Main points

- With The dry weather, a crop failure is estimated – sugarcane processed below 535 mmt.

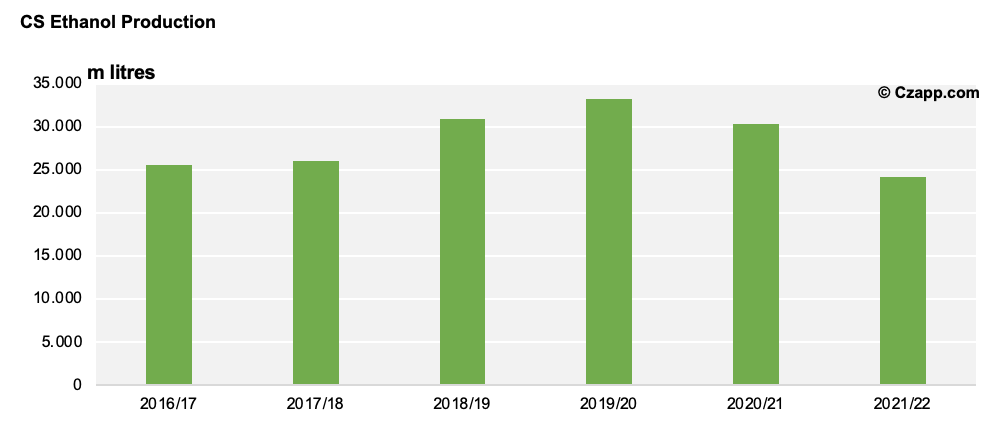

- The mix should remain sugary, impacting ethanol production.

- Less ethanol, less CBIO emission – will we have a CBIO supply shortage?

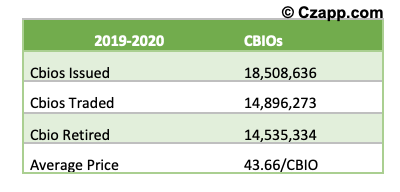

RenovaBio in Numbers

- In 2020, the RenovaBio program avoided the emission of 15mmt of CO2.

- Despite the troubled start, the first year of the policy was a success with almost 98% of the decarbonization targets fulfilled:

- 106 distributors out of a total of 141 met the goal.

- For this, 14.9 million CBIOs were traded, generating a financial volume exceeding 650 million reais.

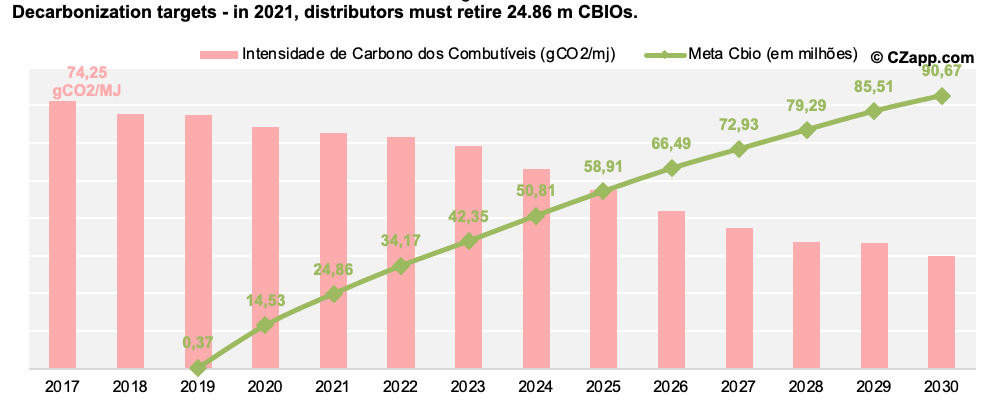

- For the year 2021, the goal requires that 24.86 mm CBIOs are acquired by 136 distributors:

- BR Distribuidora continues with the largest share of 26.35%.

Priority for sugar, harmed ethanol

- It is estimated that the CS Brazil will processed this season 535 mmt of cane.

- The mills are advanced in sugar pricing, which makes it difficult to change the mix to ethanol – market conditions are necessary to allow positive washout operations.

- Consequently a smaller volume of ethanol will be produced (24.2 billion l).

- And due to the structure of the RenovaBio program, less ethanol production, less Cbios to be emitted by the mills.

- With that, the question remains, will the crop failure impact the CBIO market?

Cbios

- Until June 23, total Cbios issued by biofuel producers this year were 13.97 mm;

- Added to the 2020 surplus (3.97 mm CBIOs), the available volume so far is 17.93 mm, – and capable of covering 72% of the target.

- Distributors have already purchased more than 8 mm of Cbios, with approximately 16 mm remaining to be purchased by the end of 2021

- It is important to remember that the Cbio volume per distributor is based on their fuel sales in the previous year.

- Therefore, the current behavior of the Otto cycle does not impact the 2021 targets.

- If we take into account that:

- 80% of ethanol mills are already able to emit Cbios

- average Cbio emission ratio is 836l for anhydrous and 886l for hydrous

- This year’s total Cbio offer would be 29 million, added to the 2020 surplus, this would have a balance 8 mm higher than the target required for 2021.

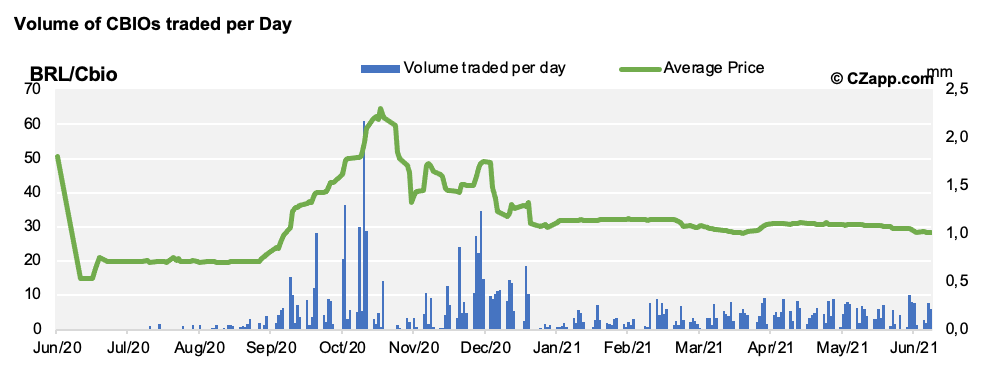

- Since April, an average of 176,000 CBios are traded per day, far from the liquidity seen at the end of last year

- As a result, the price remains stable at around 30 reais/CBIO.

- The price trend should remain stable, depending of course on the obligated parties’ buying curve.

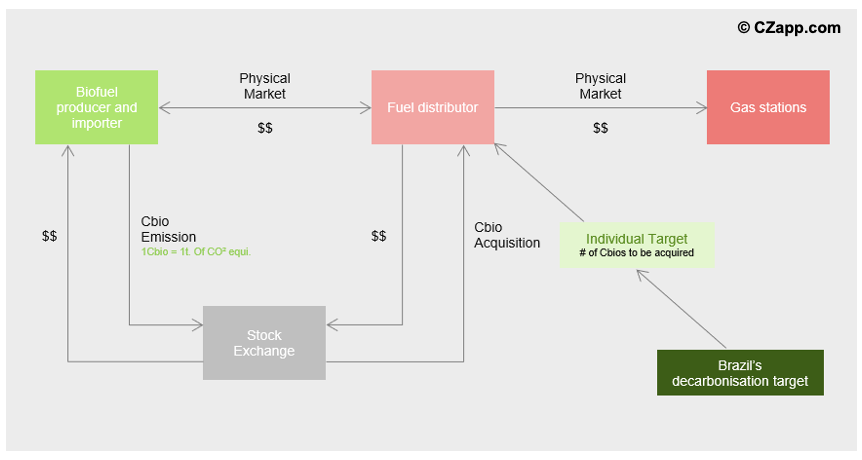

Reminder: What is RenovaBio?

- RenovaBio is the Brazilian national biofuels program launched in 2016

- The main instrument of the program, in accordance with the Paris Agreement, is the establishment of annual national decarbonization targets for the fuel sector.

- The national targets will be divided into mandatory individual targets for fuel distributors

- To meet their goal, fuel distributors will need to acquire CBIO certificates on the stock exchange

- Each CBIO emitted by biofuel producers corresponds to one ton of carbon that is not released into the atmosphere.

- Biofuel producers voluntarily issue CBIOs, based on their energy-environmental efficiency rating of the volume of biofuels sold.

Dashboards that you might like