Insight Focus

Urea prices keep struggling to hold. The main buying activity comes from India, while a progressive increase in Chinese supply is set to bring down prices. Global ammonia markets are split among two tiers with prices east of Suez moving upward due to restricted availability, whilst west of Suez prices are stable to soft.

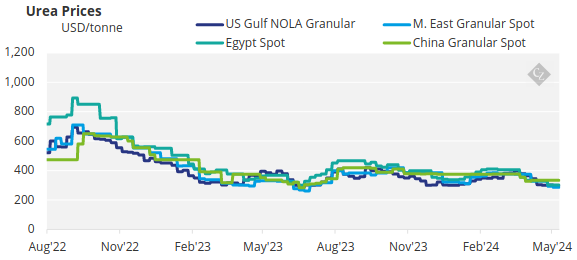

Urea Feels Pressure

The granular urea market is under continued pressure and traded another USD 7-8/tonne lower this week from the Middle East versus last week with one cargo said to be destined for the Australian market selling at USD 268.50/tonne FOB, down from USD 275/tonne FOB last week.

The big question is again China, but it appears Chinese material will only enter the market sometime in June. This is due to the delayed spring season in China and lower inventories. The supplier trading book for June is also light so urea prices could continue to feel pressure although there are some signs that the price could hold for a few weeks until the introduction of Chinese material. In 2023, only about 250,000 tonnes of Chinese material came into the market in June and sold mostly in the Southeast Asian region.

Looking at other markets, Egyptian producers are struggling to maintain levels above USD 290/tonne FOB with slow demand in Europe. Brazil has been quiet, with focus on the tragic flooding in the southern state of Rio Grande do Sul which surely will create havoc for farmers. Traders have been offering prices of urea above USD 300/tonne, but bids are coming in as low as USD 290/tonne CFR.

NOLA/US has been rather quiet due to the wet weather and May barges are being offered at around the USD 285/short ton (USD 258/tonne) FOB level. Pupuk Indonesia held a tender for prilled urea this week and up to 10,000 tonnes was concluded at USD 312.50/tonne FOB with the product appearing to be destined for the Philippines.

The outlook for urea is still bearish with producer books for June light and the expected introduction of Chinese urea into the market.

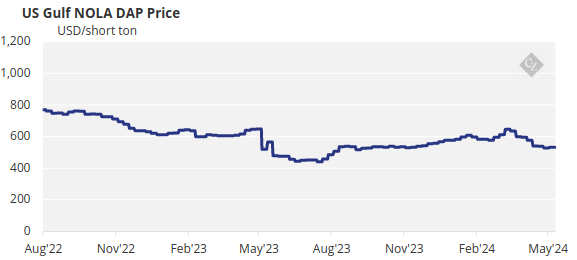

Processed Phosphate Focus on China, India

On the processed phosphate side, it is all about India and China. Indian DAP traded this week at USD 507/tonne CFR in a tender. This price is sub-USD 480/tonne FOB but still far from the USD 420/tonne FOB 52-week low in China.

It remains to be seen how pragmatic the Chinese suppliers will be in the weeks to come when it is estimated that the industry average break-even number is around the USD 475/tonne FOB mark. However, some producers with their own phosphate rock may have lower levels of breakeven.

OCP of Morocco exported roughly 2.5 million tonnes of granular phosphates in the January-March period, a 20% increase from around 2.08 million tonnes during the same three months of last year, according to Office Des Changes data. Phosphate rock exports from Morocco in Q1 jumped 42% year on year to 1.19 million tonnes.

Morocco’s January-March phosphoric acid exports reached 460,980 tonnes, up 9% from 422,693 tonnes during the first quarter of 2023, the Office Des Changes data show. The US Department of Commerce last week increased the countervailing duty (CVD) on imports from Morocco’s OCP to 14.2% from 2.12% previously as part of a preliminary determination.

MAP prices in Brazil appear to be holding at around the USD 570/tonne CFR mark. Chinese MAP 11-52 is available around USD 565/tonne CFR, but the product will not arrive in Brazil in time for the season and will be consumed instead during Safrinha, according to an importer.

Some market sources in Brazil have suggested that MAP 11-52 from China has been sold as low as around USD 555/tonne CFR recently, albeit for shipment in June-July.

Port operations have been suspended at Porto Alegre due to catastrophic floods in southern Brazil. Operations at the port of Rio Grande were also impacted, though some market sources suggested that operations were being maintained for now. Blending facilities in the state of Rio Grande do Sul have reportedly been closed due to the flooding.

With increased Chinese availability as the weeks progress, it is expected that we will see processed phosphate prices edging lower.

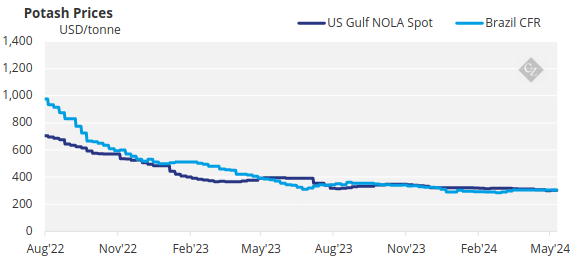

Brazil Only Bright Spot for Potash

Potash price points remain under pressure in some key global markets, while others managed to hold up for another week. Brazilian spot prices were assessed unchanged again this week at USD 310-315/tonne CFR as sellers continue to struggle to reach the anticipated USD 320/tonne CFR levels.

The spotlight this week has been on the severe flooding in the southern state of Rio Grande do Sul, and the subsequent suspension of operations at the Port of Porto Alegre.

Southeast Asian prices have resisted downward pressure, staying at USD 280-300/tonne CFR for sMOP for the last three weeks. Average sMOP prices are at their lowest since the end of May 2021 and are anticipated to fall further in the region.

The outlook for potash is generally bearish with the exception of Brazil, which is expected to hold or slightly increase until June then taper off.

Ammonia Market Appears Bullish

There is bullish sentiment across ammonia markets. East of Suez showed little sign of receding this week as supply constraints and simmering demand continued to support prices across the region. This is in stark contrast to the Western Hemisphere, where most benchmarks appear flat-to-soft as seasonal interest wanes.

The Ma’aden complex is due to go down for maintenance and the Petronas Bintulu facility is down due to technical issues. Both factors appear to have supported ever increasing ammonia prices East of Suez and all eyes are on India to see what price level tenders will see.

The outlook for ammonia prices East of Suez may find support in limited availability, whilst West of Suez, prices are stable to weak.