- This week, 540kmt were nominated in CS.

- Out of this volume, 100kmt was only for China;

- August line up stands at 3.3mmt.

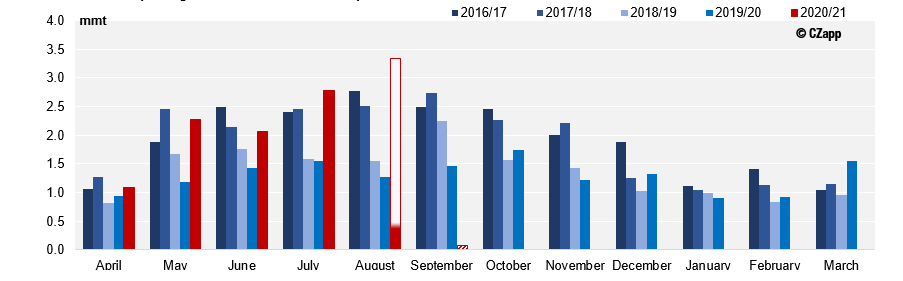

CS Brazil Monthly Exports

- Preliminary data shows that 2.8mmt of raws were exported from CS in July – in line with estimates.

- For August, this week 540kmt of raws were nominated in CS.

- August line up already stands at 3.3mmt.

CS Raws Line Up – August could see a record of exports out of CS

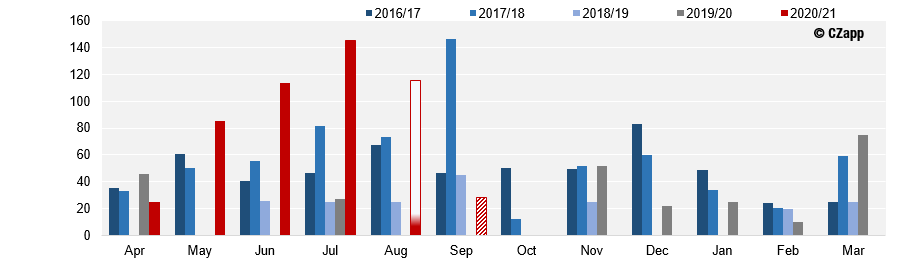

- As for whites breakbulk, only one vessel nominated in Sao Sebastiao port this week.

CS Whites Line Up – July whites exports, the highest in 8 years

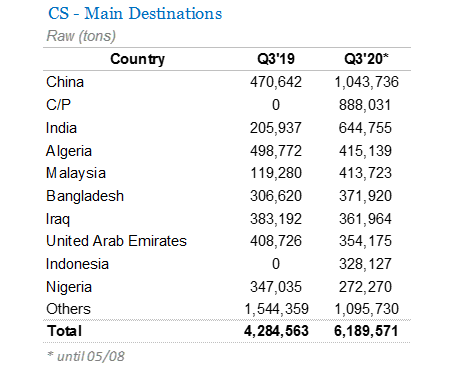

Destinations

CS Brazil Raw Sugar Main Destinations

- Out of the nominations this week 100kmt are for China – total nominations in Q3 stands at 1mmt.

- The last time Chinese offtake was this strong was in 2015 – and could be even higher.

- For UAE, 70kmt nominated this week, taking total Q3 offtake to 354kmt.

- Have a look at our interactive data to see Brazilian top destinations: Global Shipments.

Port Situation

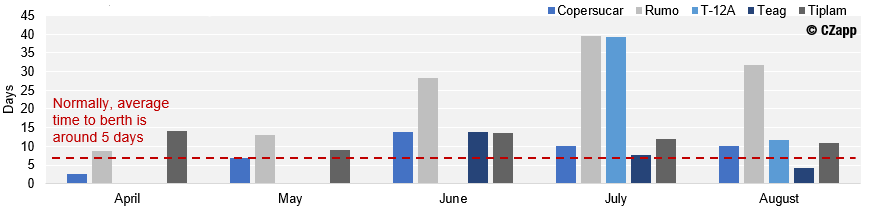

- Waiting time to berth seems to be reducing this month.

- Rumo remains the terminal with the highest waiting time.

Santos Average time to berth per terminal

- However, waiting time could rise in other terminals over the next days.

- There are programmed stops in 2 terminals:

- T-12A: dredging services will be carried out from 8th to 12th August;

- Tiplam: programmed maintenance from the 21st to the 23rd August.

Summary Table

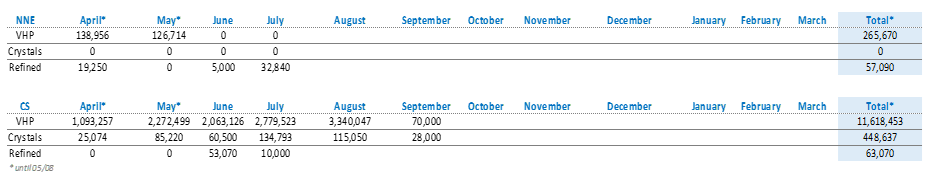

2020/21 Brazil Summary Table of Exports (tonnes)