Main Points

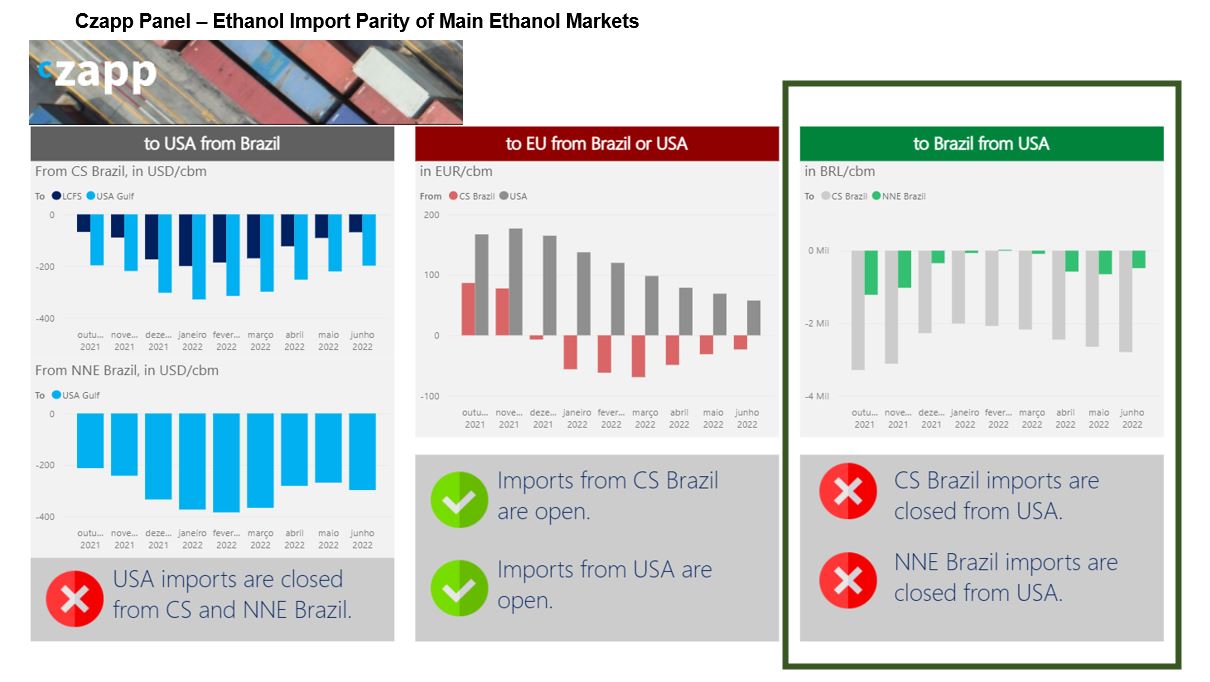

- Ethanol import margins remain closed.

- But still 600m liters are expected in the coming months.

- Why is the sector is importing with a financial loss?

Greater Demand

- With hydrous ethanol losing its competitiveness at the pumps (because of parity above 70%), part of its consumption migrated to gasoline.

- The result was greater demand for anhydrous so far this year – anhydrous is blended into gasoline.

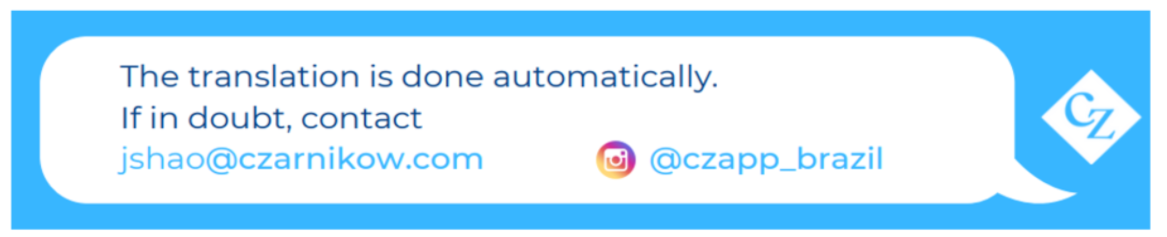

- Cumulative sales of anhydrous reached 5.56 billion liters in the first half of October – the highest volume ever recorded.

- In the total expected for the crop, anhydrous ethanol sales are expected to end at 10.2 billion liters – the second largest, in second only to 2016/17

Biggest Supply

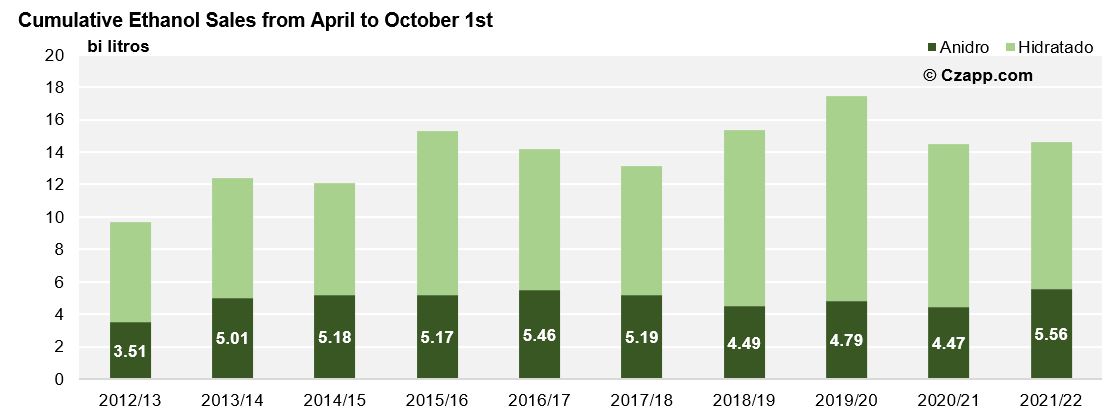

- The production of anhydrous ethanol so far is the largest ever recorded, with 9.5 billion liters.

- Although the production of ethanol from sugarcane is the largest since 2017/18, who has helped in the greater supply is corn ethanol – 42% above last year.

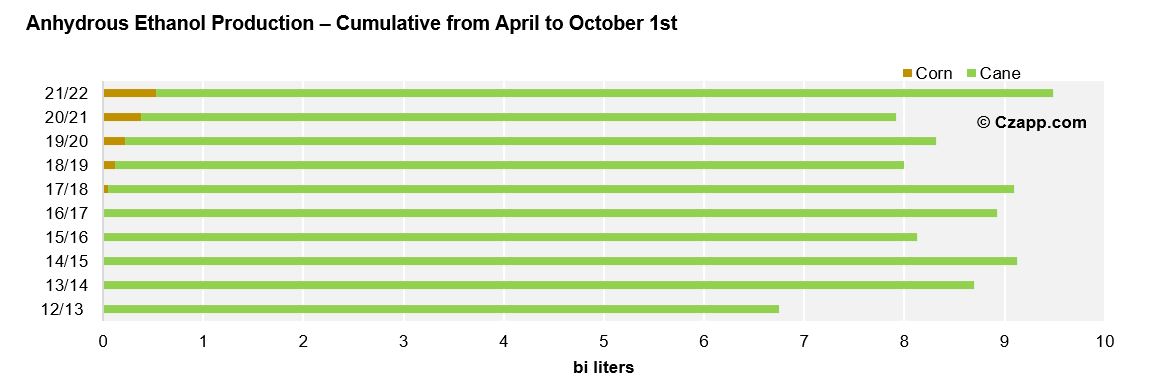

- And even with a record offer, the carryover stock at the end of March would be tight.

- Based on an estimated growth in fuel consumption of 5.5% for 2021/22, anhydrous stocks at the end of the crop would be around 400m liters – within the limit of the ANP minimum stocks rule.

- That wouldn’t even be able to meet the demand for half the month.

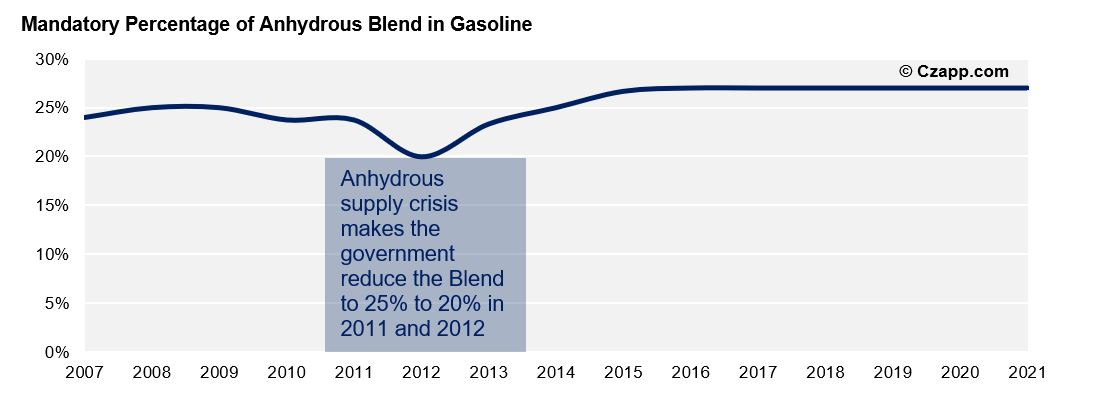

- Looking at the Stock-to-Use ratio, it would be the lowest recorded since 2011 – and we know what a chaos that year was.

- With a risk of low off-season stocks, it intensified the government’s threat to reduce the anhydrous blend from the current 27%.

- To prevent this drastic measure, the sector had to find an onerous solution…

Importing with Loss

- Currently the anhydrous mixture can be determined between 18-27.5% at the government’s discretion.

- After years of campaigning in the sugar-energy sector to raise the upper limit from 25% to 27.5%, it was finally approved in 2015.

- And since then the mandatory blend remains at 27%.

- With the risk of low ticket stocks, the sector began to worry about the possibility of the government reducing the mix to a minimum – that is, 18%.

- If that happened, the sector could take years to get back to previous levels and lose confidence in being able to supply the market.

- Faced with this risk, some groups got together and decided to import ethanol even at a loss.

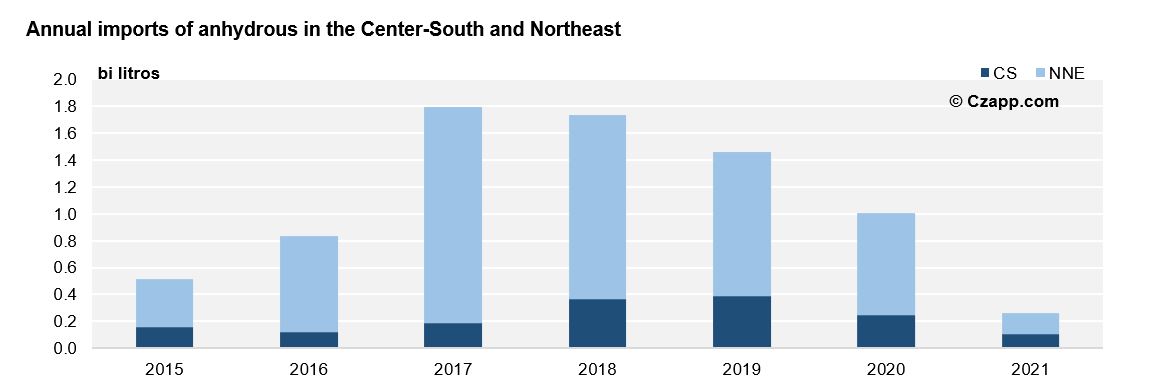

- It is expected that in the next 6 months, around 600m liters will be imported in the Center-South.

- A volume more than enough to raise inventories to close to 1bn liters in early April 2022.

- We continue to follow the ethanol lineup, which at the moment has 35m liters to be unloaded between Santos and Paranaguá.

- Looking at imports so far, they are the lowest in the last 7 years.

- With the expected volume for the coming months, this tends to change…

Other Reports that you might like:

Dashboards that you might like: