Mains Points

- Raízen has just held the largest IPO of 2021

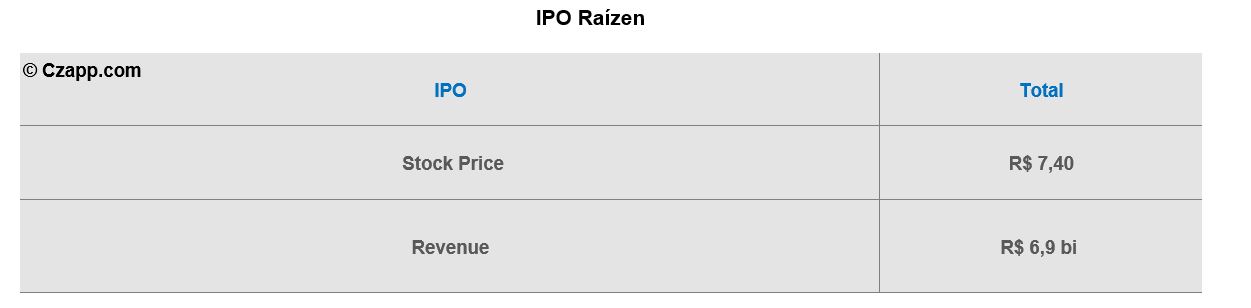

- Its IPO moved almost BRL 7 billion

- One of the destinations for the capital raised will be second generation ethanol and biogas.

Raízen Taking Flight

- After buying Biosev earlier this year, Raízen has now gone public on the stock exchange.

- Approximately 17% of the cane crushed at CS Brasil per year can be processed by Raízen.

- Its IPO moved R$6.9 billion and should be the largest in Latin America this year.

- The initial expectation was that the IPO would raise between R$10-13bn, however, the company had to reduce its initial ambitions and lower its value.

- Total demand for Raízen’s shares reached BRL 30 billion

- BRL 14 billion came only from individuals.

- Its market value went from R$60 billion to R$76 billion. – To give you an idea of its controlling company, Cosan has a market value of BRL 48 billion.

- The capital raised, according to the offering prospect, will be mainly used to expand renewable products capacities such as 2G ethanol and biogas.

- The shares will debut on the stock exchange this Thursday

Energy Transition on Focus

- Foreigners were attracted by the company’s energy transition discourse and represented around 60% of the demand for the shares.

- The prospect defines that 80% of the money that come with the IPO will go to the expanion of the production and commercialization of renewable products.

- The main investment is in second-generation ethanol

- However, the plans are ambitious and execution must be swift if they are to reach the goal of 20 2G ethanol mills by 2032

Other reports that you might like