Opinion Focus

- Petrobras has reduced Brazilian gasoline prices by 6%.

- This is negative for ethanol prices and cane mill cash flow.

- Is this going to be President-elect Lula’s way of controlling fuel price inflation?

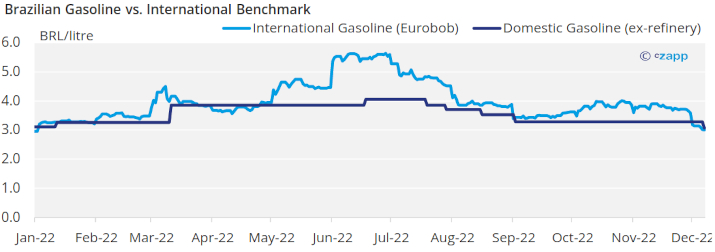

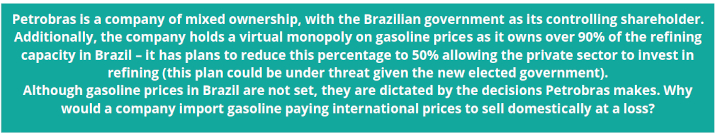

This week, Petrobras reduced gasoline prices by 6%. The company is still following international gasoline prices, which have been falling. Therefore, a reduction in Brazilian prices is justified as domestic gasoline has been sold above international prices since the end of November. It is the first price adjustment in more than 3 months (and since the Presidential election) but the 5th price reduction since July.

However, something feels a bit off. Earlier in 2022 price adjustments were slow to respond to rising international gasoline prices to avoid passing high fuel price inflation to Brazilian consumers. Furthermore, the price reduction comes a day after a meeting between the company’s executives with the newly elected president’s transition team. Will Lula’s team continue to ensure domestic gasoline prices track international energy prices? It’s an important question for Brazil’s sugar and ethanol sector.

Ethanol Prices Need to Fall Too

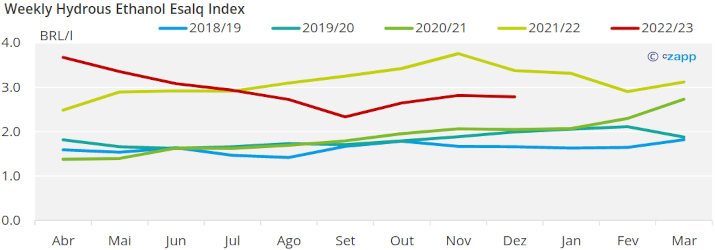

Ethanol has a seasonality in prices due to the cane harvesting period. Once the cane crush starts in April, ethanol prices tend to come down, reaching the bottom around August. Once the season starts to wind down and fresh ethanol supply reduces, prices come back up. We are now entering that second period.

However, ethanol prices are also directly influenced by changes made to gasoline. This is because the consumer will choose the cheapest fuel at the pump. We could see this in July when the Brazilian government changed fuel taxes and reduced ex-refinery gasoline prices. Gasoline prices fell by 30%, reducing consumer demand for ethanol and therefore ethanol prices.

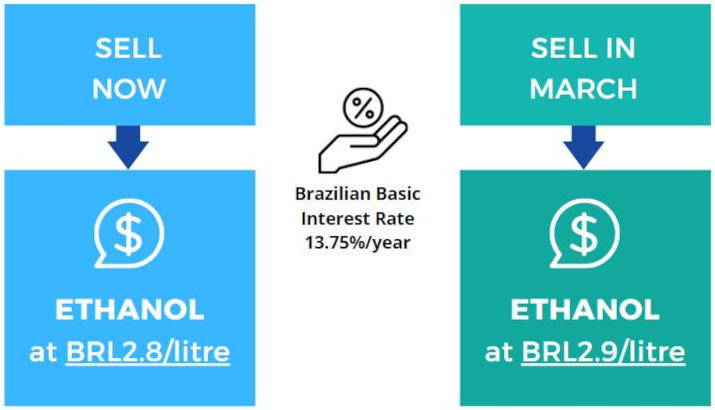

With the gasoline price reduction this week, ethanol prices would need to fall by BRL0.15/litre (80points) to retain today’s pump price parity with gasoline. In other words, it’s going to be harder for ethanol prices to rise during the cane harvest offcrop.

This won’t change mills’ decisions on whether to make sugar or ethanol right now: they are about to stop crushing cane. But it does affect their cash flow in the offcrop, and the volume of ethanol they decide to carry into the offseason.

Using Lower Gasoline Prices to Reset Fuel Taxes

When Luis Inácio Lula da Silva won the election in November, we highlighted several scenarios for ethanol prices. Now, with the transition of government being carried out, we have a bit more clarity on the direction we might be heading.

If we assume the BRL stays around its current range and Brent crude oil is at around USD 80/bbl, this would be enough to keep Brazilian gasoline prices above BRL 3/litre. This is where prices are at the moment.

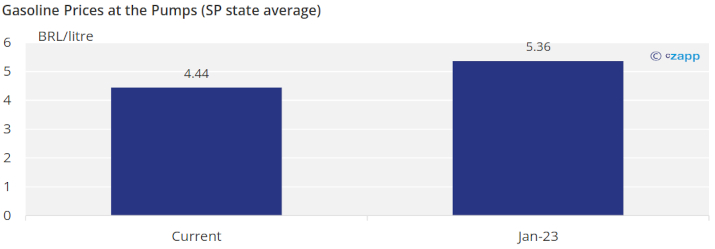

However, fuel tax exemptions end on 31st of December. Off the bat, 2023 will begin with gasoline prices rising from BRL 4,4/litre to BRL 5,36/litre at the pump, a 20% increase. Not an exactly popular way to start the first month in office!

There are also discussions about increasing ICMS taxes on gasoline to previous levels. This would make gasoline prices rise a further 11%, up to BRL 6/litre. From a cane mill perspective this would be ideal, since would give room for ethanol prices to increase to BRL 3/litre or almost 18c/lb (No.11 basis).

However, we believe that this is where Petrobras’ price policy will be affected. The only way for President Lula to allow a return of the fuel taxes without affecting the end consumer is to reduce gasoline prices at the refineries. In order to maintain gasoline pump prices around current levels, Petrobras would need to cap ex-refinery prices at around BRL 2/litre, from around BRL 3/litre today.

All these changes will not occur overnight. It will be a process, a long one, but one we assume is the most likely scenario for Brazilian fuels.

Food for Thought: Consecana (Cane Prices)

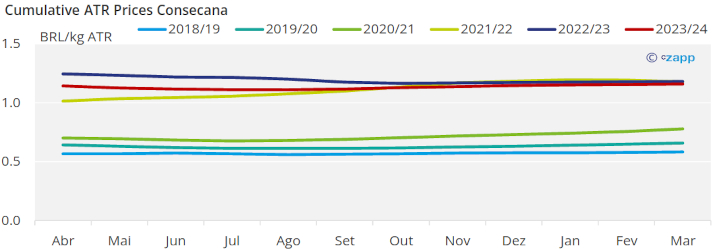

Lower ethanol prices affect mills revenues. But they are not the only ones impacted. Cane prices in Brazil are determined by the prices of all the final products originated from cane. And ethanol prices have a 46% parcel in the composition.

If ethanol prices come down, then mills with large volume of cane from third party suppliers benefit from a reduction in cost of production. Mills with 100% own cane are unaffected.

Consecana Prices and Projections on Czapp Interactive Data

On the other hand, cane suppliers and farmers leasing their land to cane will see a reduction in revenues. Could ethanol prices come down enough to bring Consecana values below BRL1/kg of ATR for the first time in 3 years? No. Well, not according to our base scenario for ethanol prices…