Insight Focus

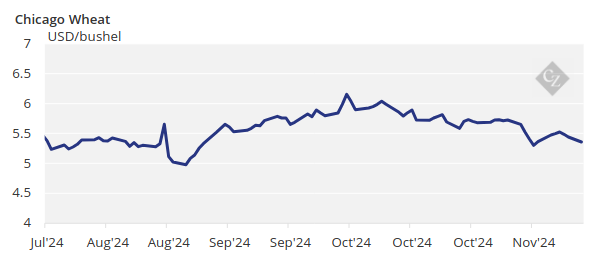

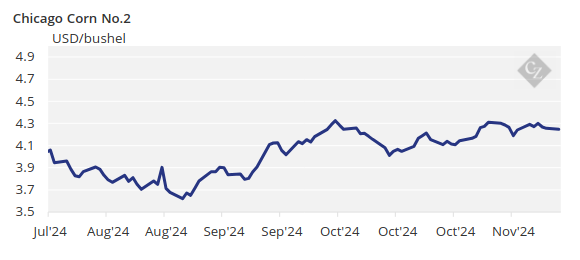

Wheat prices rose on Black Sea supply concerns. Meanwhile, corn remained flat after the US harvest. Agricultural conditions are generally favourable, with minimal weather risks. Black Sea disruptions are the main factor that could drive prices higher.

Overall, most agricultural regions are in good shape. The northern hemisphere is wrapping up the corn harvest and completing wheat planting, with no significant weather risks—except for the potential impact on wheat if unseasonably warm weather delays its winter protection ahead of frost.

South American weather is favourable, supporting the development of corn as the season nears its end. With few factors driving prices higher, the main concern remains potential supply disruptions from the Black Sea.

There are no changes to our 2024/25 Chicago corn forecast, with an average price of USD 3.90/bushel and an upside bias. The average price since September 1 has been USD 4.15/bushel.

Wheat Prices Rally Amid Black Sea Tensions

Last week began with a strong rally in wheat prices due to concerns over potential supply disruptions from the Black Sea, following President Biden’s approval of long-range missiles for Ukraine and rising tensions that could affect trade flow.

Despite US wheat conditions improving by five points during the week, fears of disruptions from Ukrainian ports continued to drive market uncertainty.

US winter wheat planting is 94% complete – on par with last year and the five-year average. The wheat condition is 49% good or excellent, up by five points week-on-week and one percentage point above this time last year.

Winter wheat planting in Russia was 96.7% complete. The last crop’s harvest is virtually finished but officially 99% harvested with 87.3 million tonnes of gross weight. This should equate to some 83-84 million tonnes of clean weight.

Winter wheat planting in Ukraine is 98% complete, ahead of 92.3% last year. Winter wheat planting in France is 90% complete, also ahead of 73% last year and the five-year average of 87%.

Wheat Supports Corn Prices

Wheat pulled corn prices higher, but gains were limited by the completion of the harvest in the US. Corn closed the week with marginal gains while wheat saw gains of over 1% in both the US and Europe.

US corn is now fully harvested. The French corn condition was 75% good or excellent, down one point week on week and behind the 82% recorded last year. Harvesting in France is 82% complete, or 11 points higher week-on-week. This is very slow when compared with the 97% harvested at this time last year and the five-year average of 96%.

Ukrainian corn is 92% harvested, ahead of 82% last year, with a yield of 6.4 tonnes/ha compared with 7.48 tonnes/ha last year. Russian corn is 88.9% harvested.

The summer corn planting in Brazil is 52.4% complete, more advanced than the 49% recorded last year. According to CONAB, crop conditions are excellent, maintaining high productive potential at this stage. Argentinian corn is 39.4% planted, well ahead of 26.2% last year. The condition was 31% good or excellent.

Favourable Weather Conditions for Crops

On the weather front, the US is expected to have favourable conditions in the corn belt with mild temperatures and average rainfall, though less rain is forecast for wheat areas. Brazil and Argentina are expected to continue to receive rain, while Northwest Europe’s predicted rainy conditions will benefit planted wheat. The Black Sea region is also expected to experience favourable weather.

As mentioned, the increasing tensions between Russian and Ukraine sparked concerns over potential supply disruptions to grains trade flows. However, with Ukrainian exports continuing uninterrupted, it remains uncertain whether a risk premium is justified.

US corn is now fully harvested so any harvest pressure on prices should slowly disappear, and the focus turns to South American weather and the progress of the Brazilian and Argentinian harvests.