Insight Focus

- The picture has turned less bearish for corn and soybeans following March’s WASDE report.

- Russia’s influence on the wheat markets continues to weigh on prices.

- Now in the northern hemisphere, farmers must decide what to plant.

Corn recovered from the recent lows after a mixed WASDE report, which was supportive for corn and soybeans, and a bit bearish for wheat. The publication of the report gave a boost to corn prices, which rallied by the end of the week, while lower US ending wheat stocks pressured prices lower.

With the changes made in the March WASDE report, the big picture has become more supportive and less bearish. The overall stock build for grains is 17.8 million tonnes.

We think we may have seen the lowest point for corn as farmers head to fields for planting and margins are poor. But there are good planting conditions, so the focus turns to weather in the northern hemisphere and planting progress. We think European wheat quality will deteriorate due to excess rains, which will lend support to wheat prices.

There is no change to our Chicago corn forecast for the 2023/24 (September/August) crop, which is averaging in a range of USD 4.15/bushel to USD 4.4/bushel. The average price since September 1 is running at USD 4.61/bushel.

USDA Corn Production Estimates Fall

Corn recovered last week after the sell off of the previous week. There is a perception the market is cheap mostly due to very tight margins at actual price levels, potentially resulting in less area planted in the coming spring.

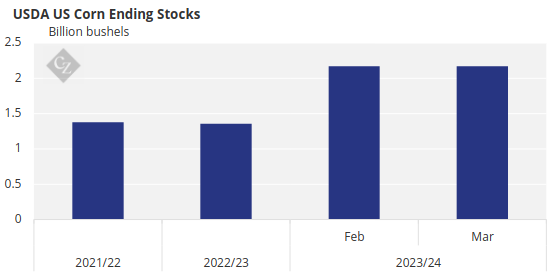

The USDA also reduced global production forecasts in its March WASDE report. The USDA made no changes to its US corn estimate for 2023/24, leaving ending stocks unchanged at 2.172 billion bushels with a stock to use of 14.9%.

Source: USDA

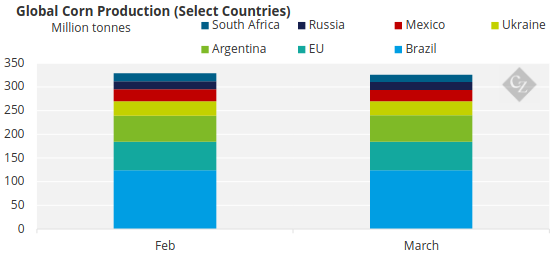

Global corn ending stocks were revised 2.43 million tonnes lower to 319.6 million tonnes. This was due to 1 million tonnes of higher production in Argentina, which was more than offset by 400,000 tonnes less in Russia, 1.3 million tonnes less in South Africa, 1 million tonnes less in Ukraine and 1 million tonnes less in Mexico.

Source: USDA

In Brazil, the worries of dry weather that had resulted in several downgrades to soybean and corn production are now creating an upward revision to soybean production. Financial services firm StoneX last week raised its soybean production estimates by 1.15 million tonnes to 151.5 million tonnes. This is against Datagro’s estimates of 147.3 million tonnes.

Safrinha corn planting is progressing faster than last year, with 73.7% planted compared with 63.6% last year. The first corn crop is 29.4% harvested versus 22.6% last year.

Corn conditions in Argentina were 29% good or excellent, one-point lower week on week. Harvesting is 2.1% complete. BAGE’s corn production estimate remained unchanged at 56.5 million tonnes, very much in line with the 56 million tonnes projected in the March WASDE report.

Wheat Faces Black Sea Competition

There was more pressure on wheat from Black Sea sellers after Egypt cancelled its May tender, apparently targeting lower prices. The wheat condition in France is less favourable than last year, although unchanged from last week at 68% good or excellent.

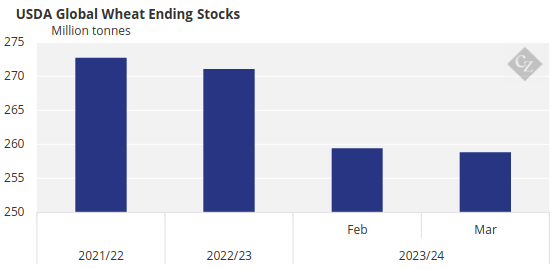

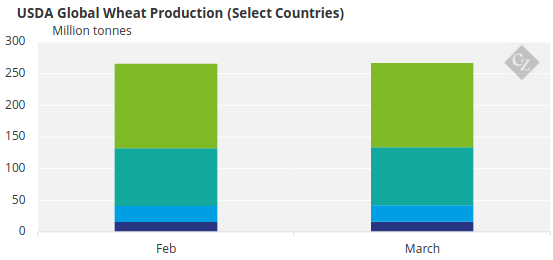

The March WASDE report increased US wheat ending stocks by 15 million bushels, which all came from lower exports, presumably due to strong competition from Black Sea origins. Global wheat ending stocks were reduced by 610,000 tonnes.

Source: USDA

Production was fine tuned in a handful of countries with Argentina up by 400,000 tonnes, Australia up by 500,000 tonnes and Russia up by 500,000 tonnes. The only reduction came from the EU, which is projected to produce 350,000 tonnes less wheat. All in all, production came in higher so lower ending stocks can be attributed to higher consumption.

Source: USDA

The US is expected to continue experiencing mild temperatures alongside some rains. Brazil is expected to receive some rains in parts of the centre-west, while rain in Argentina will fall mainly in the centre and northwest. Weather in Europe is forecast for mild temperatures. We think European wheat quality will deteriorate due to excess rains.

New Season, New Crops?

The planting season is starting in the next few weeks in the northern hemisphere and farmers now need to decide on what to plant. By this time of the year, the decision should have been made as seed and fertilizers have been bought already. But corn margins are poor, and this could lead to some last-minute changes by those that have delayed their commitments as much as they can. The outlook for spring crop development is good, with great soil moisture across the whole northern hemisphere, which is a good start for the planting season.

The March WASDE report has turned the market a little more positive. There are now 2.43 million tonnes less of corn stocks with a global stock build of 18 million tonnes. There are also 610,000 tonnes less of wheat, with a global stock draw of 12.3 million tonnes. We also have 1.8 million tonnes less of soybeans, with a global stock build of 12.1 million tonnes. The overall stock build for grains is 17.8 million tonnes.

It is important to highlight the discrepancy between Conab and USDA projections for Brazilian corn production. While the WASDE report estimates 127 million tonnes of corn production, Conab remains at 113.7 million tonnes. This is a big difference, and it will probably be revised lower in the April WASDE report.