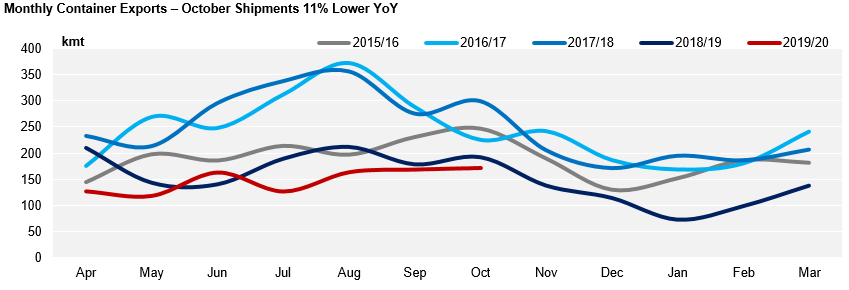

- October whites container exports are down 11% YoY at 171kmt;

- Tendency is for volumes to reduce over the upcoming months;

- West African countries remain as top destinations;

Lowest Exports in 10 Years

- Container shipments have been steady for the past 3 months, around 165kmt;

- Despite the continuous pace, it is the lowest monthly volume of the past 10 years;

- October data showed that container exports totalled 171kmt – 11% down yoy;

- Just a note on stats: container data has over 1 month delay which is why we are writing only now about October exports;

- From now on, the expected tendency is down;

- In Q4, whites production will be over (due to the end of the season in CS) and with a lower availability, export figure should follow the same trend;

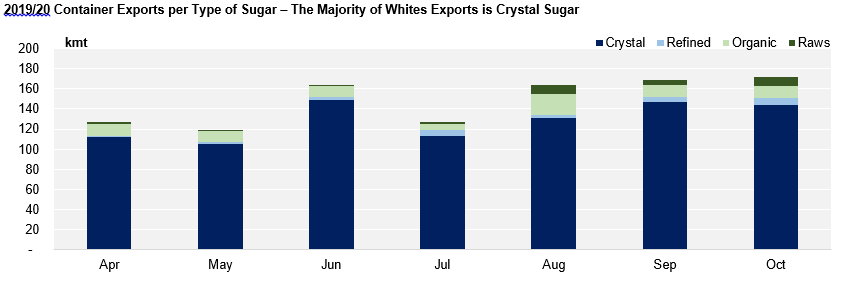

- Looking at quality of whites exports out of Brazil, the majority is of crystal sugar, with the remainder composed of small volumes of refined, organic and direct consumption raws;

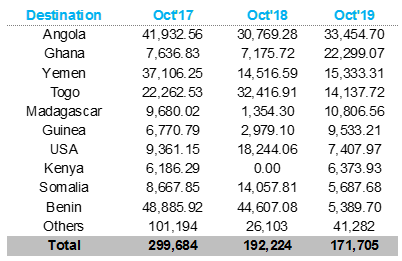

Destinations

- Historically, the main destination for Brazilian white exports is Africa;

- This has not changed, despite the reduction in volume of the usual main offtakers;

- Meanwhile, other West African countries have increased demand but not enough to offset the decrease from other destinations.

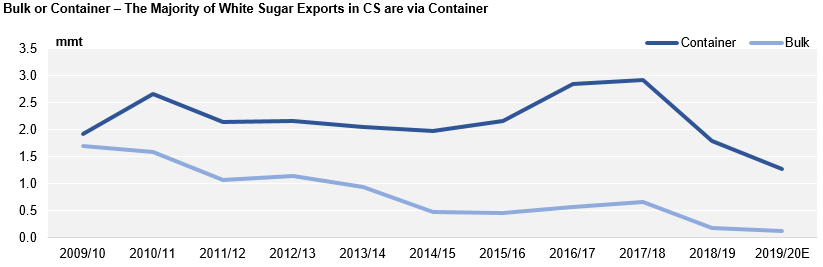

White Sugar Export Profile

- The tendency of white sugar exports in CS has moved towards container shipments;

- Break bulk exports has diminished significantly each year due to the size of the shipments and most significantly due to terminal availability;

- Terminals in CS (specially Santos) prefer to work with bulk cargos that are more efficient;

- Meanwhile, in NNE the majority of white sugar exports are made via break bulk due to the terminals higher idle capacity.