Insight Focus

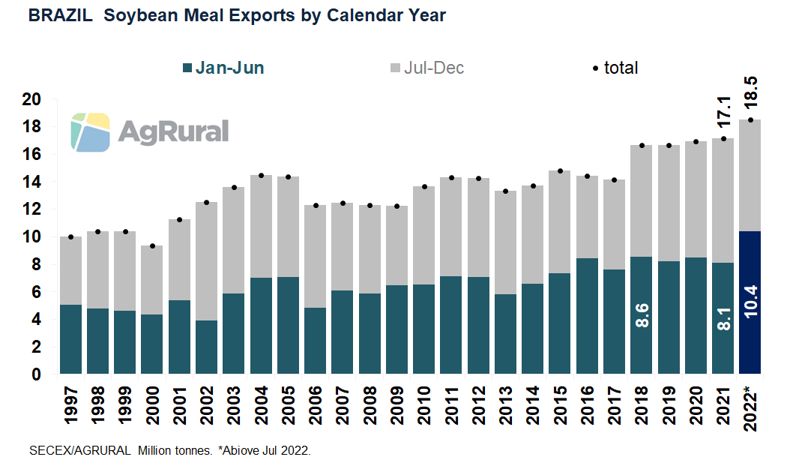

- Brazil exported 10.4m tonnes of soybean meal in H1 2022, a record-high for the period.

- 2021-22 soy crop failure has weighed on bean exports, but hasn’t prevented a rise in crushing.

- Lower domestic use of soybean meal due to less demand for meat, is driving meal exports.

Brazil’s soybean meal exports in the first half of the year hit a record high for the period. Data provided by the Ministry of Economy showed shipments totalled 10.4m tonnes, a 28% year-on-year increase and 21% higher than the previous 8.6m-tonne record set in 2018.

The main destinations were the EU (4.5m tonnes, up 20% on the year), Indonesia and Thailand (1.5m tonnes each, up 47% and 12%, respectively) and Vietnam (975k tonnes, almost double).

The Brazilian Association of Vegetable Oil Industries (Abiove) is forecasting that Brazil’s soybean meal exports will hit 18.5m tonnes in 2022, surpassing the

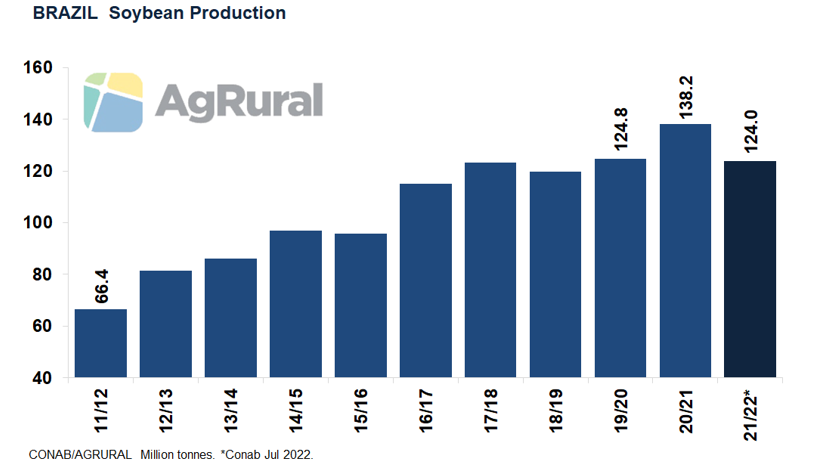

annual record set in 2021 by 1.4m tonnes. Oddly enough, this is all happening after a sharp drop in soybean production, with the 2021-22 crop, harvested from January to May, coming to a mere 124m tonnes, well below initial expectations of 145m due to the drought that affected southern producing areas.

Smaller Crop and Larger Crush

Despite the lower soybean harvest earlier this year, Abiove expects Brazil will crush 48.3m tonnes in 2022, up from 47.8m in 2021, when soy production was 138m tonnes. The soybean crush is growing at the expense of weaker soybean exports, which are estimated by most sources at 75m-77m tonnes, down from a record 86.1m last year.

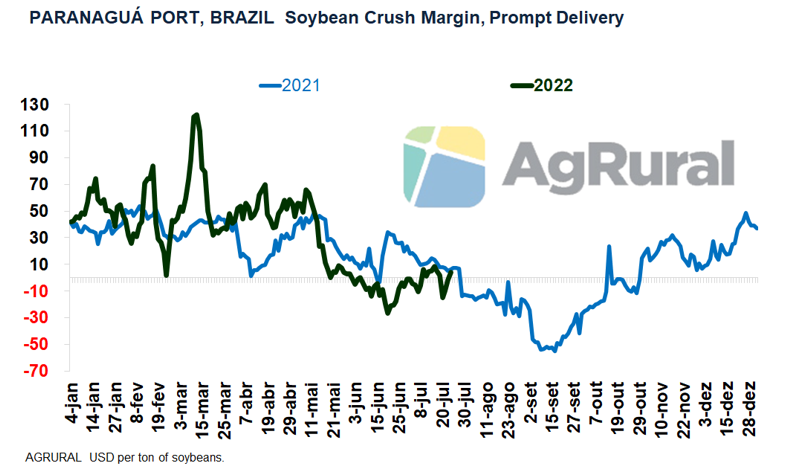

This reduction in soybean exports, in turn, is the result of lower imports by China and higher crushing margins in Brazil. Earlier in the year, margins hit historical highs, prompted by record vegetable oil prices and greater international demand for soybean oil and meal in the first six months of 2022, when Brazilian soybean products made up for part of the drop in oil and meal exports from other countries such as Indonesia, Ukraine and Argentina.

Falling Domestic Consumption

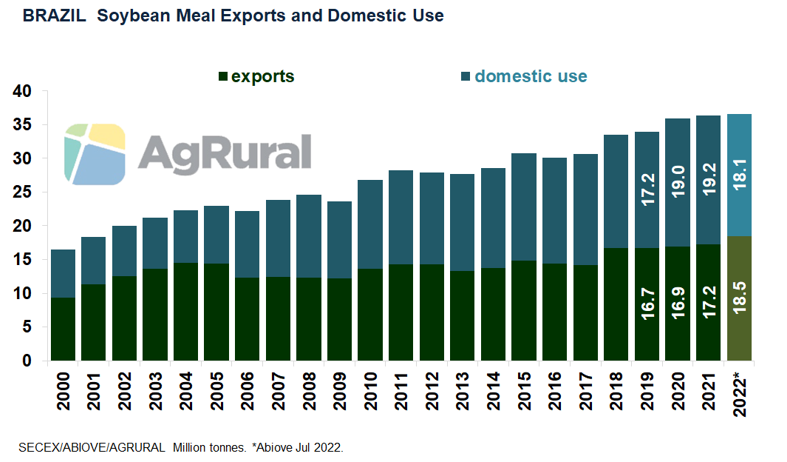

The jump in Brazilian soybean meal exports, however, can only be partly explained by the drop in soybean shipments and the increase of a mere half a million tonnes in crushing. With soybean meal production estimated by Abiove at 37m tonnes, slightly above the 36.8m produced last year, Brazil is only managing to significantly increase its meal exports because domestic consumption has been falling. According to Abiove, domestic demand is likely to total just 18.1m tonnes in 2022, 1.1m less than in 2021 and the lowest since 2019.

Difficult Moment in Meat Production

The world’s largest exporter of beef and chicken and fourth largest of pork, Brazil’s meat shipments have increased significantly over the past five years. Pork exports jumped 61% over the period, while beef shipments rose 40%. Chicken exports, a market in which Brazil has been the leader for the longest time, grew by 4%.

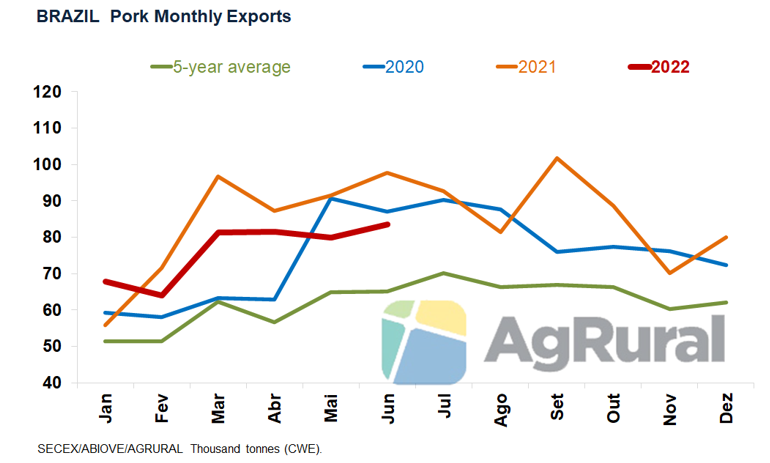

In the case of pork, exports were supported by the increase in Chinese demand between 2019 and 2021 due to African swine fever, which reduced China’s domestic production. In 2018, Brazil exported 722k tonnes of pork worldwide; in 2021, it exported 1.32m tonnes. In 2022, however, exports are expected to drop to around 1.25m tonnes because of the drop in Chinese purchases and domestic production stagnating because the increase in production costs and the difficulty in passing these costs on to consumers have shrunk producers’ margins.

Weaker Domestic Consumption

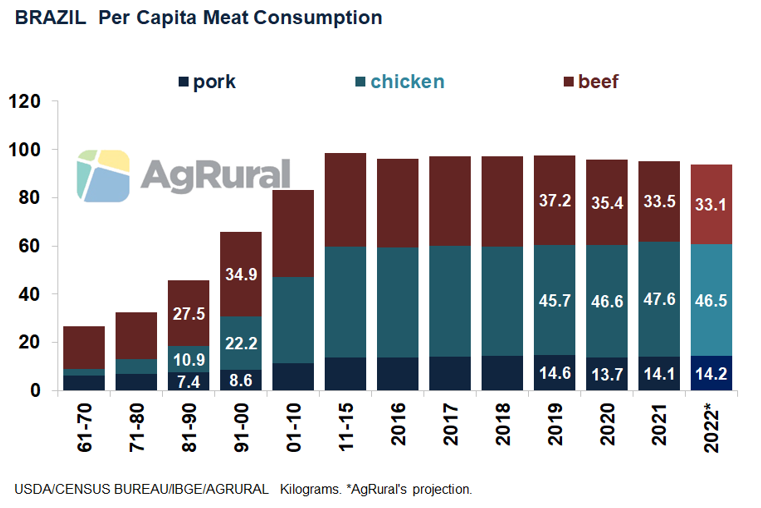

Contrary to what has been happening in the pork sector, Brazilian beef and chicken exports are continuing to grow in 2022 and are ensuring a more positive income scenario for producers. Brazilian domestic meat consumption, however, has been severely affected by the loss of consumer purchasing power over the past few years, which has been aggravated by the economic effects of the COVID-19 pandemic.

In 2021, per capita beef consumption in Brazil was the lowest since the 1980s. Pork and chicken, the production of which requires more soybean meal are cheaper alternatives. Even so, their combined consumption grew little in 2021 and is likely to fall in 2022. Under these conditions, domestic demand for soybean meal loses ground. The increase in international demand for Brazilian soybean meal, the growth in crushing margins and new the export record established in the first half of the year, therefore, are more than welcome to the Brazilian soybean industry.

Other Insights that may be of interest…

Why Soybean Meal Prices Are Diverging from Other Commodities

Rising Meat Prices Will Gnaw Away Demand

Have the Indicators the Supply Chain Should Monitor Changed?