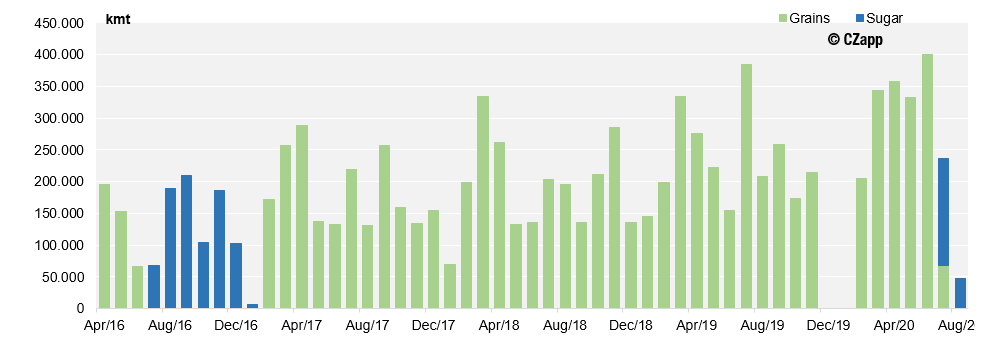

- Almost 150kmt of sugar has been diverted from other terminals to T12-A;

- It is the first time the terminal operates sugar since 2016/17 season;

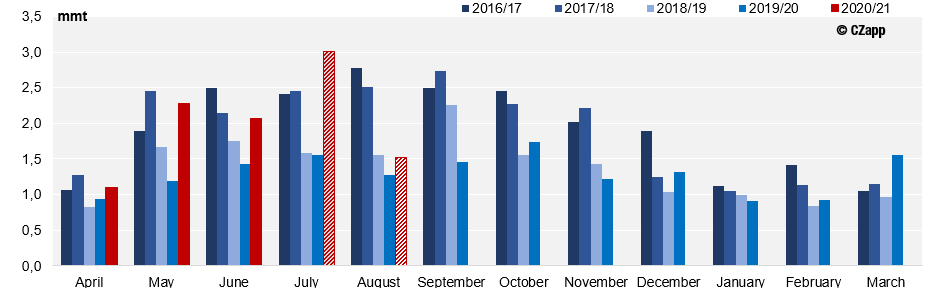

- Pace of nominations have increased this week with 760kmt added to CS lineup.

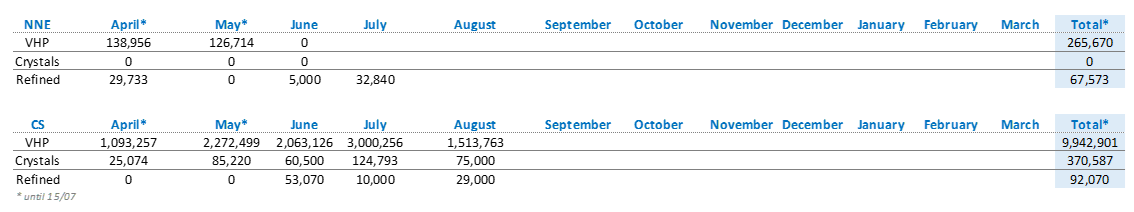

CS Brazil Monthly Exports

- This week, 760kmt of raws were nominated in CS – it is a pick up in pace since the slower past week.

- July line up now stands at 3mmt but given the pace of operations we believe that around 200kmt should roll into August.

- August line up stands at 1.5mmt.

CS Raws Line Up – June is already topped

- This week we have finally seen some nominations and vessels expected to berth at T12-A terminal.

- It is the first time since the 2016/17 season that the Cofco terminal operates sugar.

T12-A Terminal Exports – Back to sugar after 3 seasons

Destinations

CS Brazil Raw Sugar Main Destinations

- Out of the nominations this week 70kmt are for UAE – total nominations in Q3 stands at 282kmt.

- Another nomination for Tunisia, with 33kmt – Q3 offtake stands at 100kmt.

- Have a look at our interactive data to see Brazilian top destinations: Global Shipments .

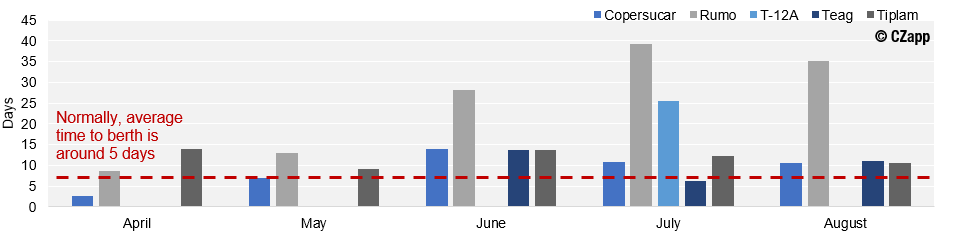

Port Situation

- The vessel line remains high, as does the waiting time to berth.

- Rumo remains the terminal with the highest waiting time.

Santos Average time to berth per terminal

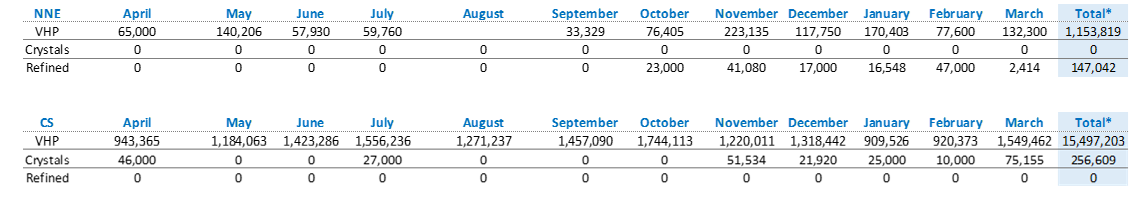

Summary Table

2020/21 Brazil Summary Table of Exports (tonnes)

2019/20 Brazil Summary Table of Exports (tonnes)