Insight Focus

India and Peru both face mango production issues this year. Brazil has increased its presence on the mango export market.

Europe Has Appetite for Mango

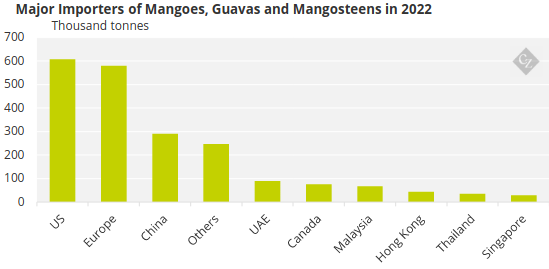

The Netherlands is Peru’s top buyer, taking over 40% of its total exports. In fact, Europe is the second largest importer of fresh mangoes in the world, coming in only behind the US.

The US buys mango mainly from Mexico. About 90% of Mexico’s mango exports are sold to the US due to favourable trade conditions.

Source: UN Comtrade

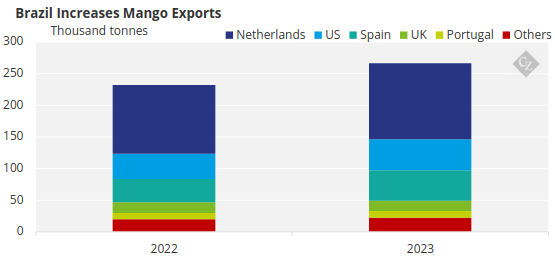

The demand for mangoes in Europe is stable and has been growing for several years. Countries like Brazil and Peru remain the dominant suppliers. Given Peru’s weather-related struggles, Brazil has stepped in to fill the gaps in the European market.

Despite ranking sixth globally in total production, Brazil is a major exporter, with Europe as its top market. The Netherlands, a key entry point, receives almost half of Brazil’s exports.

Source: UN Comtrade

Favourable climates, advanced irrigation, and ongoing research ensure consistent production and a bright future for Brazilian mangoes. Brazil is now able to offer year-round availability. Notably, Brazil exports four distinct varieties: Palmer, Keitt, Tommy Atkins and Kent. In contrast, Peru focuses on Kent mangoes for the European market.

Brazil exported a record USD 315 million in 2023. This surge is fuelled by the Vale do São Francisco in the Northeast, now the dominant source of Brazilian export mangoes, accounting for about 90%. Bahia and Pernambuco lead production within the region, each contributing nearly half of all export-oriented fruit.

Americas Produce World Supply

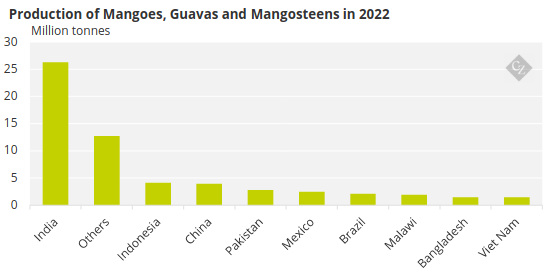

India is the biggest mango pulp/concentrate producer in the world, accounting for approximately 50% of global production.

Source: FAOSTAT

There are several challenges facing the South Indian mango crop this year, like extreme weather conditions, late blooming and pests. As a result of these factors, this year’s yield is expected to be lower, with production expected to be only 30% of the previous year, according to one Indian mango producer.

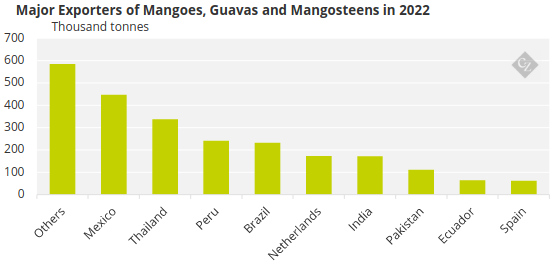

However, by far the biggest exporters are in Latin America. In 2022, Mexico exported over 447,500 tonnes of mango, while Peru and Brazil jointly exported about 470,000 tonnes. This means issues in these producing countries is much more likely to impact international prices, although supply concerns in India are also likely to weigh.

Source: UN Comtrade

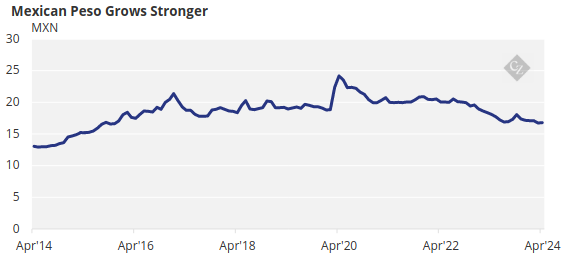

The good news is that the 2024 Mexican crop is looking promising. However, the Mexican Peso is very firm at the moment, resulting in higher production costs.

Source: St. Louis Fed

To clear out last season’s stock before the new harvest, processors are offering mango concentrate at slightly lower prices. This is good news for EU and US buyers.

However, Peru’s mango farmers are facing a disappointing season. Exports are down over 65% compared to last year, with only 80,000 tonnes shipped. This decline in exports is largely due to extreme weather conditions, which are restraining mango flowers and causing early fruits.

Peru is particularly susceptible to the impacts of the El Nino weather pattern, given that the phenomenon takes place off the Pacific coast of Ecuador. The 2023-2024 phenomenon has been one of the strongest ones in recent history and even though it is fading at the moment, its influence is not.

Record-breaking temperatures are expected for months to come. While El Niño weakens, it can still have huge impacts on weather systems.

Concluding Thoughts

- With India and Peru both facing production challenges, Brazil is stepping up to meet European demand.

- As the El Nino weather pattern changes to La Nina, weather in Peru may become more favourable for mango growing – although weather-related challenges could continue in the short term.

- While Mexico has a promising harvest, a strong Mexican Peso might lead to higher production costs for exporters.

- All these factors could mean Brazilian producers have a golden opportunity to dominate the European mango market.