Insight Focus

The law establishes rules for CO2 emissions and carbon credits trading. This is a huge step towards setting up a market that is expected to be worth more than USD 100 billion by 2030.

New Carbon Regulation Established

One year ahead of the 30th Climate Conference (COP 30), which will be held in Brazil in November 2025, the country has taken an important step towards reducing greenhouse gas emissions and rewarding businesses that adopt sustainable practices. Congress just passed Bill 182/2024, which regulates the carbon market.

Until now, carbon credits were traded only on the voluntary market and, therefore, were not linked to legal obligations or periodic checks. Trading values were also not public.

The new law, which was forwarded for presidential sanction, defines limits for pollutant emissions. Companies that exceed the established ceiling, predicted at 10,000 tonnes of CO2 per year, must purchase carbon credits to offset emissions, in addition to setting decarbonization targets.

“The legal system allows companies to offset emissions through the purchase of carbon credits, which should generate opportunities and facilitate the achievement of decarbonization goals,” said Letícia Gavioli, sustainable finance coordinator at WayCarbon.

The legislation should create quite a market. To give an idea, large companies, such as Petrobras, emit more than 40 million tonnes of CO2 per year.

Companies and organizations that emit a value of CO2 higher than the defined limit will need to prepare reports on emissions and compensation, which must be monitored by a regulatory body to be created within the scope of the Brazilian Greenhouse Gas Emissions Trading System. The regulated securities market will be implemented gradually over six years.

Local Amazonian communities will be able to issue carbon credits. Photo: iStock.

The law also provides the possibility for indigenous peoples and extractive communities to issue carbon credits based on forest preservation, which should even arouse the interest of international investors. B3 is already preparing the creation of a specific carbon market platform with open data on the values traded, bringing more transparency to transactions.

Private Sector Support Needed

The measure has support from the private sector. In October, a group of 59 CEOs from large companies, such as Natura, BRF, Suzano and Itaú, launched a manifesto in favour of approving the bill. “This is a fundamental measure to stimulate the development of low-carbon technologies and open up new opportunities for generating wealth,” the document said.

A study by ICC Brasil, the Brazilian branch of the International Chamber of Commerce, carried out with the consultancy WayCarbon, points out that the regulation of the carbon market could generate more than USD 100 billion in the country from 2030. Today, the market covers less than 5% of this value per year.

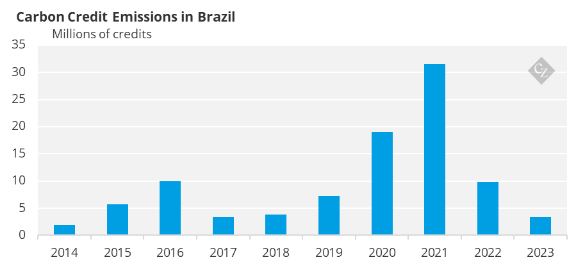

Emissions of carbon credits are also expected to increase exponentially, surpassing 30 million credits traded per year — 10 times more than the current volume. Today, trading is carried out on the voluntary market, on the initiative of the companies themselves, without a legal mandate. This helps to explain the annual variation in credit issuance and the more restricted volumes.

Source: FGV

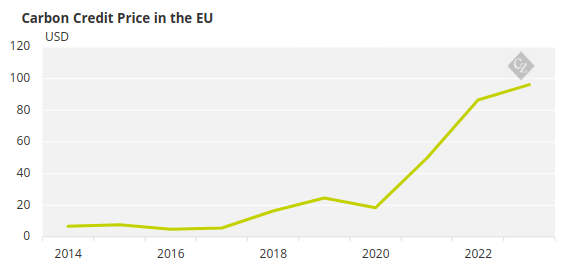

With market regulation, prices should also rise, approaching the European market standard. In 2023, the value of carbon credits reached an average of USD 96 in Europe, according to the World Bank. Today, carbon credits are traded at a much lower level in Brazil, between USD 5 and USD 20.

Source: World Bank

Greater Opportunities Exist

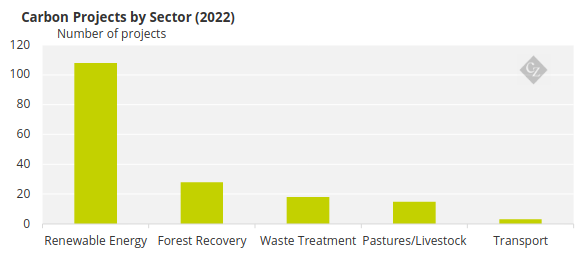

The opportunities created by market regulation must be distributed across different sectors, especially those that already invest in sustainability or carry out activities that contribute to reducing CO2 emissions. A good example is the renewable energy sector, a champion of decarbonization projects that generate credits in the voluntary market in Brazil.

Source: ICC Brazil and WayCarbon

The biofuels sector is also a natural candidate for issuing carbon credits, especially with the approval of the Future Fuel Law. Sanctioned in October, the legislation encourages the production of biodiesel, ethanol, biogas and SAF.

There is currently no obligation for agriculture to officially participate in the carbon offset system, but it will be able to carry out reforestation programs and carry out other sustainable actions. Some players may even issue credits.

The European Union, which imposed the first regulations on its carbon market almost 20 years ago, is considered one of the biggest global cases in the sector. In Latin America, some countries have been following the same path. A good example is Mexico, which defined a legal framework for the carbon market in 2020. Chile and Colombia have also prepared to regulate the market.

Worldwide, 36 countries have already created a legal system for trading carbon credits or are in the implementation phase, according to the World Bank. “This is a global trend and now Brazil will be able to take advantage of the opportunities of a regulated market,” said lawyer Rodrigo Lima, partner at Agroícone, specialist in sustainability and agribusiness.