Insight Focus

- EU targets 90% beverage bottle collection by 2029; currently collection average 61%.

- Digital DRS are being trialed in some supermarkets and towns in the UK and Belgium.

- Digital, app-based collection programs could supplement traditional DRS and boost rates.

Enhancing Recycling Through Deposit Return Schemes

European governments are actively exploring strategies to bolster recycling efforts, aligning with a range of legislative goals and obligations.

Under the EU’s Single-Use Plastics Directive, there are ambitious targets to achieve a 77% collection rate for plastic bottles by 2025, escalating to 90% by 2029.

Yet, data from 2020 reveals that the average collection rate stands at approximately 61%, as reported in the PETCORE’s PET Market in Europe: State of Play 2022 report.

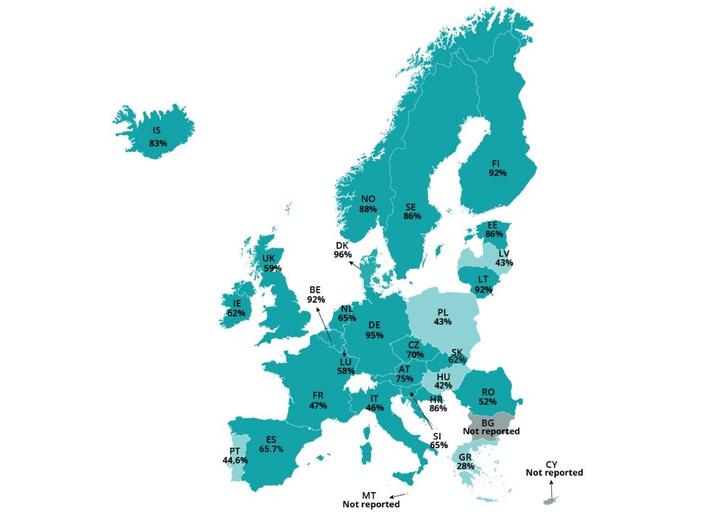

European Bottle Collection Rate. Source: UNESDA.

In general, countries in Europe that have already established Deposit Return Schemes (DRS) demonstrate higher success rates in recycling designated products, notably certain beverage containers.

Out of the ten European countries with fully operational DRS systems, nine have achieved recycling rates of 83% or higher. The Netherlands, due to partial coverage, registers a collection rate of 65%. Notably, Germany leads the way with a remarkable recycling rate of over 95% for PET bottles.

Source: iStock

However, the implementation of DRS systems within a country often encounters a series of challenges:

Cost of Implementation: The expenses associated with introducing a DRS can be substantial, particularly for larger nations. This includes investments in establishing collection and recycling infrastructure, as well as educating consumers about the system.

Public Awareness and Acceptance: The success of any DRS hinges on high levels of public awareness and acceptance. This necessitates comprehensive educational campaigns and active public engagement.

Collection and Recycling Infrastructure: A functional DRS mandates the presence of a robust collection and recycling infrastructure. This encompasses an adequate number of collection points, such as curbside recycling bins and on-the-go reverse vending machines, coupled with the capability to process the collected materials effectively.

Enforcement: Effective enforcement of DRS principles is essential to guarantee that consumers return their containers and that businesses fully adhere to the scheme. A successful approach combines education, monitoring, and penalties as necessary.

Moreover, the coordination of various stakeholders, including government bodies, businesses, and consumers, often emerges as a pivotal challenge in DRS implementation.

Establishing a transparent and efficient governance structure is indispensable to ensure the scheme is both executed and managed effectively.

Scotland’s recent ill-fated attempt to roll-out a DRS independent of the rest of the UK, underscores the significance of a unified approach amongst shareholders. The Scottish DRS is now scheduled for October 2025 at the earliest, in line with the rest of the UK.

What Is a Digital Deposit Return Scheme?

Many current proposals for Deposit Return Schemes primarily rely on the widespread use of Reverse Vending Machine (RVM) technology.

Reverse Vend. Source: Tomra

In contrast, a Digital Deposit Return Scheme (DDRS) represents an innovative approach to recycling beverage containers, utilizing digital technology to enhance consumer convenience. DDRS systems also primarily revolve around kerbside collection methods.

DDRS is still in its early developmental stages but holds the potential to revolutionize the recycling of beverage containers. By simplifying and streamlining the recycling process, DDRS aims to boost recycling rates and reduce litter.

Under a DDRS, consumers make a small deposit when purchasing a beverage in a container, such as a plastic bottle, metal can, or glass bottle. They can then reclaim this deposit by scanning a unique code on the container through a smartphone app. This code is linked to the consumer’s digital wallet, enabling the automatic refunding of the deposit upon scanning.

Consumers may also have the flexibility to redeem their deposits at various locations, including kerbside recycling bins, on-the-go reverse vending machines, and participating retailers.

Recent Examples:

UK-based Innovators Collaborate (Polytag, Bower, Ocado Retail): In a ground-breaking initiative, UK recycling technology innovators Polytag and the Swedish recycling app Bower have partnered with Ocado Retail, the world’s largest online supermarket.

Source: PolyTag

This initiative allows Ocado Retail customers to receive financial rewards for recycling milk bottles by scanning QR codes on the bottles. These codes offer cash rewards, coupons, or charity donations through the Bower app.

Nestlé Waters Supports Recycling Trial in Wales (Buxton Water): Buxton natural mineral water brand has participated in a unique recycling trial in Brecon, South Wales.

Source: Nestle

This trial explores the use of digital technology in a deposit return scheme for drink containers. It involves households scanning labeled containers with their mobile phones and recycling them through kerbside collection or designated return points around the town.

DDRS Trials Planned in Belgium: The Flemish region in Belgium plans to introduce a deposit system for plastic beverage bottles and cans in 2025. Consumers will not need to physically return the containers to shops; instead, they can scan codes on both the containers and recycling bins, with the money deposited directly into their accounts.

Benefits and Pitfalls of DDRS

Pros of DDRS:

- Enhanced Convenience: DDRS offers consumers a hassle-free method for reclaiming deposits, eliminating the need to visit specific locations.

- Inclusivity: DDRS benefits individuals with disabilities and those in rural areas, making recycling more accessible.

- Data Accessibility: The use of QR codes enables real-time tracking of packaging lifecycles and recycling rates.

- Cost Savings: Environmental consultancy Resource Futures estimates significant cost savings over traditional DRS, as DDRS eliminates the need for widespread reverse vending machines.

Cons and Challenges:

- Material Quality: Recycling quality from existing kerbside bins may be lower compared to dedicated DRS channels.

- Data Ownership: Concerns about data ownership and access need to be addressed for transparency.

- Potential for Fraud: There is potential for fraud, but mitigation strategies such as GPS and AI technology can help identify and prevent fraudulent activities.

Despite these challenges, data shows that 84% of the UK population uses a smartphone for private use, and Ocado surveys show that 80% or more of customer were likely or very likely to scan a QR code for a deposit return.

In summary, DDRS could be a very effective way to speed up the implementation of deposit returns, boost recycling rates and facilitate the transition to a more circular packaging economy.