Opinion Focus

bp will acquire Bunge’s stake in their Brazilian cane milling joint venture. bp will own outright around 5% of Brazil’s cane milling capacity. The prize for them is SAF feedstock, as they seek to be the world’s leading SAF supplier by 2030.

bp Takes Control

bp announced it will acquire Bunge’s 50% stake in their joint venture BP Bunge Bioenergia S.A. The JV operates 11 sugar cane mills in Centre-South and Northeast Brazil, crushing 32m tonnes of cane. From this, the mills can make 1.1m tonnes of sugar, 1.5b litres of ethanol and export 1,200 GWh electricity to the grid.

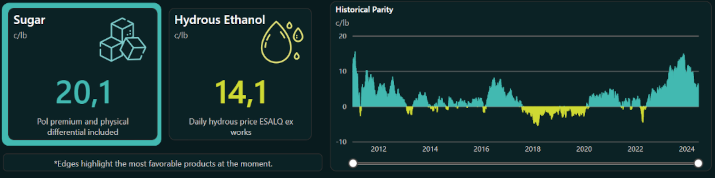

Of all these products, it looks like it’s the ethanol that’s the prize. This seems strange to anyone who looks in detail at the Brazilian sugar cane industry. Today, mills earn 20c/lb from sugar and just 14c/lb equivalent from ethanol. The answer is to look at this transaction on a long-term basis.

The Growing Importance of Sustainable Aviation Fuel

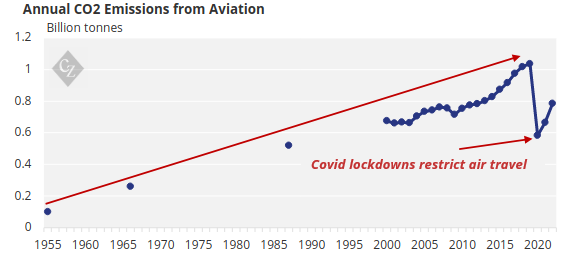

Reducing aviation carbon emissions is a major headache. Ships can sail. Cars can be electrified. But with current technology battery-powered planes aren’t viable.

Sustainable aviation fuel (SAF) seems to be the only medium-term answer. Aviation decarbonisation has barely begun. The sector accounts for around 3% of global greenhouse gas emissions, but the number of passenger kilometres flown continues to rise. SAF accounts for less than 1% of overall aviation fuel usage.

More than 140 countries have pledged to become net zero and so need to reduce aviation emissions. But doing this will require a huge amount of feedstock to make the SAF. If we assume that by 2040 50% of jet fuel is SAF, and of this 10% is made from ethanol feedstock, we’d need the equivalent of a whole new CS Brazilian sugar cane industry! The capital expenditure required is huge and the race for feedstocks will be intense.

bp Seek to Dominate

bp just fired the starting gun for that race. The acquisition of Bunge’s stake in their cane milling JV should be complete by 2024. At a stroke this gives bp 50 thousand barrels of ethanol equivalent a day of biofuel and biogas, setting it well on its way to become a sector leader in SAF. For context, its strategy is to “grow its biofuels production and biogas supply to around 100 thousand barrels a day and around 70 thousand barrels of oil equivalent a day by 2030.”

The acquisition enables bp to be more disciplined in other areas of biofuel investment. In the acquisition press release, bp mentioned it would pause investment at two other bioenergy sites and “continues to evaluate three others for potential progression, aiming to streamline its portfolio for enhanced value and returns”. Although not mentioned in detail, these 5 sites are likely to be those at:

- Kwinana, Australia – formerly the site of an oil refinery that’s been converted to an import terminal. bp had proposed repurposing part of the terminal to become a biorefinery by 2030.

- Rotterdam, Netherlands – already co-processing biofuels and planning a new biofuels production facility at an already operational oil refinery by 2030.

- Castellon, Spain – already co-processing biofuels and planning a new green hydrogen facility at an operational oil refinery by 2030, some of which will be used for SAF.

- Lingen, Germany – already producing SAF from waste oils by co-processing at an operational refinery.

- Cherry Point, Washington, USA – already co-processing to produce renewable diesel.

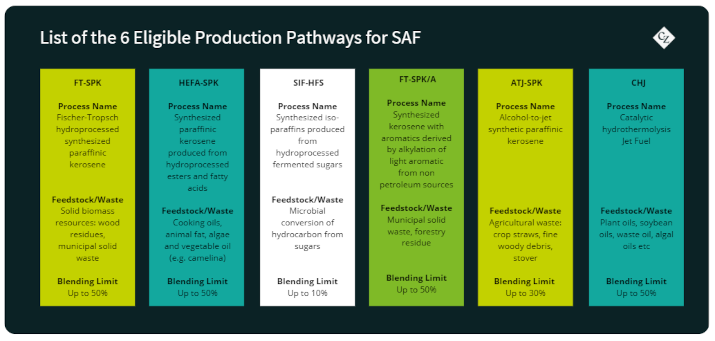

This means that bp are already proposing to use three different feedstocks for SAF: ethanol, waste oils and green hydrogen. The BP Bunge Bioenergia acquisition should be seen in the context of this broader strategy.

For aviation, this mix of feedstocks is a good thing, not a flaw. Currently, all the world’s jet aircraft are powered by fuel that comes from one source – crude oil. Surely it’s better to be omnivorous rather than rely on one energy source?

Bunge Focuses on Core Business

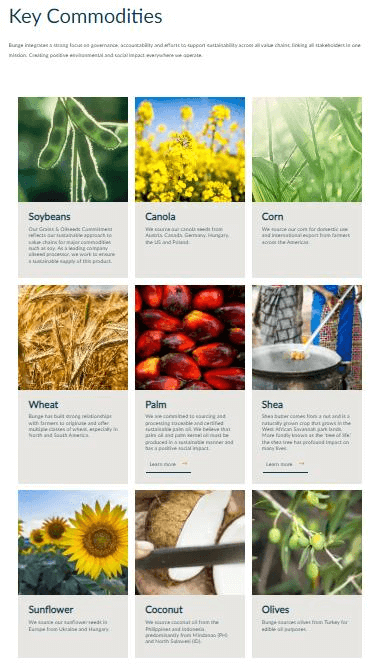

As for Bunge, their intentions are clear. CEO Greg Heckman said, “the business… is not core to Bunge’s long-term strategy.” Bunge are a world-leading oilseed processor and a major producer/supplier of plant-based oils and fats. Their key commodities are soybeans, canola and corn. In this context, it’s hard to see how sugar cane processing fits with the rest of the business.

Source: Bunge

How Are You Positioned?

What does this mean for your business? The race for SAF feedstocks is likely to affect virtually every agribusiness and food producer in the world in the coming decades as the alcohol-to-jet and hydrogenated esters and fatty acids pathways grow in scale.

We can provide you with the support you need on all aspects of this story. We have a corporate finance team active in bioenergy and agriproducts. We have a consulting division dedicated to SAF, ethanol and decarbonization. And we offer premium analysis of sugar and ethanol markets too. Contact me at sgeldart@czadvise.com to work together.