Insight Focus

The government will auction 24 highways by 2025. It’s also preparing a package of railway concessions focusing on the Central-West and North, the center of agricultural production. This is important for the flow of grains and other commodities.

Government launches auctions for roads and prepares railway plan

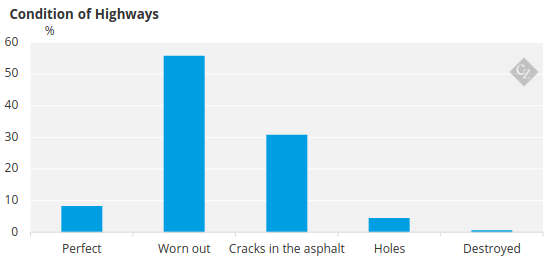

Infrastructure bottlenecks are one of the biggest challenges for Brazilian agriculture. Only 13% of the roads are paved and there are just 31 thousand kilometers of railways, of which 10 thousand kilometers are inoperative. By comparison, the American railway network is 225 thousand kilometers.

The good news is that in recent years a series of highway and railway concessions have been granted to improve transport infrastructure. Now, the government is preparing to auction 24 roads and, if everything goes well, some railways. “We have a big challenge”, says George Santoro, executive secretary of the Ministry of Transport, in an exclusive interview with CZ App.

George Santoro, executive secretary of the Ministry of Transport. Source: Marcio Ferreira/Ministry of Transport.

What is the plan for holding highway auctions? Will there be 12 auctions this year?

Yes. We already have two important auctions scheduled, on BR 181, in the Minas Gerais section, and on BR 040, between Belo Horizonte (MG) and Cristalina (GO). Three others have already been approved by the Federal Audit Court (TCU), such as BR 153/262 and BR 262, in Minas. The CN2 concession, in Goiás, should also be withdrawn. And we are going to grant concessions for state highways that were federalized in Goiás, on the agribusiness route. These are some examples.

These roads in Goiás are important for grain transport, aren’t they?

Yes. Highway auctions are very focused on roads in the Center-West and Minas Gerais. There is also one in Rondônia, BR 364, in Arco Norte, between Porto Velho and Vilhena. The volume of grain transported by these highways has increased significantly, so these concessions are fundamental. The idea is to reduce logistical costs, with improvements in paving, duplication of lanes and greater road safety.

Source: CNT.

Should some old concession contracts, which had problems, be reviewed?

Yes, there is an optimization agenda for some contracts. These are old contracts that, due to errors in demand and changes in cargo transport logistics, need to be redone. So, we remodeled the contracts, which are now going to auction.

And what is the concessions plan for next year?

We will auction 12 more highways. All notices and contracts will be standardized. What changes is the economic modeling of each project, but the technical standard is the same. We are doing this to reduce the time taken to bring projects to market and attract investment. Today, it takes us around three years to complete a project, which already represents progress. But the ideal is a year and a half or two. We are looking for this.

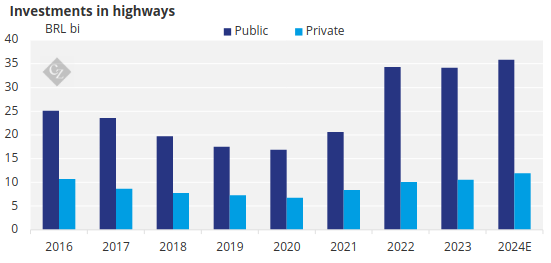

Source: Inter.B.

Investors

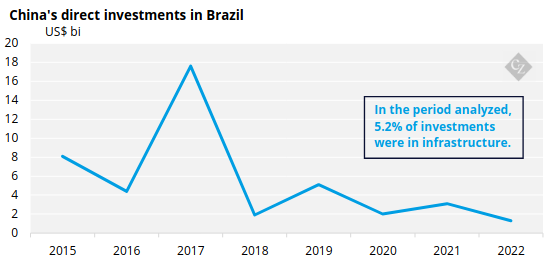

How is investor interest in the auctions that will be held this year? Is there any interest from China, for example?

China has a major project in Bahia, the Salvador-Itaparica bridge. And the engineering company Concremat is now Chinese. China is very interested in food security. Conversations with Chinese companies are very much in this direction. But China is still flirting with our infrastructure market. It is more likely that in 2025 a Chinese company will enter an auction.

Source: BRICs and Brazil China Business Council.

This year, should the best-known players on the market participate in the auctions?

Yes, they are big companies that already know our market. European companies, for example, have a longer tradition of participating in our auctions. It is important to say that if we add the remodeling of old contracts and the new auctions that we will hold this year, it amounts to BRL 200 billion in investment.

Banks and investment funds are talking to form consortiums and participate in the auctions. And there will be a line of credit from the Brazilian Development Bank (BNDES) for these auctions, which should help attract investors.

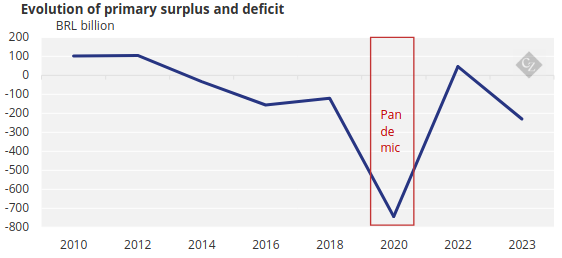

Could fiscal risk, with increased public spending and exchange rate fluctuations, harm auctions?

Those looking at long-term infrastructure projects aren’t too worried about this. But in relation to investment funds that aim to have a faster return, say four years, a certain stability is necessary. And construction companies don’t want to expose themselves to risk, which makes it difficult. They need to have a capital structure and the funds end up creating an interesting composition because they raise money cheaper. This opens the market.

Source: Central Bank.

How does agribusiness see these projects?

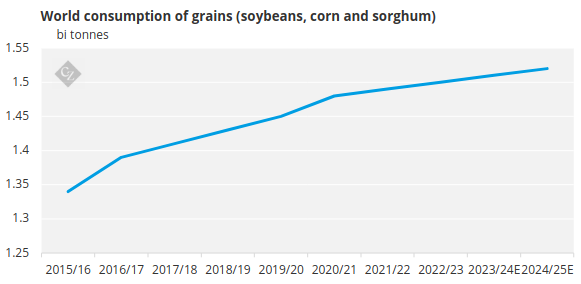

These are very important projects for the sector. Agribusiness is tense because loads are often stopped. And the tendency is for the world to demand tens of millions of tonnes of more grains per year, with Brazil playing an important role in this scenario. And here there is still the problem of competition in ports between grains and sugar. The logistical challenge is gigantic.

Source: FAO.

Isn’t it important to also look at the local roads, which transport cargo to the main roads?

Yes. We entered a partnership with the World Bank to structure a concession model for these highways, which are very important for agribusiness. In some cases, we will form public-private partnerships. The World Bank has already completed the studies and the modeling of the concessions should be finalized in July, to be launched by the end of the year.

Railways

In relation to railways, how are the projects going?

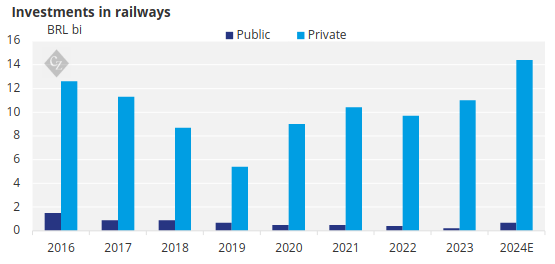

We are set to launch a plan this year. It is important to remember that some contracts with railway operators are expiring and some renewals have been brought forward in recent years. We understand that pricing was inadequate in some cases. A renegotiation was carried out with operators such as Rumo and MRV. With Vale, we are finalizing the renegotiation. This will generate resources that could reach BRL 25 billion.

We want these resources to stay in our portfolio, and not in the National Treasury, to finance a major railway plan. The major railway projects in the world rely on public money. But of course, all of this will depend on government approval. In the case of railways, the objective is for the government to invest a portion and the private sector to contribute the rest.

Source: Inter.B.

And how are the projects for the Central-West Integration Railway (Fico), and other railways?

The first section of Fico, between Goiás and Mato Grosso, should be delivered by Vale by 2027. In section 2, in the center of agribusiness, between the cities of Água Boa and Lucas do Rio Verde, in Mato Grosso, the idea is to do a concession.

In the case of the East-West Integration Railway, Fiol, we have a problem because section 1, of more than 400 kilometers, is under the responsibility of a company that recently had its assets confiscated and sent more than 500 workers away. As the market has shown interest in the company, perhaps this issue will be resolved by the market itself.

I know that the issue of ports is not your responsibility, since you are responsible for land transport, but we also have a problem there, don’t we?

Yes. It is not the most efficient port that is chosen to transport the cargo, but rather the one that represents the lowest cost for the merchandise to reach it. This happens because there is no connection between transport modes. We also need more efficient railways. In the railway package that we must launch, there must be some regulatory figures that will increase the capacity of the railway network.

Rumo train. Source: Rumo.

In general, railways in Brazil are operated by companies that own the cargo. One of the measures we are proposing refers to the mesh saturation index. Today, it cannot exceed 90% of operating capacity at any time of the year. We will change that. The 90% ceiling will be maintained, but a moving average will be created.

The idea is to copy the airline industry’s slot model. As a result, the railway will be more interested in making room for third-party cargo. We are already talking to the companies that operate the railways, but it is not so easy because we are going to stimulate competition between the different operators on the network. And this is not quick, it needs to be put out for public consultation and the sector must be heard.

At the same time, railway projects like Ferrogrão are on hold, right?

You can’t say it’s stopped. In April, Minister Alexandre de Moraes, of the Federal Supreme Court (STF), asked us to address the environmental issue of Ferrogrão, which passes through a national park. The STF authorized us to update the studies, which have already been delivered (editor’s note: the railway project was suspended by the STF due to environmental issues and the law that allowed its creation was considered unconstitutional; the process could be judged again in the second semester). Our idea is to hold the auction.

Isn’t it risky to hold the auction without an environmental license?

We are assuming that the government will provide resources and that there will be an environmental license. The company that assumes the concession will not have any obligations before the license is completed. We are discussing this model.

Even without the environmental license, would the project have interested companies?

Yes, because the government would be a partner in the project. There are two models. One of them is to wait for environmental licensing, which would take two to three years. The other idea is to create legal and contractual conditions to mitigate risks, with the government as a partner in the project.

Can institutions such as the World Bank participate in project modeling?

It’s difficult because the World Bank has strong compliance in relation to environmental issues. We must work with agribusiness and investment funds. The next step is to develop a strategy. I’m optimistic.