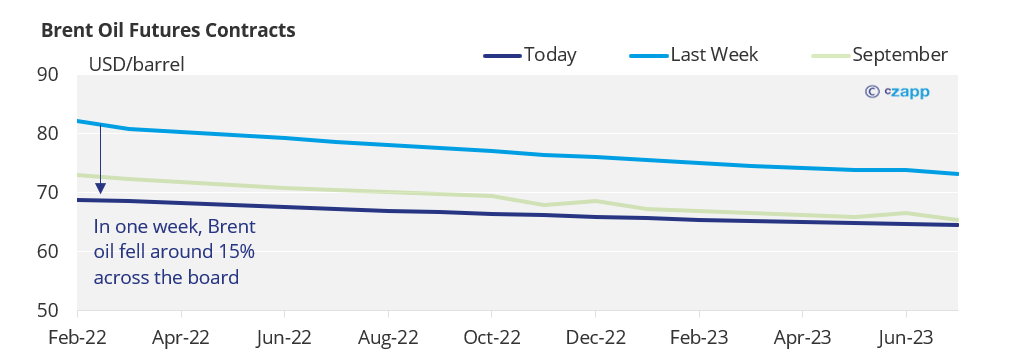

- Brent oil prices are down 15% across the board since last week.

- This has already been reflected on ethanol prices in Brazil.

- What happens to the sugar and ethanol parity if oil prices keep trading lower?

The Omicron Effect

- The discovery of another COVID variant, Omicron, has caused havoc in markets across the world since last week.

- Brent oil prices fell around 15% across the board in one week, going from over $80/barrel to under $70/barrel – at the time of writing.

- Once vaccination was leading a recovery in prices, as fuel demand was expected to pick up.

- Now, fear of more lockdowns imposed across the world lead to a bearish view for oil.

- Today, OPEC+ has a meeting to decide on whether it will stick with the initial plan of raising oil production by 400kbpd.

- But this path was drawn before this variable (Omicron) was added to the mix.

- In case it does decide to stay on course, the market reaction could be negative.

What Happens to the Ethanol Parity in Brazil?

- Just for you to see how dynamic things are, just 10 days ago we were writing about how ethanol had surpassed sugar at the spot parities and what to expect.

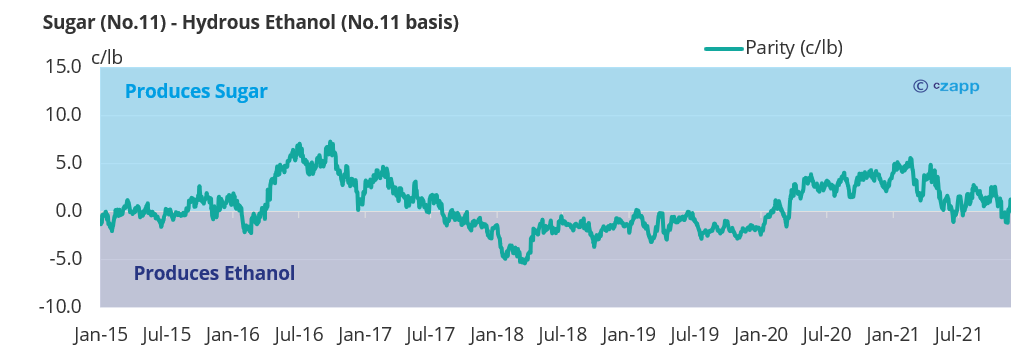

- The negative outlook for oil is already weighting on ethanol prices in Brazil, with the daily BM&F hydrous falling BRL100/cbm in 1 week.

- And the spot parity between sugar and ethanol now sees the sweetener paying over 100pts more than ethanol.

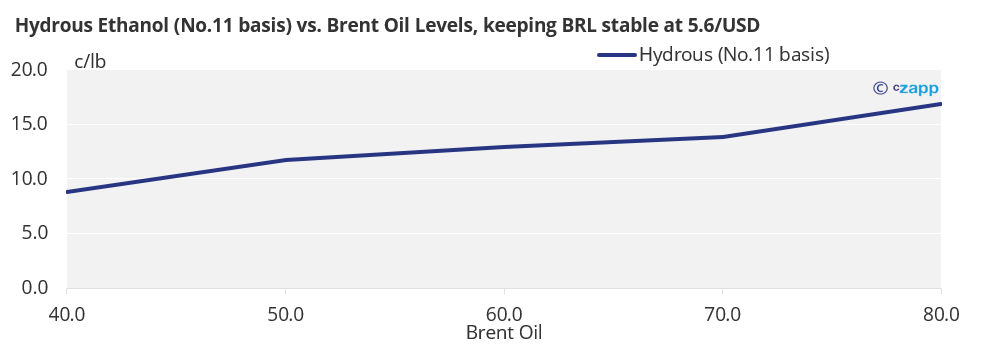

- But what happens to the ethanol parity if Brent oil prices continues to fall?

- Assuming a 70% parity for ethanol and gasoline (which is the limit for ethanol competitiveness), when we run the scenarios for different Brent oil prices, we get a level of hydrous and transform to a No.11 basis so we can compare to sugar No.11.

- Currently, ethanol prices are at around 17c/lb if Brent oil falls down to $50/barrel this means that hydrous ethanol could go down to under 15c/lb.

- And why is this important?

- This means that sugar support can fall since, even at a lower price point, Brazilian millers can capture higher returns with sugar than with ethanol.

- The lower Brent oil goes, the lower goes sugar downside…

A Brief Note on Ethanol and Gasoline Parity

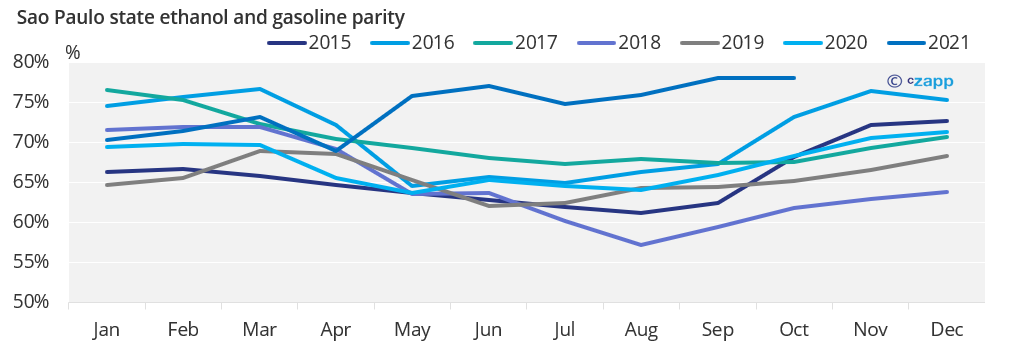

- In our model scenarios we run a 70% ethanol and gasoline parity since this is the benchmark for ethanol competitiveness.

- It works like a base scenario.

- However, ethanol and gasoline parity for this past 2021/22 season has averaged 74% – looking to SP state.

- Therefore, if you consider a higher parity then the support for ethanol becomes a bit higher.

Other Insights that may be of interest

- Will CS Brazil Shift from Sugar to Ethanol in 2022?

- Czapp Explains: Brazil Gasoline Price Composition

Interactive Data Reports that may be of interest…