Insight Focus

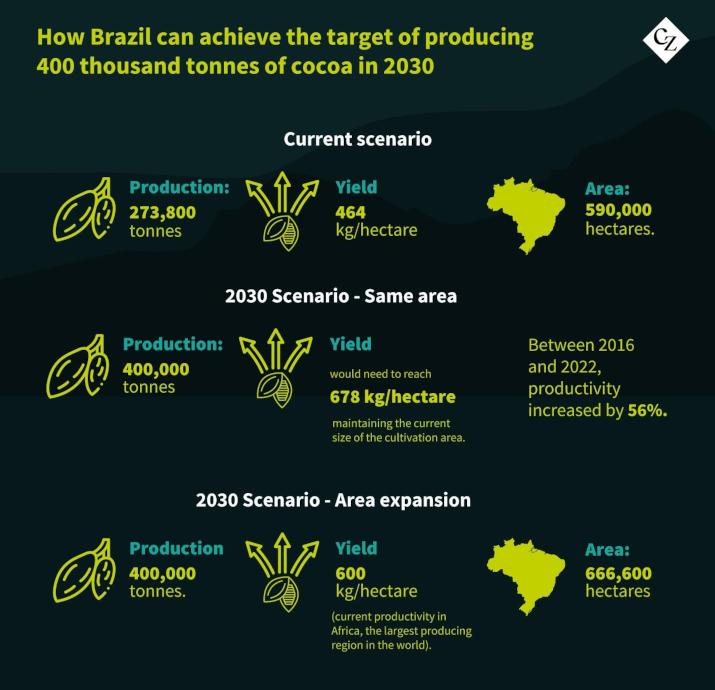

Brazil intends to produce 400,000 tonnes of cocoa in 2030, 46% more than the current year. Rising prices on the international market have been motivating producers.

Brazil Aims to Increase Cocoa Production.

Producing cocoa (and in large quantities) is not something new for Brazil. At the beginning of the 20th century, the country led the world’s production and export of the commodity. In recent decades, however, problems such as pests and fluctuations in international prices have impacted farmers, reducing production.

Now, after increasing investments in productivity and eradicating diseases such as witches’ broom, which damaged crops in the 1980s, the country has been boosting planting. The idea is to once again occupy a prominent place in global production and shipments of cocoa.

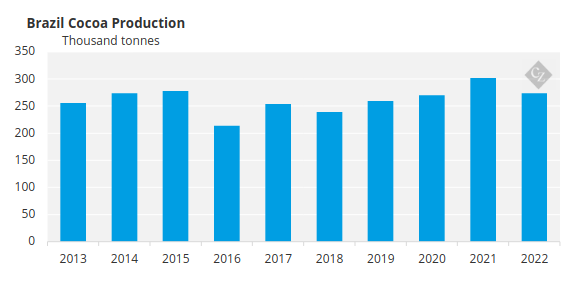

Source: IBGE

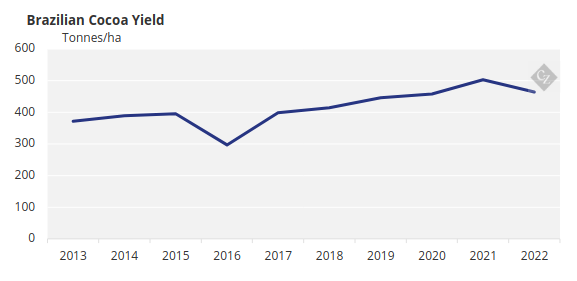

Productivity is also increasing, which has farmers excited. And there is room for further growth. “It is possible to reach 1,000kg/ha, which is considered closer to ideal, with good agricultural practices,” says Ricardo Gomes, cocoa producer in Bahia and Territorial Development manager at Instituto Arapyaú. The institute focuses on promoting sustainability in agriculture.

Source: IBGE

In places like western Bahia, yield already exceeds 1,000kg/ha. Large companies in the sector have been investing heavily to achieve this result. Cargill and Schmidt Agrícola are a good example. A few years ago, the two companies came together to grow cocoa in western Bahia, in an area irrigated by the waters of the São Francisco River, and they have been achieving high levels of yield.

Foreign Market

With global prices on the rise and growing planting, Brazil intends to become self-sufficient in cocoa production and resume exports. “Today, the industry needs to import, on average, 40,000 tonnes of cocoa per year to supply the domestic market, but by 2030 we must change this,” says Ana Paula Losi, executive president of the National Association of Cocoa Processing Industries.

The country launched a plan, drawn up by rural producers and the government, to produce 400,000 tonnes of the commodity in 2030 and position itself as a sustainable global supplier. The programme includes everything from expanding technical assistance to producers to renewing part of the cocoa trees and encouraging the adoption of sustainability certificates.

To get there, increasing productivity will be essential.

This path is not free from challenges. One of the main ones is access to credit. Small and medium-sized farmers, who make up a large proportion of cocoa producers in Brazil, face more barriers to obtaining financing due to issues ranging from greater difficulty in contracting rural insurance to pending environmental regularization.

Institutions such as the World Bank have helped family producers to register with programs such as the Rural Environmental Registry (CRA), but further progress is still needed.

Another important point concerns sustainability seals. The idea is to increase the offer of certifications, currently considered restricted. In June, the government launched the “Cacau Cabruca” certificates, for crops in Bahia, and “Cacau Amazônia,” aimed at producers in Pará. Today, the two states represent 90% of Brazilian production. The intention is to pave the way not only to produce more sustainably, but also to export at a premium.

The expectation is that Brazil will be able to export at least 20% of its production by the end of the decade, which could help alleviate the global crisis in cocoa supply.

“The goal of cultivating 400,000 tonnes in 2030 is even conservative given the evolution observed in recent years and the country’s potential,” believes Ana Paula.

Today, if Brazil produced 400,000 tonnes, around 100,000 tonnes could be exported.