Insight Focus

BNDES expands financing to produce biofuels. New projects in South and Southeast Brazil for corn ethanol and biomethane are highlighted. At the same time, the Brazilian Industrial Research and Innovation Company is looking for new routes to produce SAF.

Sector becomes a priority for BNDES

Biofuels have never been so popular. From biodiesel to SAF, the sustainable aviation fuel, a range of solutions are gaining momentum so that the world can achieve ambitious decarbonization targets.

Brazil, which has broken records for clean energy generation, intends to stand out in this race. With an eye on the green agenda, the Chamber of Deputies recently approved the Future Fuel Law, which establishes goals and guidelines to produce biofuels. At the same time, BNDES (National Bank for Economic and Social Development) announced the expansion of financing lines for the sector, which has become a priority.

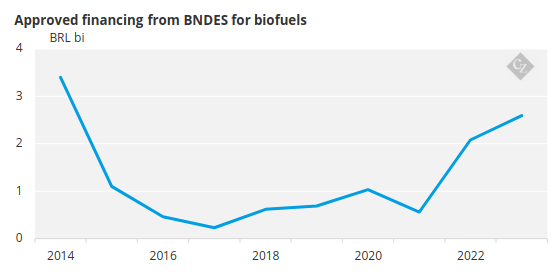

Source: BNDES.

In 2023, the release of almost R$2.6 billion was authorized to produce biofuels, 25% more than in 2022. “This year, this amount will be exceeded, as the alternative fuel area is a priority”, says José Luis Gordon, director of productive development, innovation and foreign trade at BNDES, in an interview with Czapp.

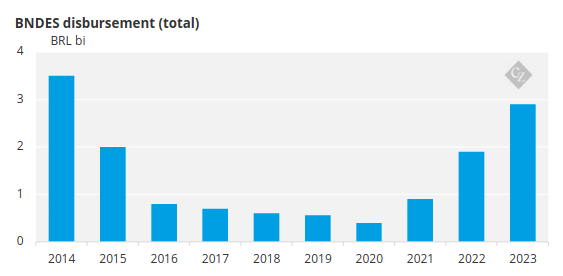

In general, the BNDES has increased the release of resources, including for other sectors, including agribusiness and industry. But the highlight really goes to biofuels.

Source: BNDES.

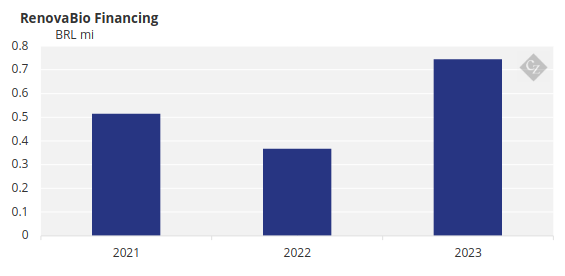

The bank works with some financing lines for the biofuels sector, such as Finem, Finame and RenovaBio (this one, since 2021). In relation to RenovaBio, 13 operations have already been approved (in 2023 alone, BNDES authorized the release of BRL 744 million for this program). The objective is to encourage certification of biofuel production, such as ethanol and biomethane, and reduce greenhouse gas emissions.

Source: BNDES.

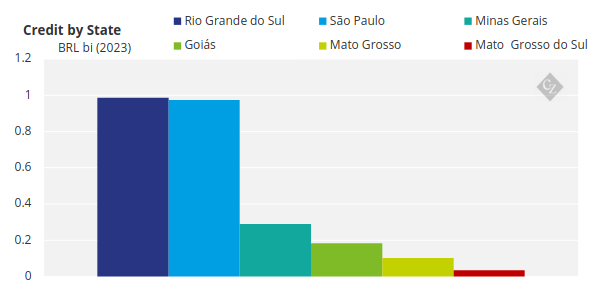

Several projects are being directed to the manufacture of ethanol and biomethane, especially in São Paulo and Rio Grande do Sul. “We have received many corn ethanol producers interested in increasing production, with emphasis on those located in the south of the country”, says Gordon.

Source: BNDES.

Last year, the bank approved financing of BRL 729.7 million for a project to build a corn and wheat ethanol factory for the company Be8 in Rio Grande do Sul. The expectation is that the production capacity will be 209 million liters per year, based on processing 525 thousand tons of grains.

Another company awarded BNDES financing was Bioo Holding, controlled by Cótica Energia. Around BRL 157 million should be used for the construction of a biomethane plant in Triunfo, Rio Grande do Sul. Also, in the biomethane sector, BRL 93.8 million was released for an Essencis plant in the city of Caieiras, in São Paulo, whose production should be sold by companies such as Ultragaz and Neogás.

SAF

The country has also invested in research into the production of SAF. In the public sector, Embrapii (Brazilian Industrial Research and Innovation Company), a state-owned company, entered a partnership with UFRJ (Federal University of Rio de Janeiro) and Petrogal, an energy company, to develop a SAF production route. The project has resources of around BRL 21 million.

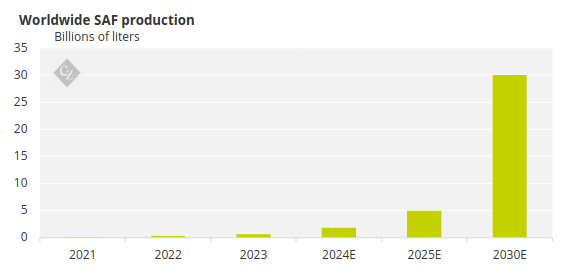

Source: IATA.

“The idea is to produce ethanol from green hydrogen, which is one of Brazil’s bets on alternative fuels and, from there, manufacture SAF”, says Marcelo Prim, president of Embrapii. “SAF is made of hydrocarbons, present in hydrogen. The issue is finding a way to manufacture on a scale at an affordable cost,” he explains.

The research should take a few years – by then, the expectation is that Brazil will be better positioned in the global race for decarbonization, with new plants in operation and greater incentives for the sector.