691 words / 3 minute reading time

- The obvious headlines surrounding the global Skimmed Milk Powder (SMP) market focus on COVID-19 and the current dry conditions in New Zealand; both of these risks were discussed in our previous SMP report.

- Another factor, which received attention earlier in the year, was whether or not India would need to import SMP.

- Perhaps India’s reservoir levels could be a key indicator of India’s import requirements…?

The Indian SMP Economy

Indian Consumption and Trade

- India is both the largest producer and consumer of dairy in the world. Usually it is reasonably balanced with local supply meeting local demand. But on occasion, India can materially enter the global dairy trade market – particularly for SMP.

- Import tariffs are currently 60% for all major dairy exporters of SMP.

- A rumour earlier in 2020 was that due to a late monsoon, the Indian Government would lift tariffs and India would become a net importer of over 50k tonnes of SMP in 2020.

Indian Production

- India currently produces just under 200m tonnes of milk per year (equivalent to ~18.6m tonnes of SMP + ~9.8m tonnes of butter under the unrealistic assumption that all milk is processed and processed into the SMP/Butter stream).

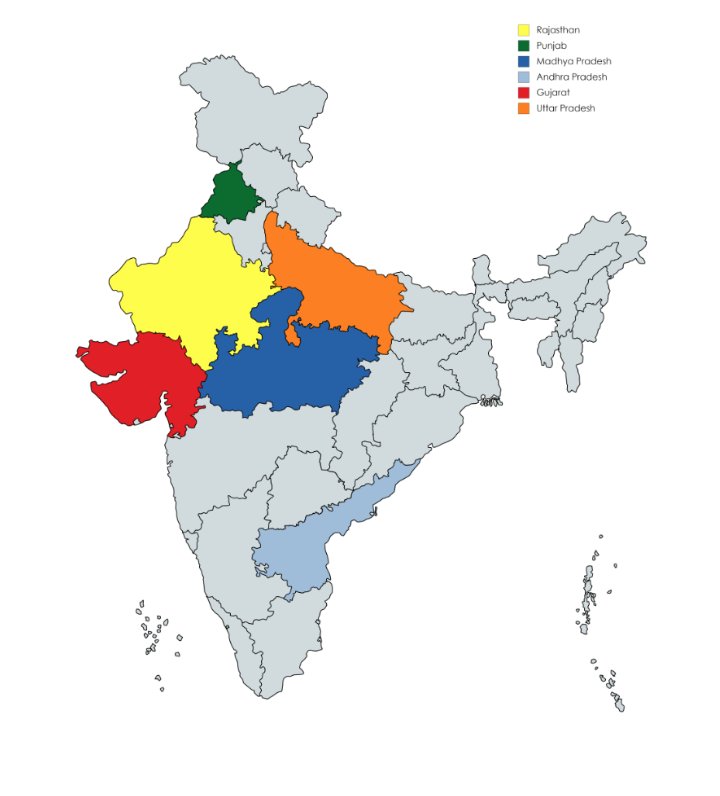

- The top six dairy producing states accounting for ~60% of all production in India:

The Hypothesis: Full Reservoirs Will Lead to Good Pastures and More Milk

- You can now track India’s reservoir levels using our new Interactive Data tool.

- Reservoir levels are measured in BCM (billion cubic metres).

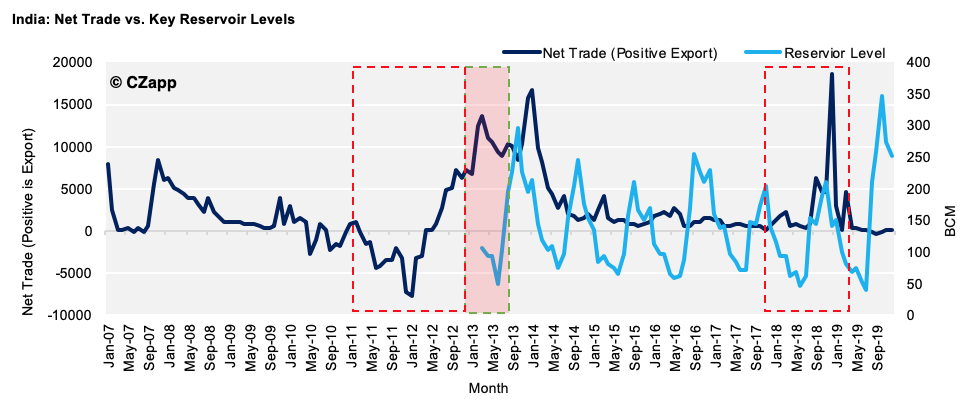

- At first glance, there appears to be no relationship between available reservoir levels in the key states and Indian dairy trade.

- But we need to adjust for:

1. Key Indian dairy trade policies that skew the above data over recent years (indicated in the red boxes above).

- An export ban between Feb’11 and Feb’12 caused a local glut in SMP stocks, which then took until approximately Jun’13 to clear.

- A large stockpile in SMP caused the Central Government to implement subsidies on exports from Apr-18 to Mar-19.

2. Seasonality in both trade and reservoir levels.

3. The lag between reservoir levels changing and net Indian SMP trade changing exists because of the time taken for the following to be impacted:

- pasture growth

- subsequent milk collections

- forward-contracting product because of this change in milk collections (exports and/or imports)

- publication of product shipments in trade statistics

4. With these factors considered, the calculated lag is eight months.

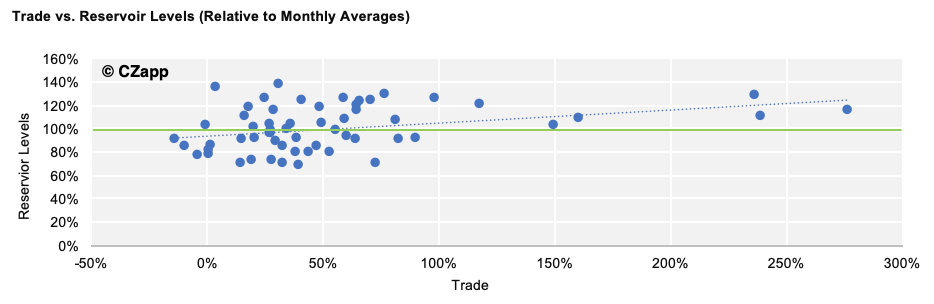

- This allows us to distinguish more of a relationship. Though only 12% of the variance in trade is explained by the reservoir levels (relative to averages).

- You will notice that, if the reservoirs are below average (dots below green line), net trade is always below average.

- This means that either exports are lower or India becomes a net importer.

- Importantly, the only instances of imports occur when reservoirs levels are below average eight months prior.

How Does This Impact Global Prices?

- 62% of the time, the reservoir level in key Indian states correctly leads the price change in eight months’ time.

- For example, if reservoir levels were above average, then eight months later the global SMP price declined (and vice versa for levels below average).

- So, What are the Reservoir Levels Indicating for Trade and Price Now?

- We can use this model to help predict the trade volumes up until Oct’20.

- By inputting the reservoir level data we have into the model, it predicts that net exports from India will be ~7% higher than normal, with only March trade being slightly below average.

- Extrapolating this 10 month forecast to the full year of 2020 suggests net SMP exports from India could be ~35k tonnes in 2020.

- The further inference we can take from this, holding all else equal, is for SMP price declines in five of the next eight months.

- Thus, based on the data we do have, it seems highly unlikely that the Indian government will issue import licences for SMP at any stage this year.

Sources: FAO, Indian Central Water Commission (data displayed on Czapp), Global Trade Tracker, USDA