- Nominations have slowed down, but China remains as top destination.

- CS saw 380kmt of raws nominated this week.

- September has already 2.4mmt nominated.

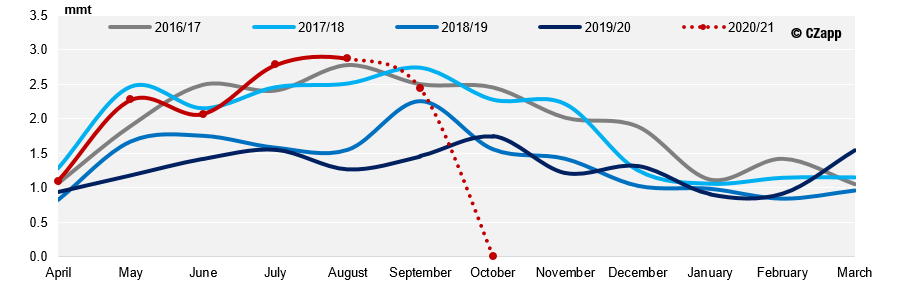

CS Brazil Monthly Exports

CS Raws Line Up – August registers record raws exports from CS

- Further tonnage rolled from August to September, leaving 2.87mmt of raws exported last month in CS – an all-time record.

- With the volume rolled from August and the 380kmt nominated this week, September line up stands at 2.4mmt .

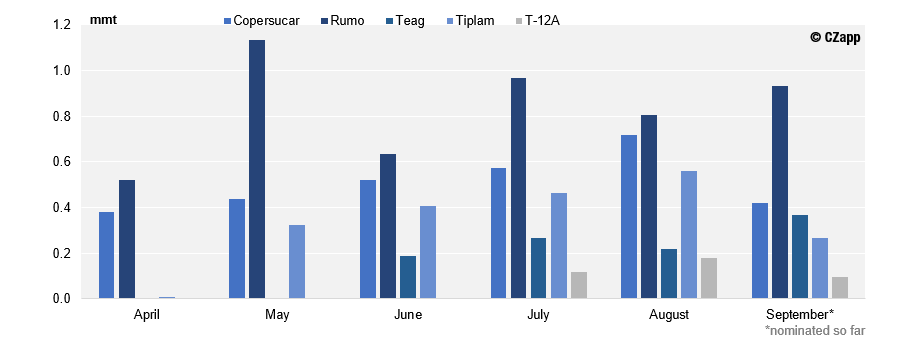

- Most of the volume is at Rumo, that remains with a high waiting time to berth of around 19 days.

2020 Santos Exports per Terminal

- Corn exports should wind down from now on, reducing logistics competition with grains, and opening more room for sugar exports.

- The question is: will sugar offtake remain high?

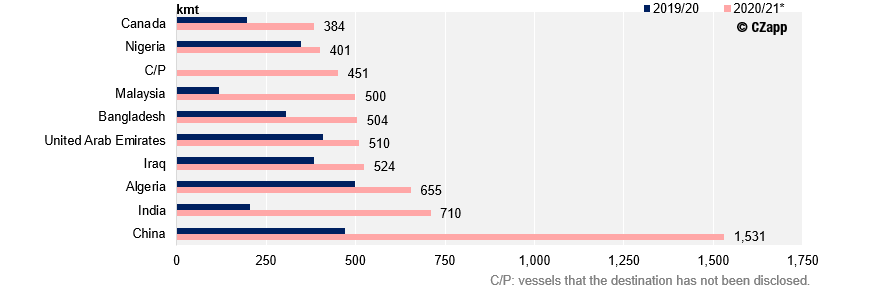

Destinations

CS Brazil Raw Sugar Main Destinations in Q3

- Out of the new nominations this week, 66kmt are for China – total Q3 offtake so far totals 1.5mmt, the highest offtake for Q3 in 7 years

- For Nigeria, 50kmt nominated this week – Q3 nominations are 15% higher than last year.

- For more details on Brazilian exports, have a look at our interactive data: Global Shipments.

Other Opinions You May Be Interested In…