Insight Focus

- Brazilian fertiliser imports jumped 15% in Jan-May, with Russia remaining the top supplier

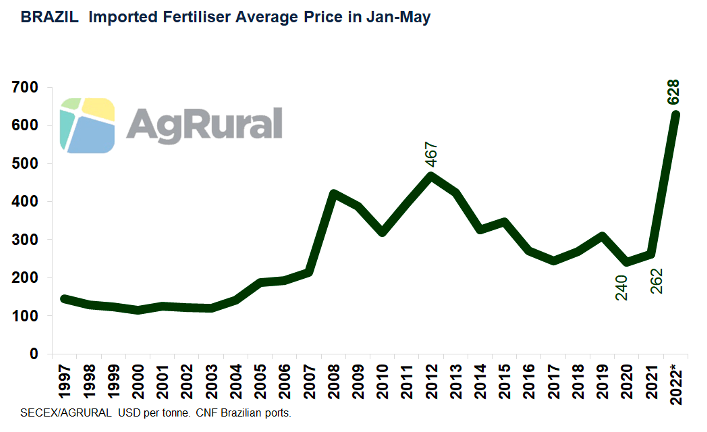

- The average imported price fertiliser more than doubled, raising production costs for the 2022/23 crop

- Nevertheless, Brazil’s soybean area is expected to grow 2.5%, to a record high 42m hectares

Soaring global food prices and speculation around the impact of Russia’s invasion of Ukraine on rain and oilseed supply have raised questions about how much Brazil can contribute to increasing world production. Despite not being a traditional wheat producer (it depends on imports for half of its consumption), the country has increased its exports and is expanding the planted area for the 2022-23 crop. Furthermore, the record high corn production that is being harvested now in the 2021-22 season will be key to filling the gap left by the sharp drop in exports from Ukraine.

But the main question about Brazil’s agricultural production that arose right after the invasion had to do with the its ability to sow a large soybean area in 2022-23 because the country relies heavily on fertilizer imports, most of which come from Russia. However, taking into account the pace of fertiliser imports in recent months and the first planting intention estimates for the new crop, which will be sown between September and December, it seems that Brazil will, once again secure, its spot as the world’s number one soybean producer.

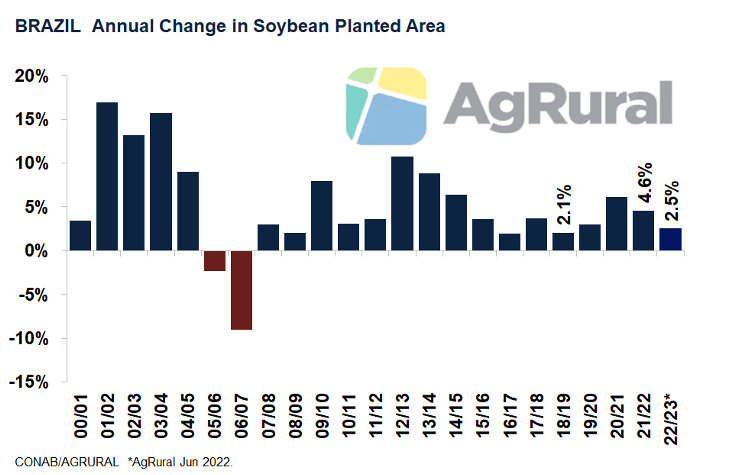

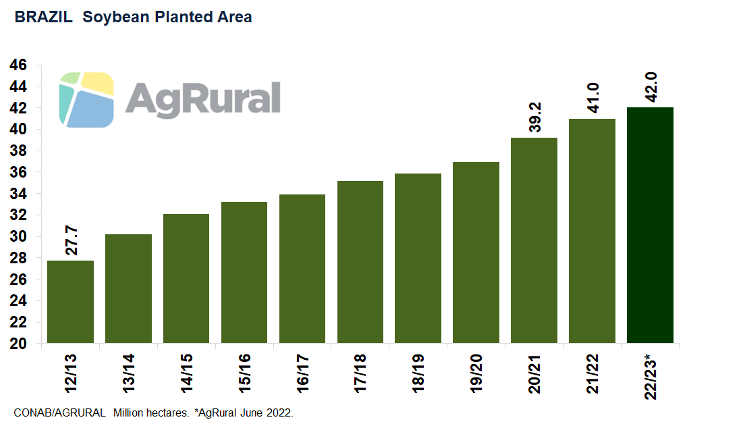

AgRural’s first estimate, which was finished last week, shows that Brazil is likely to increase the soybean area by 2.5% for the 2022-23 — less than the 4.6% expansion the previous season, but enough to secure 42 million hectares, 1 million more than the previous season and a record high.

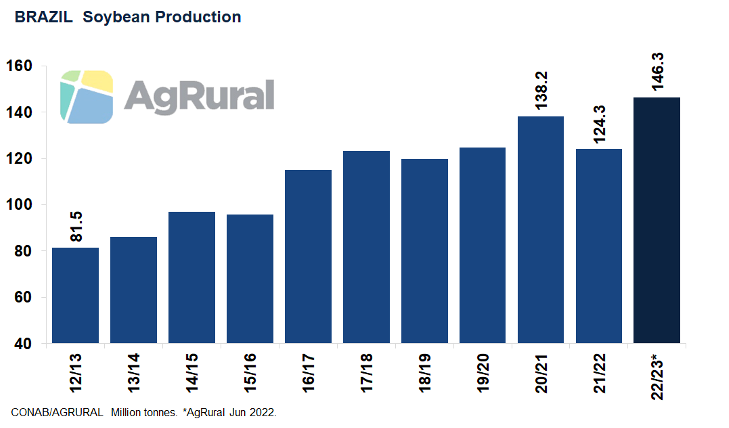

Assuming an average yield of 3.480 tonnes a hectare suggested by the 10-year trend line (up from the 3.032 tonnes harvested in 2021/22, when the crop was hit by drought, but down from the record 3.525 tonnes/ha in 2019/20), production could be 146.3m tonnes, compared with 124.3m in 2021-22 and 138.2m in 2019-20.

In May, the US Department of Agriculture estimated Brazil’s 2022-23 soybean area at 42 million ha, 1 million more than the previous crop. But the USDA is assuming an average yield of 3.550 tonnes/ha, which puts the projected production at 149m tonnes. Brazil’s crop agency Conab will release its first numbers for the 2022-23 crop in early October.

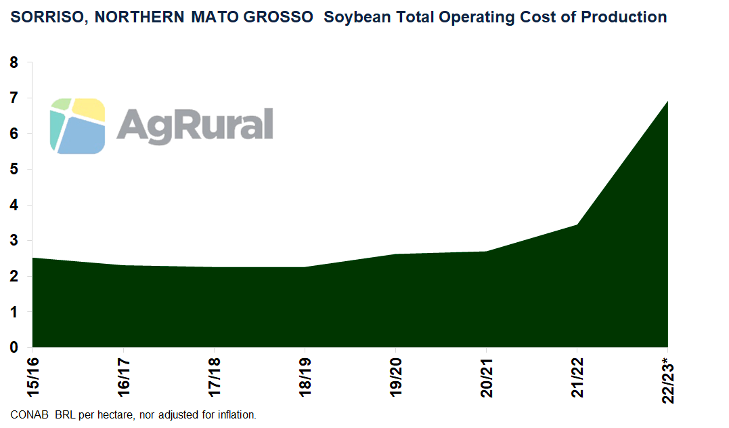

Production Cost Soars

The increase in Brazil’s soybean plantings will take place against the backdrop of a historical jump in production costs. According to AgRural, the average operating cost for landowners in northern Mato Grosso will reach around BRL 6,400/ha (USD 1,222/ha), up 53% on the year. It could be even more, but farmers in the state normally buy most of their inputs several months before the planting season, and that tradition has helped them mitigate the impact of higher fertiliser and chemical prices on their 2022-23 production costs.

Even so, in a scenario of firm prices, normal weather and good yields, planting soybeans is still a good deal – hence the expectation of a larger area. In northern Mato Grosso, 2022-23 net income on the operating cost is projected at 60% – about half the profitability of the 2021-22 season and the lowest since the 2019/20 crop, but still a very reasonable level for the region.

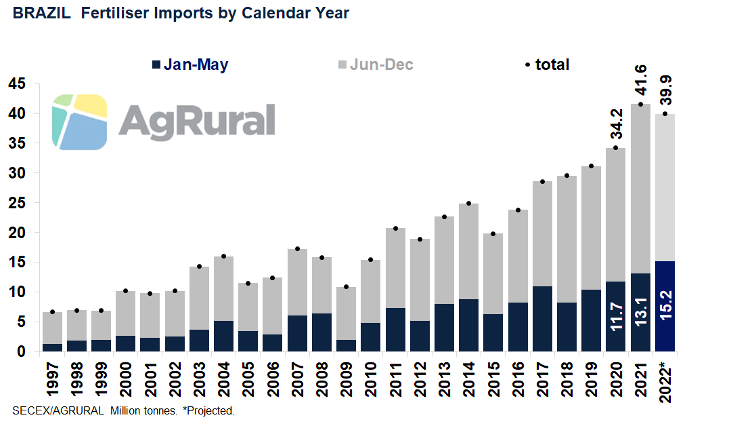

Fertiliser Imports Set New Record

Although much more expensive, fertilisers apparently won’t be as big of a problem for Brazil’s 2022-23 soybean crop as was thought shortly after the invasion of Ukraine and the imposition of sanctions on Russia. In addition to local initiatives for a more rational use of fertilisers, which will result in lower demand, fertiliser imports increased in the first five months of 2022.

From January to May, Brazilian ports received 15.2m tonnes of fertilisers, 16% more than a year earlier and a record high for the first five months of the year. Brazil is likely to slightly reduce its fertiliser imports until the end of 2022, but the total volume will still be the second-highest on record.

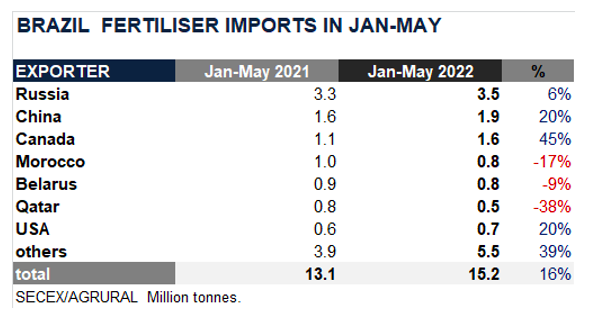

Considering the first five months of 2022, Russia remained as the main source of Brazilian fertiliser imports, on 3.5m tonnes, 6% more than a year earlier. The growth was driven by the strong performance in May, when Brazil received 1.1m tonnes of Russian fertilisers, 78% more than in May 2021. But imports from other sources in January-May grew even more than those from Russia, especially those from Canada (45%), the US and China (20% each).

The price paid for imported fertilisers from January to May, however, was high: USD 628/tonne, more than double that of year earlier and a record high.