Insight Focus

- Inspections are slowing vessel traffic from Ukrainian ports.

- Ukraine is blaming Russia for slowing the inspection process.

- Grain exports last week were 691k tonnes, down from 800k-1m tonnes normally.

Forecast

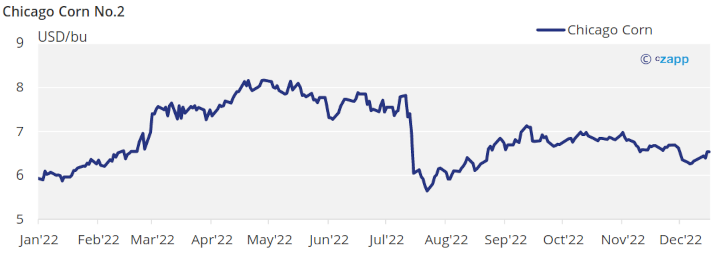

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 5,8 to 6,3 USD/bu with an upside bias depending on Ukraine’s harvest and Argentinian conditions. The average price since Sep 1 is running at 6,72 USD/bu.

Market Commentary

We had a positive week in US Corn and Wheat, while negative in Europe, but most of it was due to the expiry of the December contract with March being now the front month. The cheaper dollar vs. an expensive Euro also played its part.

The week started positive, especially for Wheat on the back of Russia intensifying attacks on Ukraine and raising fears of potential supply disruptions out of the Black Sea. Some ports were hit by blackouts last week, but also the inspection process is slowing traffic of vessels. There appear to be some 90 vessels in the lineup adding inbound and outbound ones. Ukraine is blaming Russia for slowing the inspection process. The reality is that grain exports last week fell to 691k ton or a 16% fall week on week. The export flow is slowing down as it had been in a range of 800k ton to 1 mill ton per week.

The week was also positive for Corn in Chicago despite inspections falling 39% week on week.

Corn harvesting in Ukraine is 70% complete vs. 98% last year and yield continues low showing 6,3 ton/ha or -16% year on year. Corn harvesting in Russia is 77% complete. Corn planting in Argentina made good progress and is now 47% complete but still below the 66% planted last year while condition remained unchanged with just 18% in good or excellent condition. First Corn crop planting in Brazil made good progress and is now 76,6% complete still below 80,6% last year.

On the Wheat side, interestingly enough Russia published a note where they intent to reduce Wheat planting area in 23/24 to stabilize their local market and prices. This appears to be a move caused by the actual difficulties to export their bumper crop. They are targeting 80 to 85 mill ton of production vs. 106 mill ton they produced this last crop.

Wheat demand was healthy last week with good tender activity: Algeria, Tunisia and Iraq bought good volumes taking advantage of lower prices.

In the weather front, cold weather is expected in the US but should not be problematic for Wheat already planted. Milder temperatures are expected in the north of Europe after freezing temperatures last week with the major doubt being if winter killing is occurring given Wheat had not developed winter protections due to a warm autumn. More rains are expected in Brazil.

The fundamental picture has not changed with ample Wheat supply, mainly thanks to a bumper Russian crop, and limited Corn supply mostly from smaller crop across the US an Europe. The key issues to look at are: the final size of the Corn crop in Ukraine given they may not be able to harvest the smaller crop they have planted, the trade flow out of the Back Sea given the conflict appears to be intensifying, and the risk of winter killing in Europe given the crop had not developed winter protection. All are risks on the supply side, while we don’t really see any demand issues. Expect the market to remain well supported.