Insight Focus

- Black Sea shipping is being disrupted by the Ukraine war.

- Many vessel owners are unable to secure insurance.

- But sugar imports continue to flow into the region.

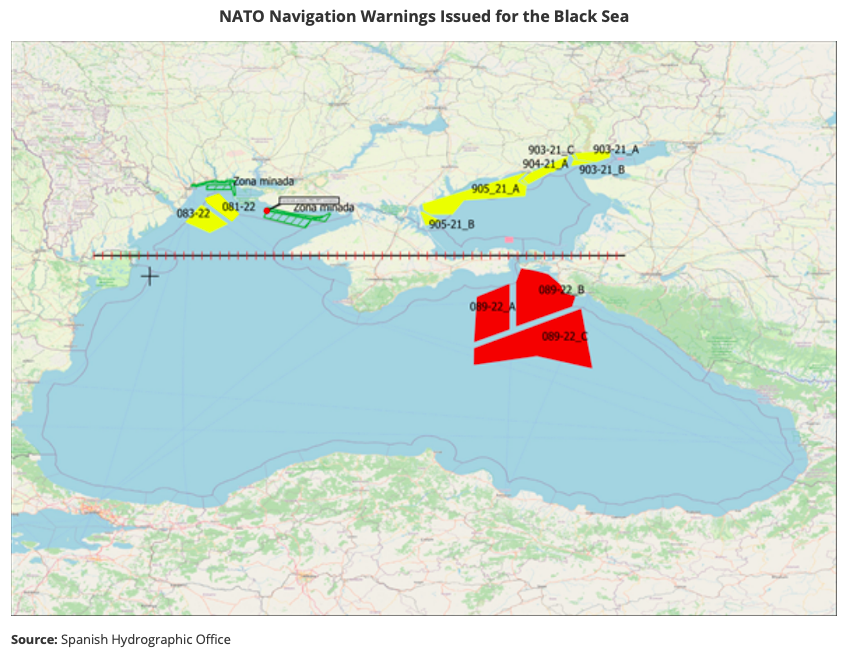

Parts of the Black Sea Designated “Warlike Operations Areas”

NATO have advised that there’s a high risk of collateral damage to civilian shipping operating in the Northwest part of the Black Sea. Several vessels have already been hit by military strikes following Russia’s invasion of Ukraine. Many vessel owners are therefore struggling to acquire insurance cover for Black Sea voyages.

On top of this, all Ukrainian ports and some Russian ports have been unable to operate normally due to the conflict. Sanctions applied against the Russian economy are increasingly restricting US Dollar transactions, so trade houses are starting to withdraw from commodities business in the region.

The impact on the grains markets has been covered widely in the news, but the sugar market has been strangely unmoved. In fact, sugar trade in the Black Sea has continued almost uninterrupted.

Who’s Importing Sugar via the Black Sea?

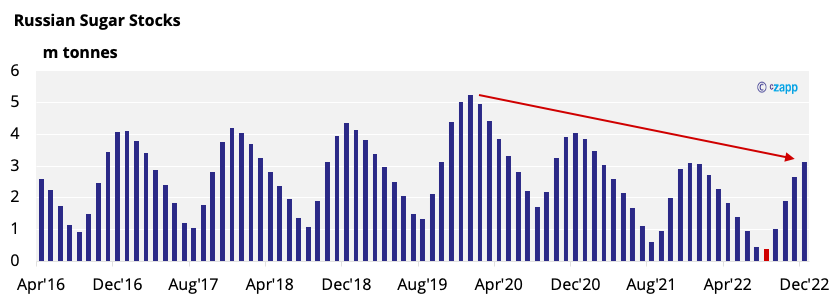

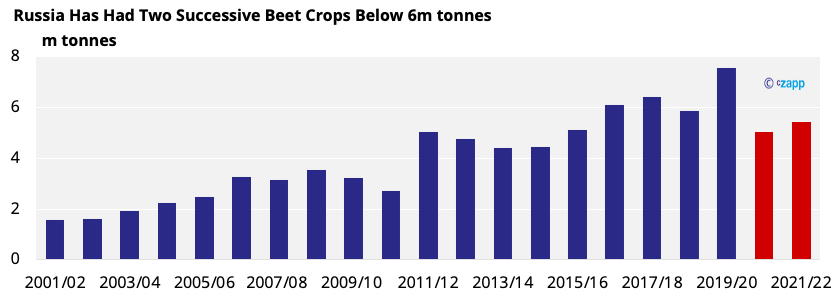

Owing to two successive shortfalls in the Russian beet crop, Russian sugar stocks are at critically low levels in 2022. There’s a risk of localised shortages in H2’22 without imports.

For the first six months of 2021, Russia froze its sugar prices and sought to import 350k tonnes of duty-free sugar through its state-controlled United Grain Company. However, the import programme was a failure with the government complaining that it was unable to secure sufficient supply at affordable prices from the world market.

This year’s beet crop has been just as poor, so sugar prices have been frozen again and Russia’s after 300k tonnes raw and white sugar imports. Imports have been delegated to the private sector with more success, as we’ll see in a moment.

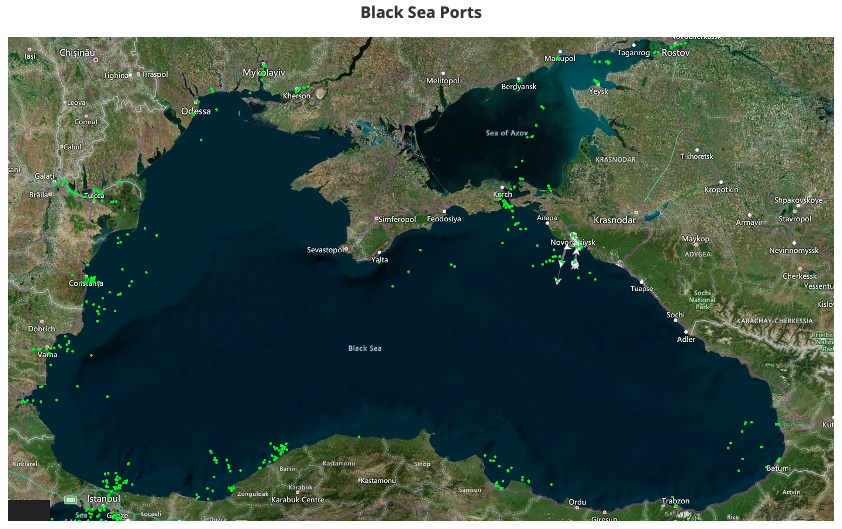

It’s not just Russia which imports sugar via the Black Sea. Refineries in Armenia, Azerbaijan, Georgia, Kazakhstan, and Uzbekistan also frequently use Russian ports (notably Novorossiysk, Tuapse, and Batumi), with the raw sugar then being trans-shipped inland.

Current Vessel Movements in the Region

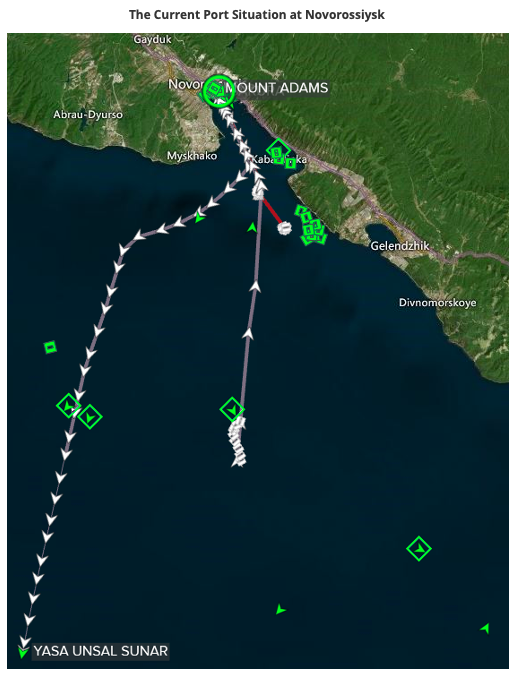

A dry bulk vessel (Yasa Unsal Sunar) has just departed the port of Novorossiysk, having discharged 44k tonnes of raw sugar for onward trans-shipment to Uzbekistan. It arrived at the port before the invasion began and discharged through the onset of the war.

In the last few moments, two further raw sugar vessels (Sakura and Mount Adams) have sailed from anchorages outside the port and have now berthed. This indicates that sugar discharge at Novorossiysk is proceeding normally.

All three of these vessels arrived in the Black Sea before war was declared. What about vessels yet to arrive? As it happens, several are on their way to the region. Closest is the Theodora, which is in the Mediterranean and steaming east towards the Dardanelles, carrying 45k tonnes of Brazilian VHP destined for Russia.

It’s likely to transit to the Black Sea within the next few days, and if it does, we can assume that some vessel owners have been able to secure insurance and clearance for this route.

Further afield, a vessel (Lilac Harmony) is loading raw sugar in the port of Veracruz in Mexico, destined for Batumi and then on to the Wellington Refinery in Azerbaijan. This is the first vessel we’ve identified to be loading sugar for the region since hostilities erupted. A second, Argyroula, has also been chartered to load 33k tonnes of raw sugar at Veracruz for the Black Sea. We should be able to monitor if either sails to the Black Sea or decides not to take the risk.

For the time being, raw sugar shipments are arriving in the Black Sea, so regional sugar imports should be able to continue. This is in marked contrast to grains exports from the region, which have all but ceased. This might also reflect the location of the sugar ports in the Eastern region of the Black Sea, further away from the conflict.

Events are changing quickly, so we’ll continue to monitor the situation to see how it unfolds.

Other Insights That May Be of Interest…

Market View: Why Isn’t the Sugar Market Stronger?

Fertiliser Importers Caught in Russia-Ukraine Crossfire

Ukraine & Grains: Who is Most at Risk?

Russia & Ukraine Grain Flows Likely to Be Disrupted into H2’22

Explainers That May Be of Interest…