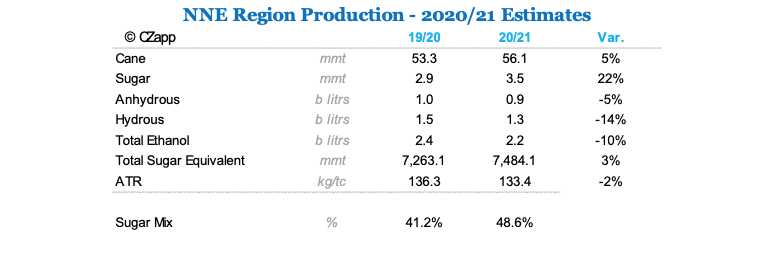

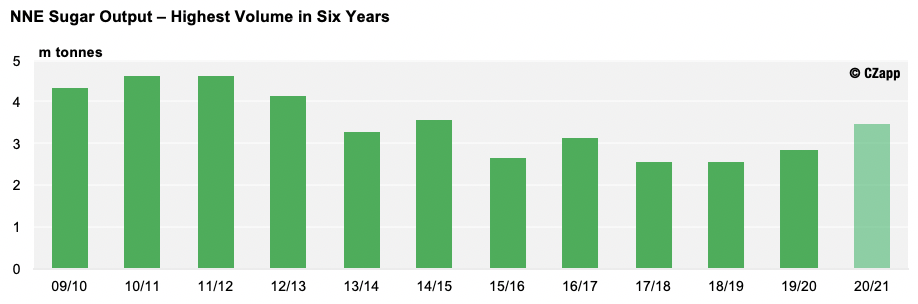

- NNE region starts the new 2020/21 season;

- Expected increase in sugar availability – production forecast at 3.5mmt;

- Ethanol imports and transfers still needed;

New season starting in September

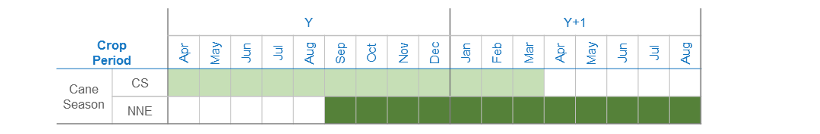

- The cane season in the NNE region of Brazil follows a different calendar than the CS;

- Now in September, the 2020/21 crop officially starts in the Northern part of Brazil.

Crop Calendar for Cane in Brazil

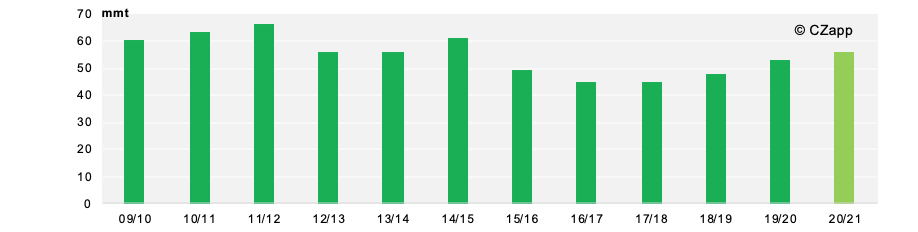

- Reports from millers in the region is that the 2020/21 season should report another year of recovery.

- Weather was good for cane development, leading to an expected increase in agricultural yields.

- Our initial estimates points to a 56mmt crush – 5% higher yoy.

NNE Cane Crush – another season of recovery for the region

Change in Strategy

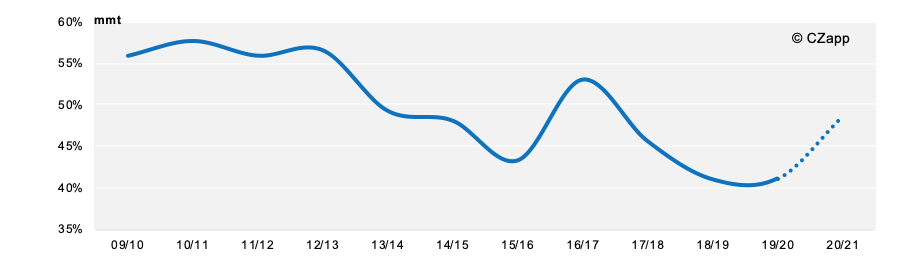

Sugar Mix – back to sugar

- After 2 seasons of maximizing ethanol output, the NNE region is expected to go back to sugar.

- With the excellent returns of sugar, sugar mix should reach 48.6% – with a potential upside.

- This results in sugar production of 3.5mmt – the highest of the past 6 years.

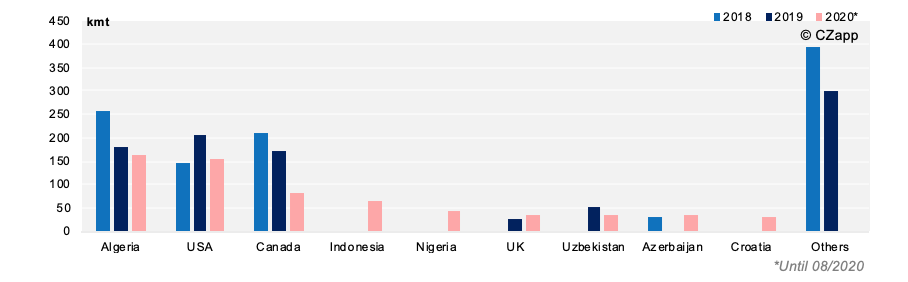

- The increase in sugar production means the region has more sugar available for exports.

- As such, we expect a 20% increase in exports from NNE, out of which the majority is raw sugar.

NNE main raw sugar destinations – North America is among the main destination for NNE sugar

- The main destinations for NNE sugar have been United State and Canada.

- In the US, NNE sugar can enter under TRQ without paying duty – current 2020 quota for the region is for 152kmt.

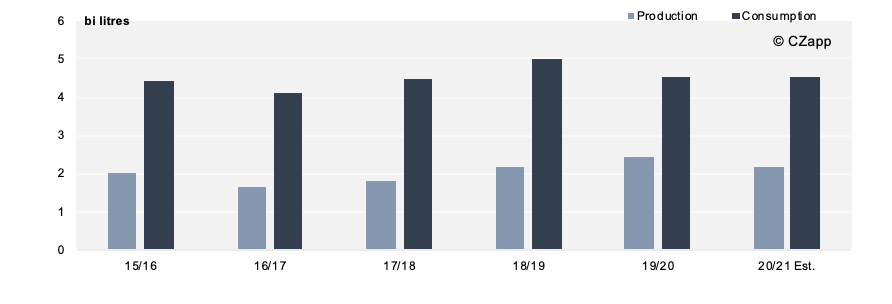

Deficit in Ethanol

- NNE has a total ethanol demand of almost 5bi litres annually.

- This means that, the region has an ethanol deficit of around 2.5bi litres.

NNE Ethanol Prod & Cons – the region has a deficit that is solved via imports and transfers from CS

- Part of this deficit is resolved via transfers from CS, and other part from ethanol imports.

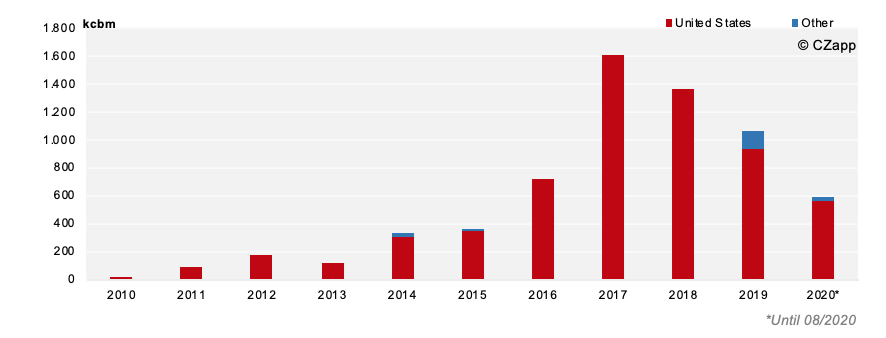

- NNE is actually a big market for American ethanol, with the region importing over 900mi litres last year – even with an import tariff of 20% on ethanol exceeding a 750mi litres quota.

NNE Ethanol Imports – huge volumes entering the region forced the government to act

- Until this month, up to 750mi litres of ethanol imports could enter the country duty free. The volume that exceeded the quota was subject to 20% duty.

- Now, recent reports say the government has eliminated the quota volume and all ethanol imports will be subject to the 20% import tariff.

Crop Summary Table