Insight Focus

ApexBrasil is focused on expanding Brazilian exports globally. Opportunities for increasing exports of avocados and beans have been identified. Fish, which set export records in 2024, is also poised for greater international demand.

Brazil Identifies New Opportunities for Food Exports

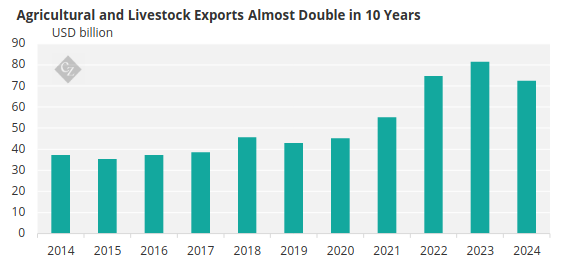

In 2024, Brazilian agricultural and livestock exports totaled around USD 72.5 billion, almost double the amount 10 years ago, with a significant impact on the trade balance.

Source: Comex.

Exports have been growing not only due to increased production, higher crop yields and external demand, but also as a result of initiatives aimed at identifying new opportunities in the global food trade.

ApexBrasil (Brazilian Export and Investment Agency), a public agency whose main objective is to promote Brazilian products abroad and map new export opportunities, plays a crucial role. In addition to conducting market studies, the agency promotes business rounds abroad and organises delegations of Brazilian entrepreneurs at international fairs.

“These actions have served to map significant opportunities for increasing the export of products such as avocado and beans,” says Laudemir Müller, agribusiness manager at ApexBrasil, in an interview with Czapp.

Laudemir Müller. Picture: ApexBrasil

What are the main international markets in which it would be interesting to increase the presence of Brazilian agribusiness products?

First, it is important to say that we are living in a time of global challenges. One of these challenges is food security, which has to do with price stability. Another global challenge is the energy transition and climate change.

Brazilian agriculture is positioning itself as a player that is helping the world deal with these challenges. Brazil can offer food while also producing biofuels and capturing carbon. And, of course, we are looking at markets in which we can increase our presence.

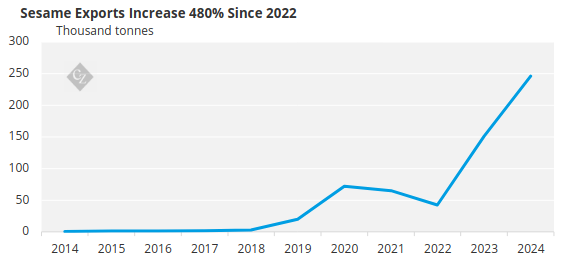

Is the greater insertion of Brazilian sesame in the global market an example of the strategy of seeking new opportunities for certain foods?

Sesame is an interesting example. We were given permission to begin exporting Brazilian sesame to the Chinese market at the end of last year thanks to the signing of phytosanitary protocols and a series of commitments related to quality control and certifications, as is customary.

China has just announced the first 21 Brazilian exporters authorized to ship sesame to China. Exports began to gain momentum with the signing of similar protocols with India in 2020.

Source: Comex.

Are there other examples like sesame?

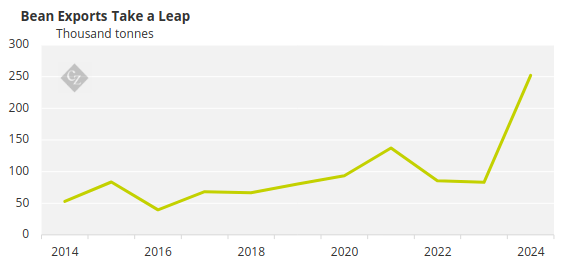

Yes, there are many opportunities in relation to crops rich in plant-based protein. There is a strong focus on diversifying beans, for example, with the planting of several species in Brazil. The demand for other pulses, a food group that is considered highly nutritious and protein-rich, such as peas, chickpeas and lentils, has also been growing.

And why is this happening?

It is related to a change in global consumption habits that is driving an increase in demand for plant-based protein. Another reason is the growth in income in India, which has a large vegetarian population.

India has a demand for around 27 million tonnes of various types of beans, lentils, peas and chickpeas. The country estimates that in the short term, it will require 32 million tonnes per year.

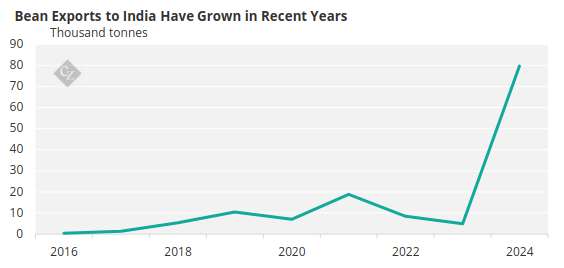

And there are some restrictions on increasing domestic production, which is why imports are important. Today, the main supplier of beans to India is Myanmar, but the country is already facing production difficulties due to climate problems. There is an opportunity for Brazil. In fact, we have been exporting more beans.

Source: Comex.

Last year, India significantly increased its purchases of beans produced in Brazil, which contributed to the increase in exports of the food.

Source: Comex.

With India’s economic growth, should there be export opportunities for other Brazilian agribusiness products?

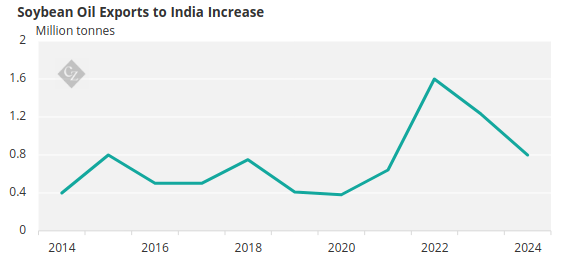

There is a growing demand for cooking oils, including Brazil increasing exports of soybean oil to India, although in a non-linear manner.

Source: Comex.

The demand for fruit is also growing. It is worth remembering that Brazil is the third largest producer of fruit, but it is only the 24th largest exporter. There is strong domestic consumption, and we do not export much.

Why has Brazil not managed to significantly increase its fruit exports?

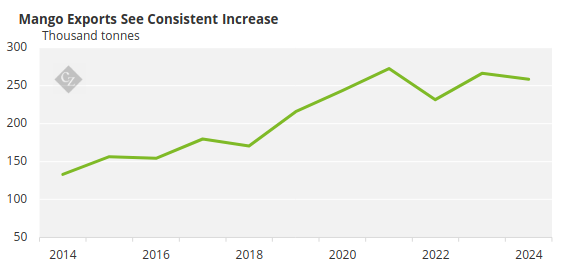

Our main exported fruits are grapes and mangoes, most of which are produced in the São Francisco River Valley in the Northeast, using irrigation. In the case of mangoes, there has been a continuous increase in foreign sales. We are working to expand our production capacity.

Source: Comex.

We have thousands of hectares that are becoming suitable for fruit production in the semi-arid region of the Northeast, where irrigation canals are arriving. We will include the foreign market in our strategy, especially in relation to grapes and avocados, for which there is strong demand in Asia and other regions.

With the US’ tariff war with Mexico and Canada, could there be more opportunities to export avocados to the US?

It is still too early to assess, but our initial feeling is that Brazil is not interested in instability. We have been working for years to develop our production model. We are betting on stability and medium-term work. But of course, additional opportunities may arise. As a result, we are looking very closely at Canada. Last year, we held some trade fairs there and we should continue with this strategy this year.

Speaking of which, what are the main trade fairs and trade missions scheduled for this year?

We are directly supporting 23 sectors linked to agribusiness, from coffee to cookies. We will take delegations to 40 trade fairs abroad in partnership with ministries such as Agriculture and Foreign Affairs.

Some of the most important trade fairs are in China, such as Sial Expo, which will be held in May, and in Germany. We have also worked with important trade fairs in Latin America, such as Expoalimentaria Peru, and in Mexico.

In these events and in market studies carried out by ApexBrasil, what have been the main opportunities identified, in addition to beans and avocado?

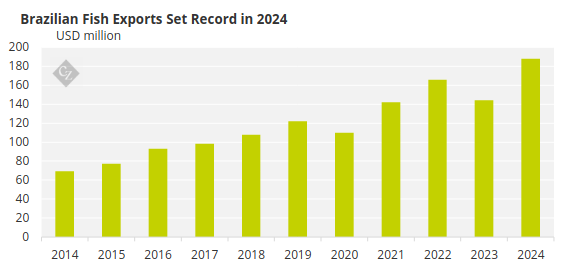

A great example is fish, especially tilapia, which is produced in tanks in controlled environments. In terms of animal proteins, Brazil has a share of almost 40% of the global chicken market. In terms of beef, it is around 20%.

But with fish, it is practically zero. If we double exports, we will have a market share of 0.5%. This is a global market worth USD 148 billion. We participate with less than USD 200 million – which is a tiny proportion.

We have a good supply of water, a good feed system and interesting genetics. Production has already started to grow. Exports are increasing, and the trend is for them to continue growing.

Source: Comex.

In general, in relation to our entire agribusiness, Brazil has a great opportunity to contribute to food security and issues related to climate change. Look at what is happening with global cocoa and coffee production, which is being affected by the climate. There is concern about this and Brazil has taken a mature stance. We can offer food while contributing to the issue of sustainability.