Insight Focus

- Second corn crop yields in Brazil’s central states threatened by drought.

- Farmer selling is slow as producers and buyers wait for better opportunities.

- Exports of 35-40m tonnes likely on imports from neighbouring countries, strong international demand

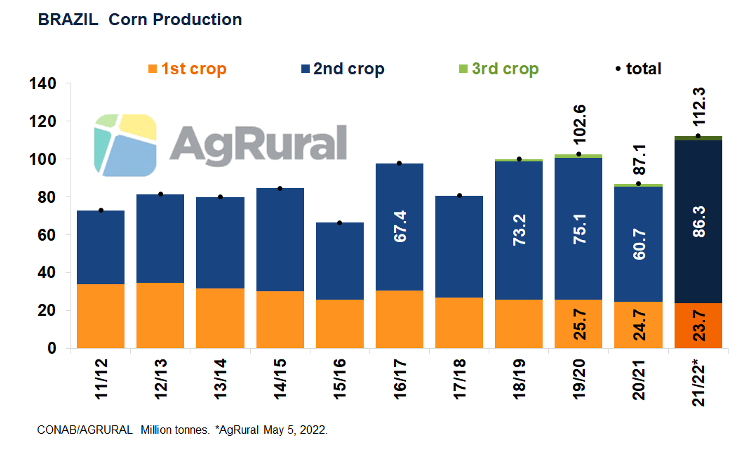

Dry conditions that have hit central and southeastern areas of Brazil since the beginning of April have already led some private consultancies to make the first reductions in their 2022 second corn crop production estimates. On May 5, AgRural cut its forecast by 5m to 86.3m tonnes. As a result, the 2021/22 total production forecast (first, second and third crops combined) dropped to 112.3m from 117.3m tonnes.

On May 12th, it was Conab’s turn to cut its “safrinha” corn production forecast to 87.7m from 88.5m tonnes. That adjustment, combined with minor changes to the first and third crops, meant the total production figure 2021/22 fell by 1m tonnes, to 114.6 million. On the very same day, the USDA, which publishes projections only for total production, kept its estimate unchanged at 116m tonnes.

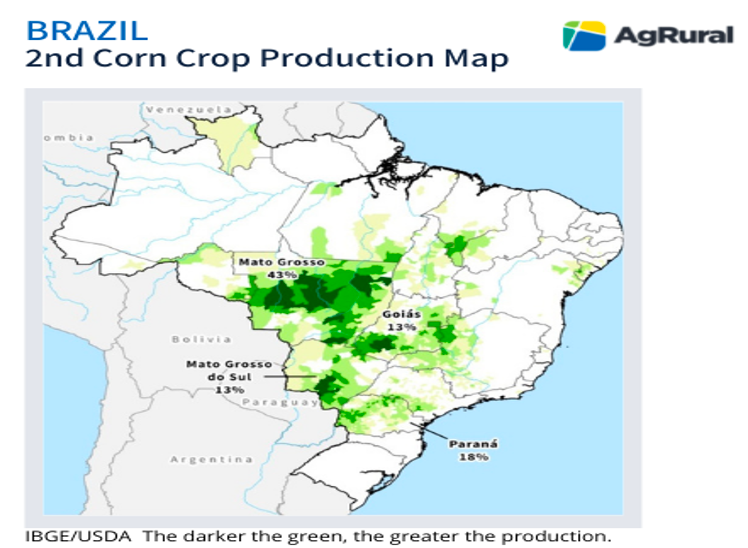

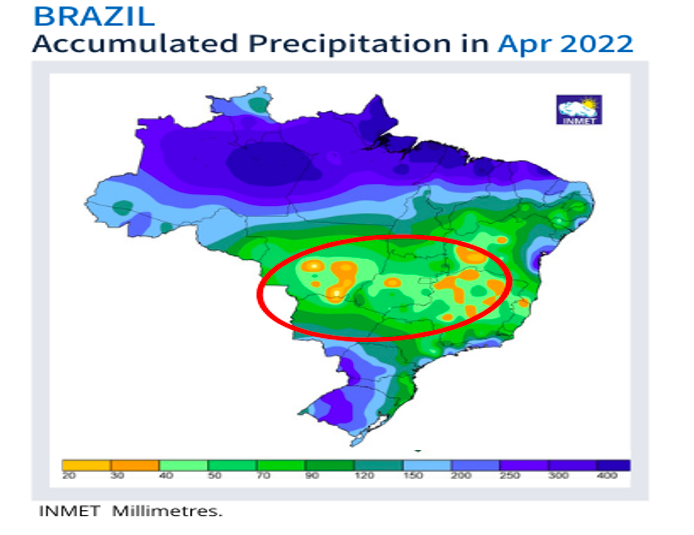

According to AgRural, the most drought-impacted states so far are Goiás and Mato Grosso (Centre-West) and Minas Gerais and São Paulo (Southeast). The lack of rain might also result in some loss of yield in the north of Mato Grosso do Sul (Centre-West). In southern Mato Grosso do Sul and in Paraná (South), on the other hand, the second corn crop is developing in very good conditions, thanks to good rains received since planting. That’s a big relief to farmers in both states, which suffered severe drought-related losses in the 2021 “safrinha” corn and then in the 2021/22 soybean crop.

Importance of April Rain

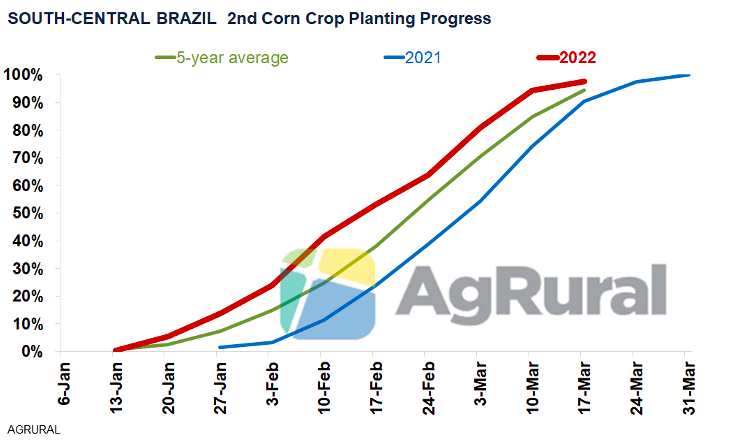

The 2022 second corn crop was planted within the ideal window and everything was going just fine until the beginning of April, when rain became scarcer from central Mato Grosso do Sul northwards. The reduction in rainfall in April compared to March is normal in south-central Brazil, but this year it was more abrupt. Corn planted until mid-February (53% of the total area in the Centre-South, compared to 38% in the five-year average) is the least affected, as it had already pollinated when moisture started to run out.

On the other hand, areas sown in late February and early March that missed regular rainfall in April and early May have suffered more severe losses and could continue to lose potential if it doesn’t rain in the second half of May and in June. It is highly unlikely to rain then because both months are among the driest of the year in south-central Brazil. Hence the importance for the second corn crop that there is no sudden cut in rains during April, as happened this year in some areas.

New cuts ahead

Because of that, and also due to the fact that the excellent second crop in Paraná and in southern Mato Grosso do Sul is still susceptible to frost-related losses up until the end of June, 2021/22 Brazilian corn production estimates will probably be lowered again over the next 45 days. Right now, it is impossible to anticipate the size of those cuts. But, with a significantly larger planted area, the good planting window and less extreme weather than in 2021, 2022’s second corn crop production will be larger than last year’s and will probably establish a new record high, surpassing the 75.1m tonnes produced in 2020.

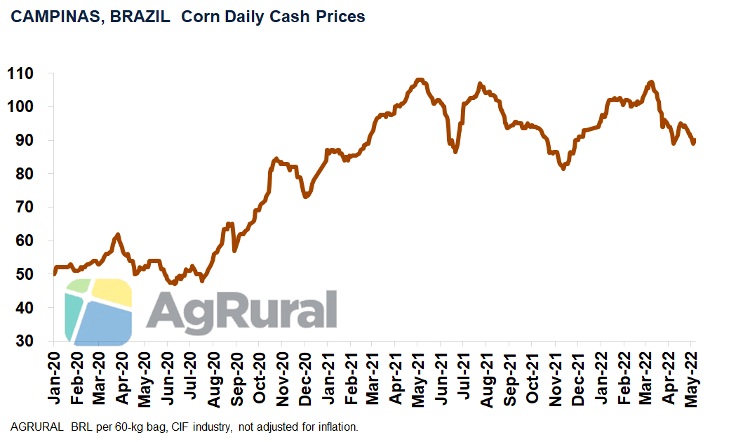

Despite the drought-related losses seen so far in the second crop, Brazilian corn prices haven’t revisited their historical highs, and the market remains sluggish. Expecting yield losses to deepen, many producers continue to wait for higher prices. On the other side of the market, buyers are also in no hurry, believing that they will buy cheaper corn in the coming months, even if the second crop keeps shrinking. According to AgRural, only 35% of the 2022 “safrinha” corn estimated production had been sold by the end of April, compared with the five-year average of 46%. In Paraná, the second-largest producer, farmer selling had barely reached 6%, compared with the five-year average of 22%.

Learning from the Past – or Not

In 2021, even with a historical second crop failure caused by drought and frost, Brazilian corn prices didn’t rise as much as expected in the second half of the year. Farmers were anticipating fierce competition for the smaller production and didn’t expect that domestic buyers would refuse to pay too much for that corn. Pressured by tight poultry and pork margins, those buyers replaced some of their corn needs with cheaper raw materials and imported corn from Paraguay and Argentina.

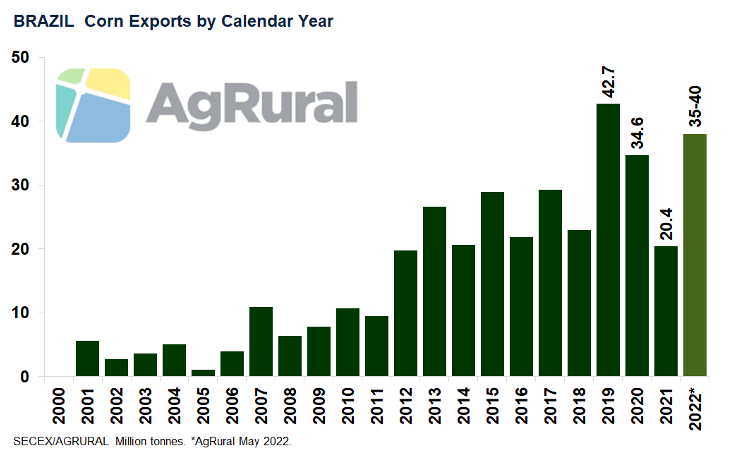

Brazilian farmers, then, were forced to accept the prices offered by exporters. As a result, Brazil exported 20.4m tonnes of corn in 2021, well below the 34.6m tonnes shipped the previous year, but way more than the around 15m tonnes many had estimated while the crop was being ravaged by the weather.

More Imports Again?

Now in 2022, even with smaller production than initially estimated, the second crop harvest is likely to put pressure on Brazilian prices at the beginning of the second half of the year. If farmers continue to resist selling, and if the Brazilian Real doesn’t get much stronger, it is quite likely that Brazilian end users will once again resort to corn from Paraguay (where the 2022 “safrinha” is in very good shape) and Argentina, where lower production this year hasn’t prevented farmers from forward selling about half of the crop so far, most of it for export.

If imports really pick up at some point and cool local prices down as happened last year, Brazilian farmers may once again be forced to sell corn for export – at prices that will still be good, historically speaking, but not as high as they would like. Under this scenario, Brazil tends to be able to export a considerable volume of corn even if it produces less than initially expected.

That is even more likely if Ukraine continues to have difficulties caused by the Russian invasion and if the US has any serious weather problems in the 2022/23 crop, which is being planted later than normal due to low temperatures and whose area is forecasted to be 1.6m hectares smaller than a year earlier. An eventual (and very likely) drop in the Brazilian Real before the presidential election, which takes place in October, would also favour exports by supporting corn prices in local currency terms.

Exporting during the Off-Season

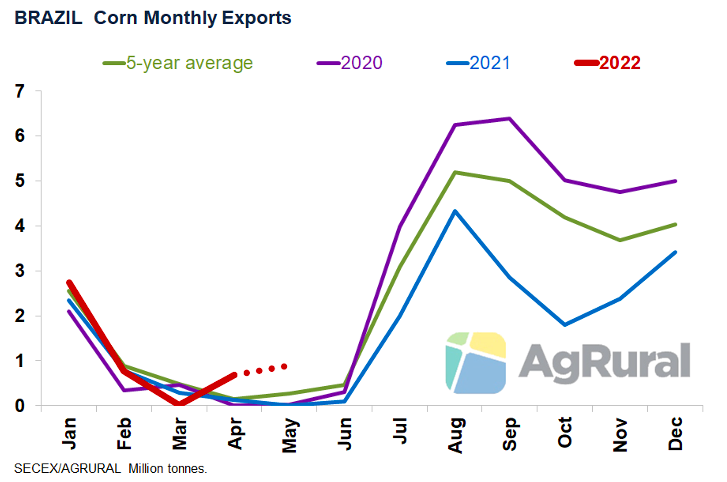

For all those factors, and even if the second crop production drops to something close to 80m tonnes, AgRural believes that exports will reach at least 35m tonnes in 2022. An undeniable sign of the increase in international demand for Brazilian corn was the record export of 690k tonnes in April, a month in which Brazil normally doesn’t ship corn abroad, especially in years with a smaller first crop, as was the case in 2022. May, the month when the second crop harvest starts, and also with no tradition in exports, has so far more than 900k tonnes of corn to be shipped.

Ukraine versus Brazil

However, the possibility of a gradual normalization of Ukraine’s exports cannot be ruled out. When the war ends, and as soon as logistical and security issues are overcome, the Ukrainians will probably be able to export the 2021/22 corn that is in their silos and also the 2022/23 corn that, despite everything, is being planted. But, with the Brazilian “safrinha” harvest about to begin, and with no sign, at least for now, of the conflict in Ukraine being resolved, it is more likely that importers will place most of their bets on the safest choice.