- The wheat markets eased off recently since the Northern Hemisphere harvest rally began.

- Weather delays and subsequent quality and quantity concerns fuelled the rally.

- Will the rally resume, or do the WASDE numbers suggest the rally was short-lived?

Market Moves

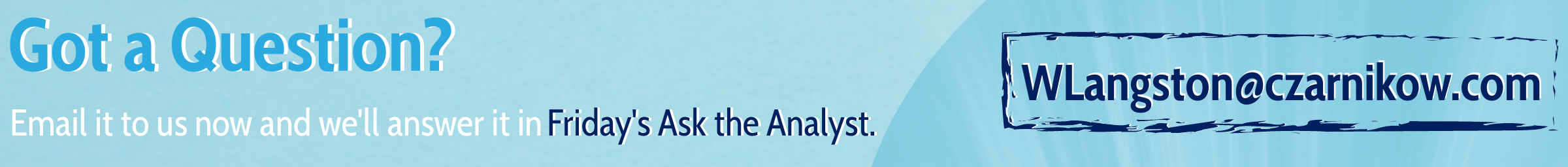

We can see from the general trend of the markets in Figure 1 that the global wheat markets have been on the rise for the last few months, until the latter half of August.

With record heat in the US and excess rain hampering harvests in Europe, the markets received the necessary feeding to keep the bulls in charge as the upward trend stirred concerns about global supply.

The last few weeks of price easing begs a simple question: are the bulls taking a breather, or do the supply and demand numbers stack up for the bears to take hold before 2021 nears its end?

Are the Supply and Demand Numbers Helping the Bulls or the Bears?

The latest global estimates published in the USDA’s September WASDE (World Agricultural Supply & Demand Estimates) may give some pointers.

The Bulls

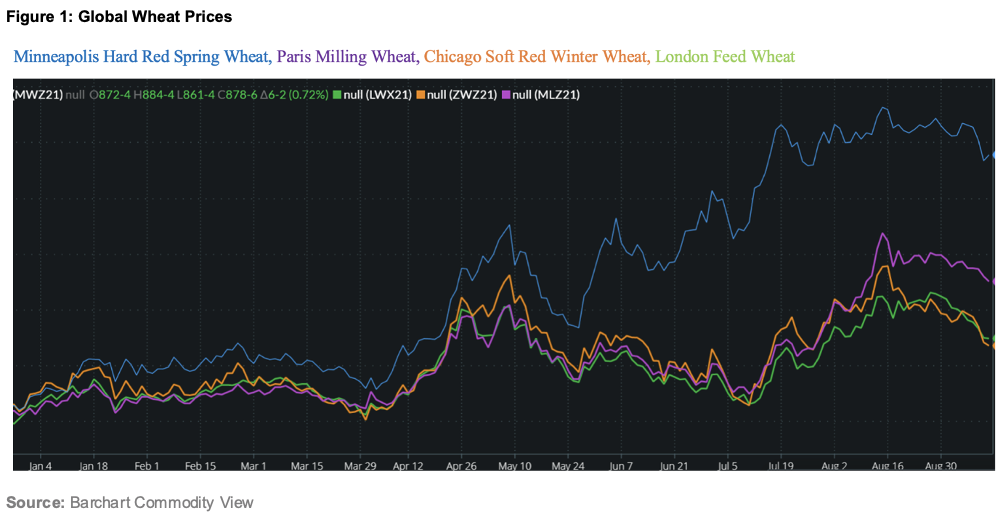

Global year end wheat stocks have fallen for the last three seasons.

The Bears

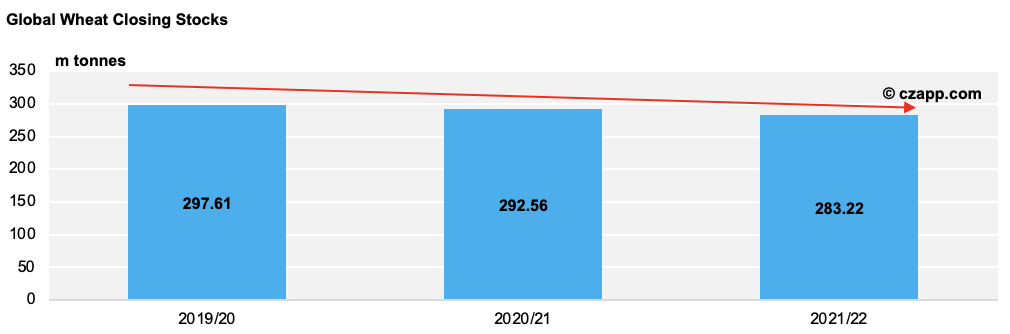

Global production is increasing.

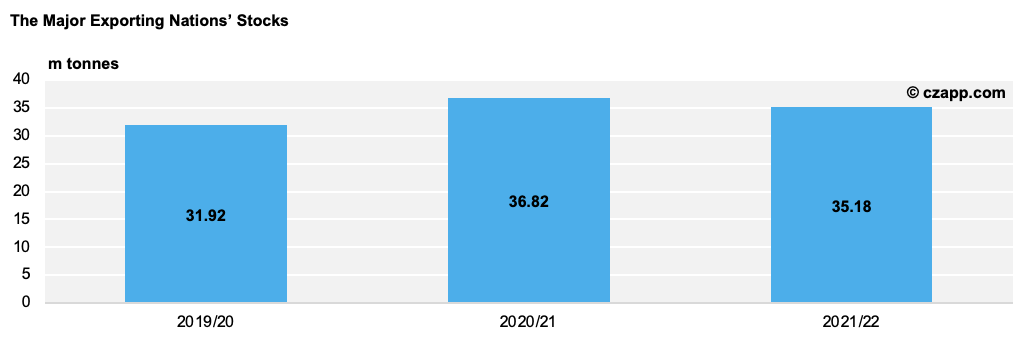

Stocks are stable in the major exporting nations.

Significant Southern Hemisphere wheat exporters, Australia and Argentina, are both on track for large harvests before the end of 2021 (31.5m tonnes and 20m tonnes respectively).

Other Influences

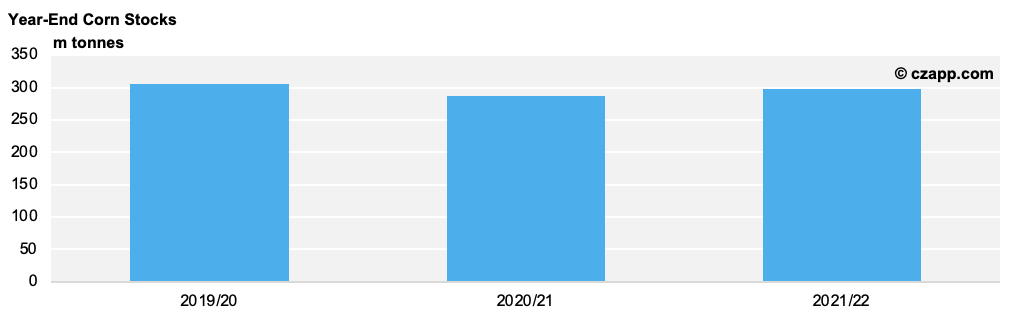

Global corn production is at 1197.77mmt (2021/22) up from 1186.12mmt in August and up from 1118.66mmt in 2019/20.

Year-end stocks are lower than recent years. However, stocks are up from the August number of 284.63mmt.

Weather uncertainty and potential weather extremes persist, particularly the drop in quantity and quality from the 2021 wheat harvest.

A Few Thoughts

The drop in global wheat stocks year-on-year has driven prices to high levels. However, the increased number in September (283.22mmt, up from 279.06mmt in August) will likely have a stabilising effect and ask questions of any raging bulls.

The reduced quality of the Northern Hemisphere milling wheat crop should keep high specification premiums at good levels – the knock-on effect being wheat unsuitable for milling, and thus added to the lower quality wheat stocks, encouraging the feed wheat bears.

Corn production and stocks is one to watch over the coming months. Changes here could impact the wheat market if supply becomes an issue. Currently, corn remains at a relatively large discount to wheat and would therefore need to gain some ground to really impact.

Conclusions

- Bulls need feeding on a virtually daily basis. Bears do not and have a greater market price influence if major news is scarce.

- September’s stock reduction in both wheat and corn should keep the lid on prices for now.

- The large Southern Hemisphere wheat crops need to materialise to maintain pressure on world prices.

- A fair Northern Hemisphere autumn with good planting conditions will provide the bears with food for thought in the longer term.

- The global numbers are pointing towards the bulls running out of enthusiasm for now with the bears gaining ground, but things can change abruptly.

Other Opinions You Might Be Interested In…

- Czapp Explains: Winter Wheat vs. Spring Wheat

- Czapp Explains: Hard Wheat vs. Soft Wheat

- The World’s Largest Wheat Producers and Exporters

- The World’s Largest Wheat Users and Importers