103, 0203, 0206

Source: UN Comtrade

This was partly in retaliation to EV tariffs being imposed by the EU on Chinese vehicles, but it also signals that China is comfortable with its existing pork supply.

Will Soy Price Drop?

China is the world’s largest soybean importer but now imports are slowing. So, what are the implications? Does this point to a price drop for soybeans?

Well, not exactly.

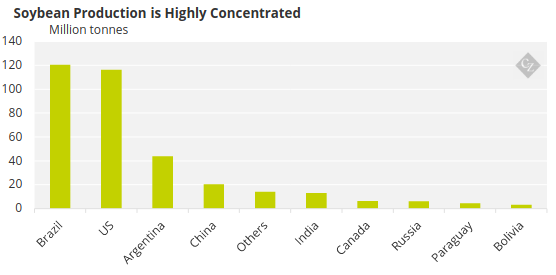

As we discussed, soybean production is concentrated in the Americas. The largest exporters are the US, Brazil and Argentina. So, let’s look at what is happening in these countries.

Source: FAOSTAT

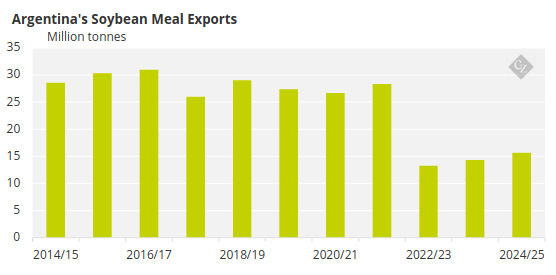

Firstly, Argentina is the world’s largest soybean meal exporter. However, for the past few harvests, soybean meal exports have declined substantially.

Source: USDA

The country has been experiencing prolonged droughts due to El Nino. There is also very poor soil quality due to decades of underinvestment, which is leading to chronically low yields. This has led to the worst soybean season in 23 years. This is likely to lead to a long-term decline in Argentinian soy production.

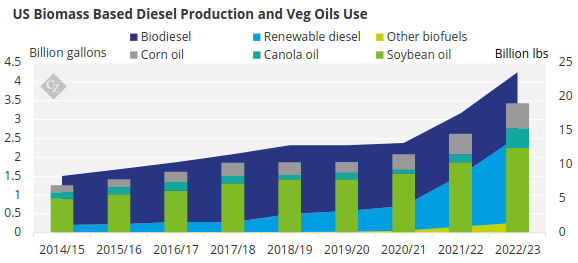

As for Brazil and the US, new demand pockets for soybeans are emerging in the burgeoning biodiesel and renewable diesel industries.

Source: OECD

According to USDA data, soybean oil accounted for more than 40% of total feedstocks used for biomass based diesel production in 2022-23.

Source: USDA

Concluding Thoughts

- There are concerns over slowing pork demand in China.

- This is likely to lead to lower demand for soybeans, which are used as animal feed.

- But despite a slowdown in China, there is likely to be a surge in demand in the Americas.

- Biofuel production is growing, and soybeans are one of the most-used feedstocks for biomass-based diesel.

- The US and Brazil are the strongest biomass-based fuel producers, and also the biggest soybean producers.

- As a result, soybean prices are only likely to rise going forward as pockets of demand open.