- Slowdown in nominations, with 200kmt added to February lineup.

- Confirmation of rumours around offtake from Iran.

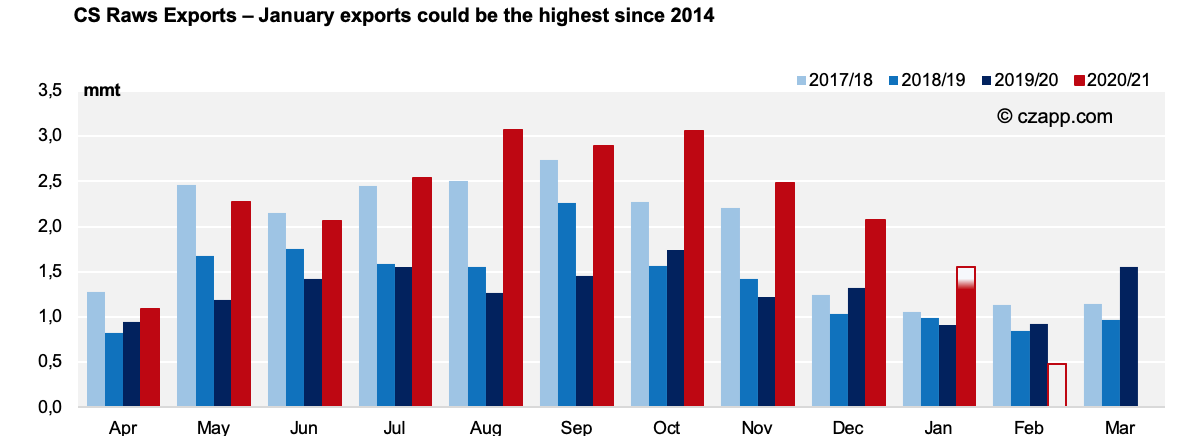

- January exports could end below expectations at 1.5mmt.

CS Brazil Exports

- Nominations pace have slowed down when compared to the previous weeks of January.

- With some volume rolled to next month, January should end with 1.5mmt of raws exported.

- All the volume added this week (around 200kmt) was for February shipments, taking the total to 482kmt.

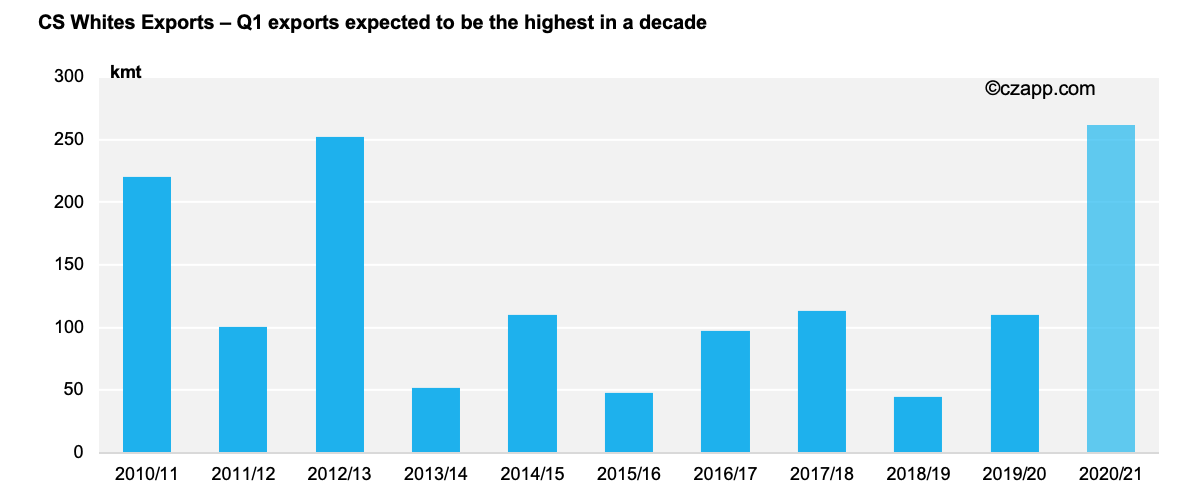

- Whites breakbulk exports continue to rise, with 43kmt added to CS line up this week.

- Total Q1 nominations stand at 262kmt – the highest volume of the past decade.

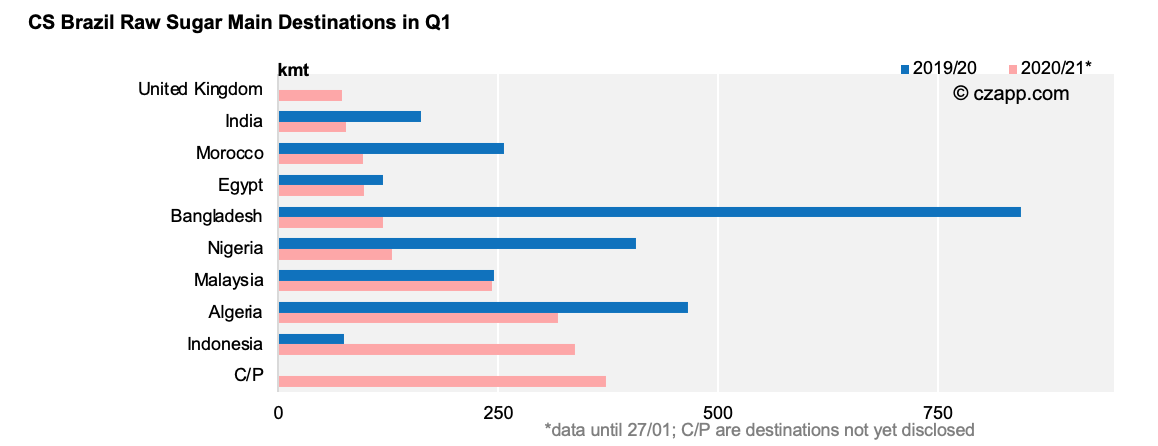

- As for destination of white breakbulk CS exports, unfortunately there is still 168kmt still pending confirmation.

- However, we have so far been able to confirm around 30kmt each for Senegal, Ivory Coast and Ghana.

Destinations

- First vessel for Iran in over 6 months, with 60kmt of volume.

- Last year, the country focused its sugar purchases from India and is now looking into other origins.

- Out of the new nominations this week, more volume for Algeria.

- After adding 90kmt last week, another 74kmt were included in the lineup for the African country – nominations are already 68% of the volume registered over Q1 last year.

- Unfortunately, the remainder of the vessel still have not disclosed their destinations.

- For more details on Brazilian exports, have a look at our interactive data: Global Shipments.

Other Opinions You May Be Interested In…