Main Points

- With a supply that has not kept up with demand, there is a risk of gasoline shortages.

- Negative import margins do not encourage a quick fix.

- As a result, higher gasoline prices are something the government doesn’t want – as a bonus, ethanol benefits.

A Little Context If You Haven’t Been Following the Headlines

- This week Brasilcom, the Association of Fuel Distributors, drew attention to a risk of fuel shortages in November.

- According to the association, Petrobras would have canceled orders for gasoline and diesel for not having enough product.

- Sources close to us say that the main impact is seen in diesel orders – something of concern for the logistics and agricultural chain, in particular for soybeans, as they will be planted in the coming months.

- But in this report we are going to focus on the impacts for gasoline and the result for ethanol.

Migration of Demand to Gasoline

- Gasoline demand has risen due to two factors:

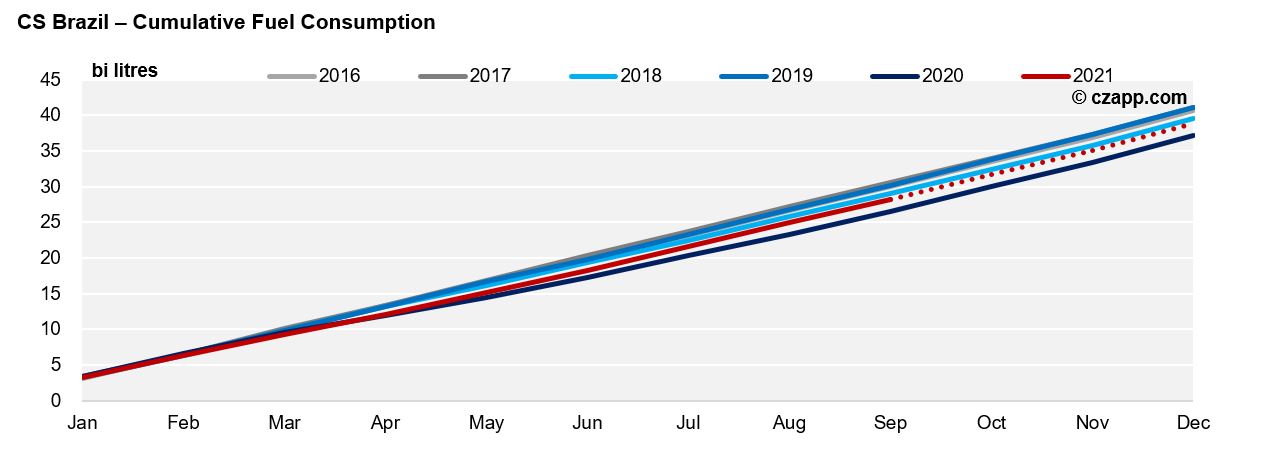

- Relaxation of pandemic restrictions, resulting in greater population mobility.

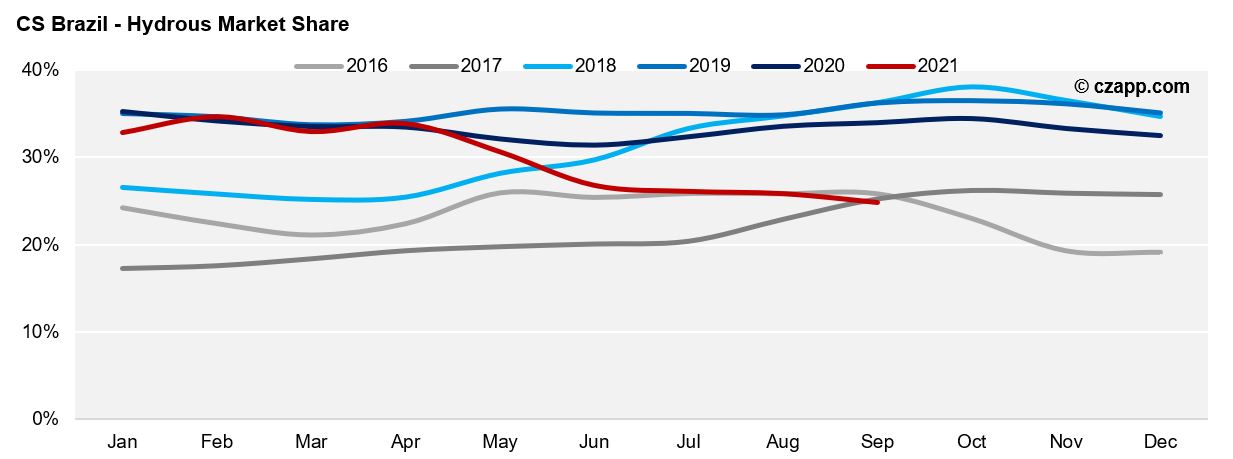

- Gaining space compared to ethanol in consumer preference.

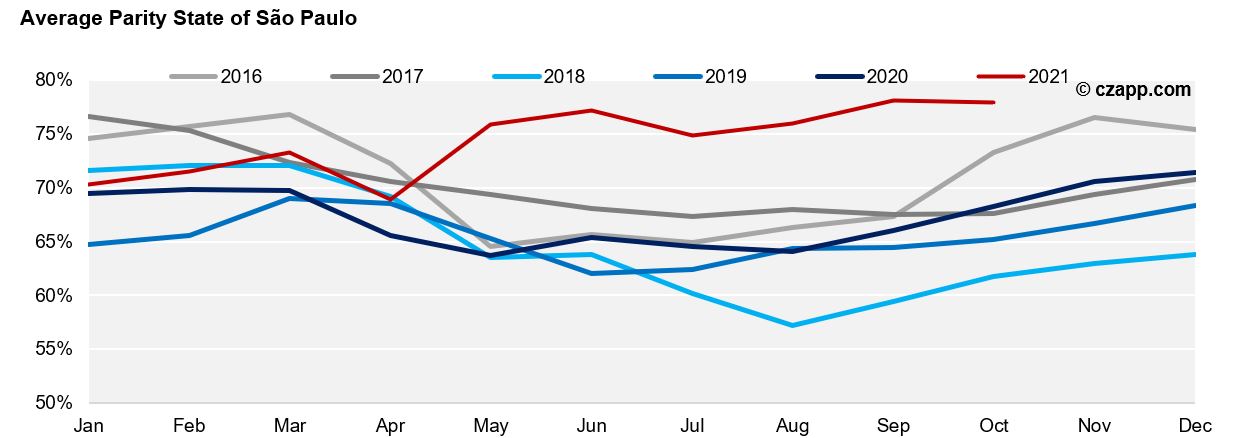

- With the parity of prices at the pumps (price ratio of ethanol/gasoline) at the highest levels of the decade (78%), the consumer migrated more quickly to gasoline.

- As a result, the hydrous market share dropped to 25% in September – the lowest level since 2016.

- Brasilcom’s recent statements regarding the cancellation of fuel orders made for November lead us to believe that the market sees an even greater migration to gasoline.

- Or that they are very optimistic about demand for the coming months…

Demand will not Surrender Alone

- Theoretically, high prices can result in demand destruction.

- The problem is that we have reached a minimum level of consumption, people are circulating, face-to-face work has returned in many cases, and as vaccination progresses, day-to-day activities return to the normal minimum.

- In addition, we have the seasonality of the holidays.

- And this year, with the Real devalued, travel abroad becomes costly, which makes people travel more in Brazil by car or bus.

- Generally, fuel consumption in December grows 15% compared to the year’s average, due to the holidays.

- Consumption is not out of the ordinary, it seems that it is the offer that is not keeping up with consumption – see the next section.

- So the result is:

- Prices have to rise even more to curb consumption and avoid shortages.

- Or imports at a loss will be made to supply the domestic market.

How do we get to this point?

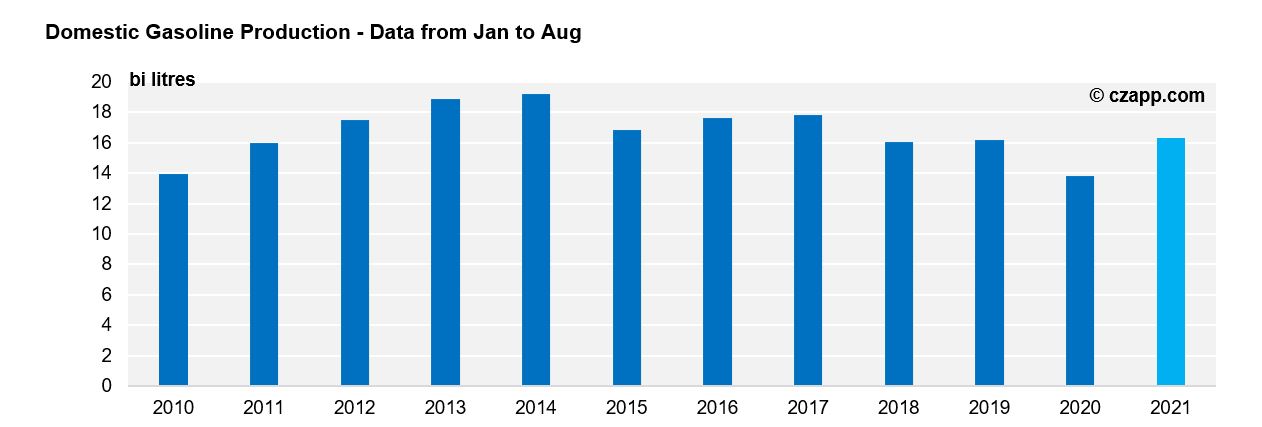

- National gasoline production is within the average of the last 3 years – data from Jan to August.

- Let’s ignore 2020, the year of the pandemic and that represents a statistical anomaly.

- Nothing out of the ordinary, except for a small detail.

- As we mentioned at the beginning of the report (see Hydrous Market Share), in the last 3 years consumers have preferred ethanol over gasoline.

- From May this year there was a change in preference, consumers switching to gasoline.

- A larger offer would be needed, but domestic production was slow to react.

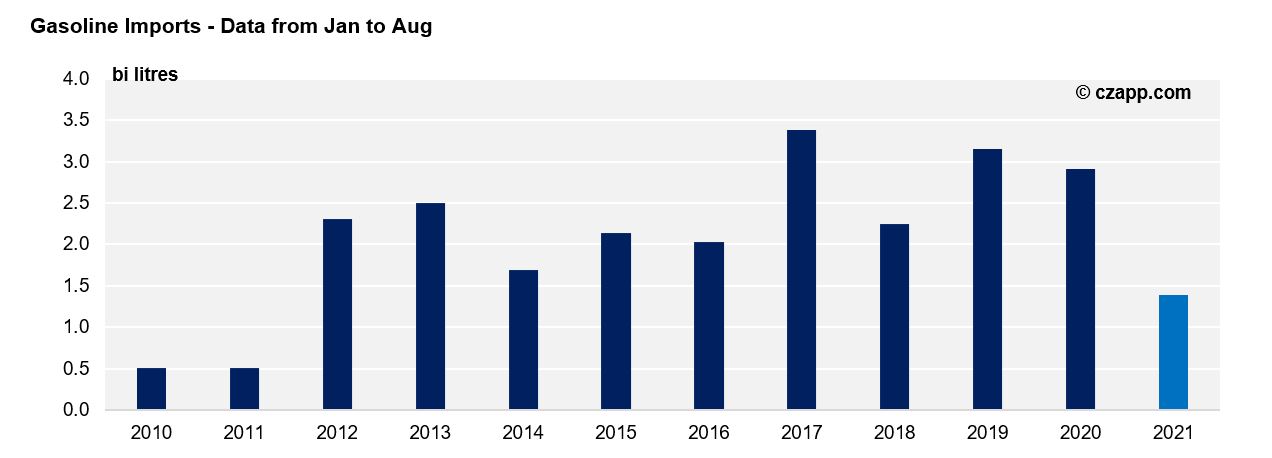

- The immediate solution would be to close the hole via imports.

- The problem is that gasoline imports registered until August were the lowest since 2011.

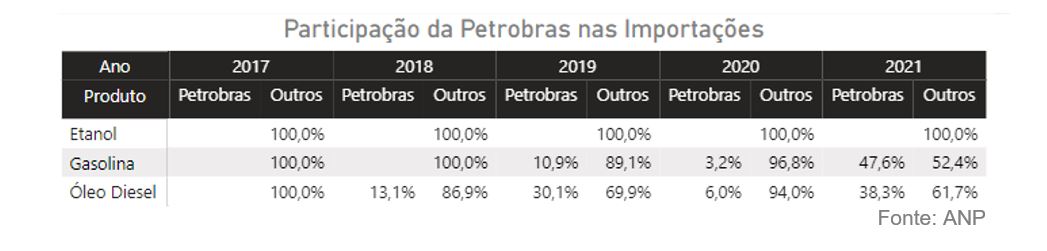

- And the most interesting thing is that if we look at the data on the participation of players in imports, Petrobras was much more active than in recent years.

- The reason is quite simple.

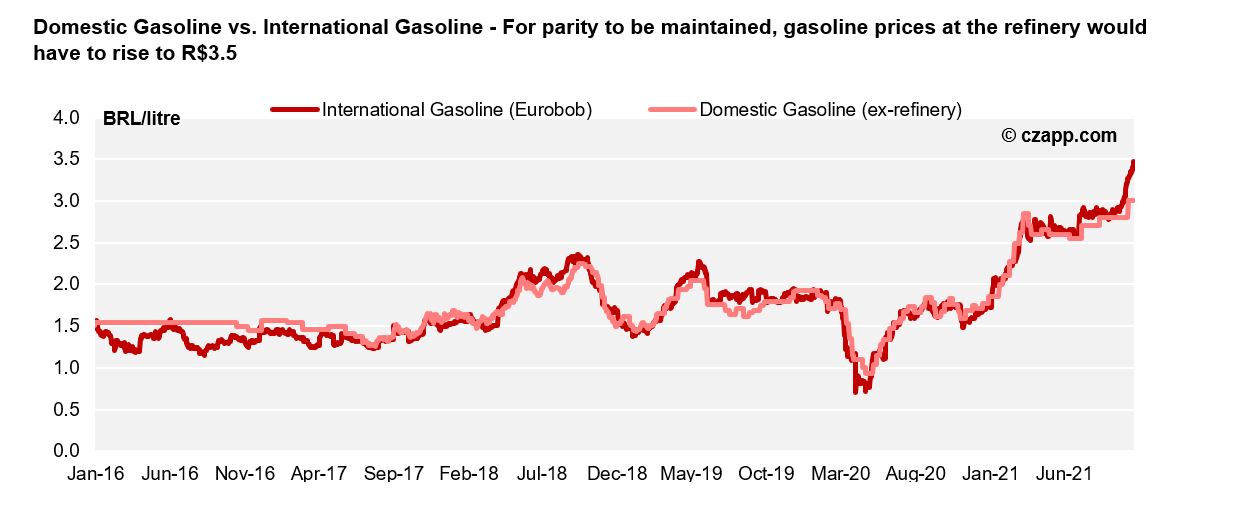

- With the pressure faced by Petrobras on account of fuel prices, the readjustments of values at the refinery have been much less frequent.

- And with that, the price parity has been below the international market.

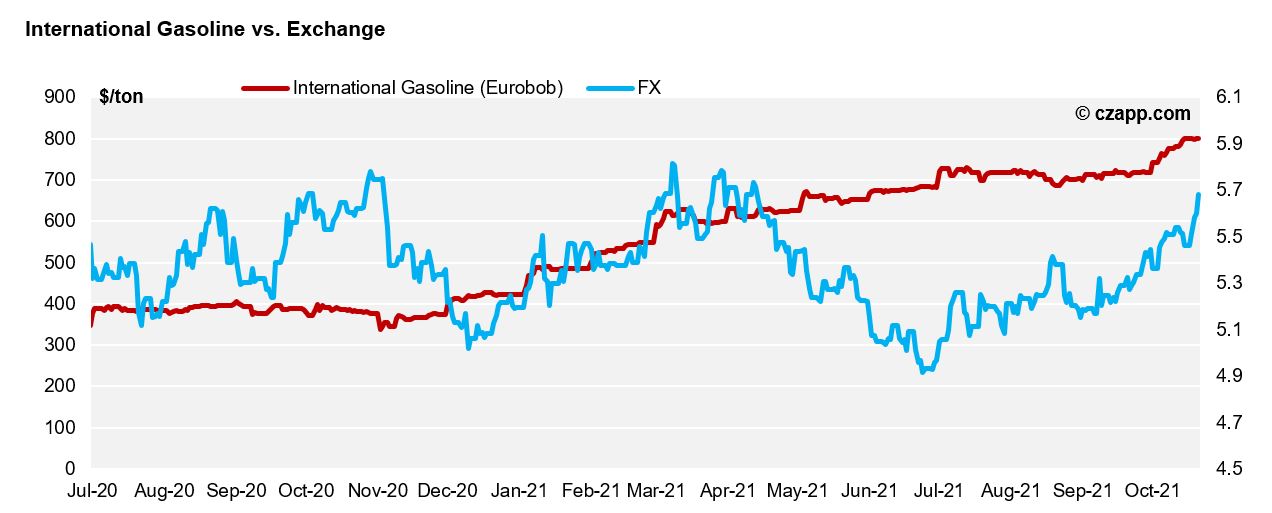

- Given the continued high in oil and the exchange rate devaluation, gasoline would have to be readjusted from the current R$3 to R$3.5.

- The environment is not favorable to other market participants.

- Without a clearer pricing policy, the only one that should matter at a loss should be the state-owned company.

Will Go Up One Way or Another

- If Petrobras in fact still has autonomy, another price adjustment should be on the horizon.

- In fact, if the country’s fiscal situation continues to worsen, further impacting the exchange rate, there are more risks for further adjustments.

- Without adjustments, necessary to make imports viable, the risk of shortages increases. And by the law of supply and demand, prices will be readjusted at the stations anyway.

- A last option would be the import even at a loss by other market participants, who would pass the cost on to consumers and ultimately causing an increase in prices at the end.

- Gasoline price rise, positive for ethanol returns.

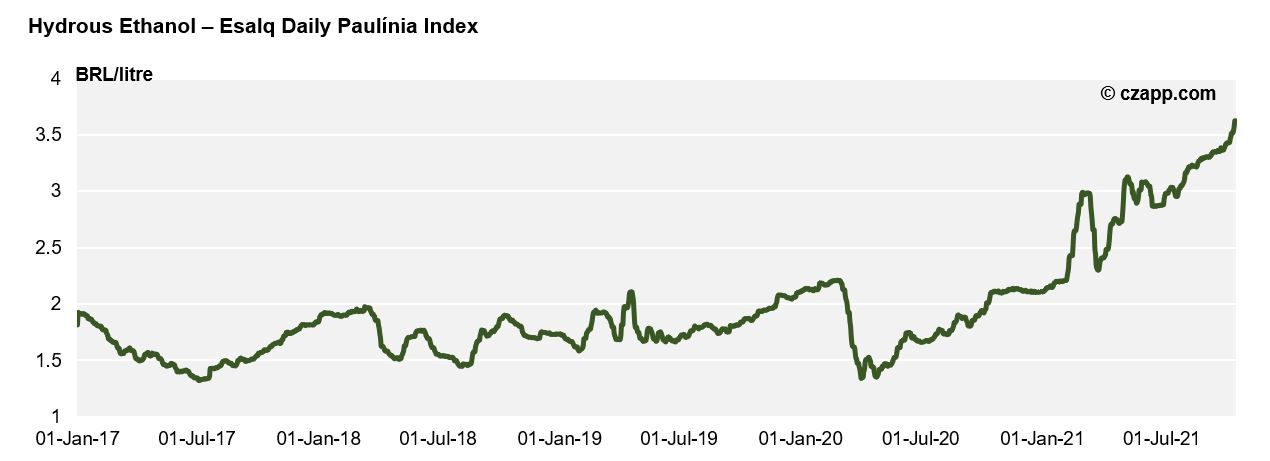

- A sharp price curve for the off-season was already expected, due to low ethanol inventories.

- But with this gasoline factor, the trend should be even higher ethanol prices.