Insight Focus

- Trove Research think the carbon offset market could grow by up to 40% this year.

- 4,253 companies have now set Science Based Target Initiative-endorsed emission targets.

- Average prices for carbon credits were higher in 2022 than 2021.

Carbon offset market forecast to grow by as much as 40% in 2023 – analyst

The primary market for voluntary carbon credits could increase by as much as 40% to around $1.9 billion in value in 2023, assuming prices and demand continue to increase at recent rates, according to Trove Research.

Trove analysts cautioned however that if retirement levels and prices fail to increase materially, the value of the market may remain unchanged at around $1.3 billion next year.

Analysts at the company, a leading carbon credit research firm, presented their review of the market in 2022 and preview of this year’s conditions in a webinar on Tuesday.

The number of companies setting Science Based Target Initiative-endorsed emission reduction goals reached a new peak of 4,253 at the end of 2022, including blue-chip names including Sony, DHL, Lufthansa, Delta Airlines and Cemex, Trove analysts noted.

While the pace of adoption of SBTI targets slowed in the fourth quarter, the market also received important guidance from a number of key sources including the ISO and United Nations that will help corporates in setting climate targets and in their adoption of carbon offsets as part of their strategy.

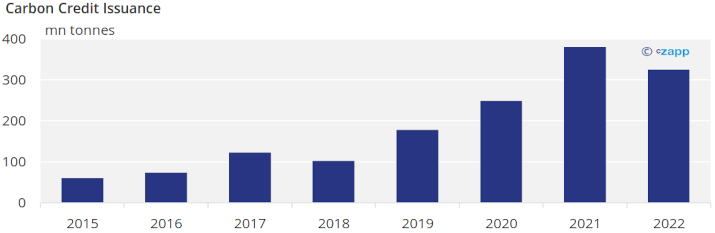

SUPPLY

Supply of carbon offsets fell 14% in 2022 to 325 million tonnes, Trove found, due largely to moratoria on the sale of credits implemented by the governments of Indonesia, Papua New Guinea and Honduras. These countries have been significant sellers of carbon offsets from REDD+ in previous years, and the overall volume of REDD+ credits issued dropped by around one-third last year as a result.

Nonetheless, around 40% of last year’s total supply was for offsets generated by nature-based solutions such as REDD+ and nature restoration, while renewable energy offsets made up a similar amount.

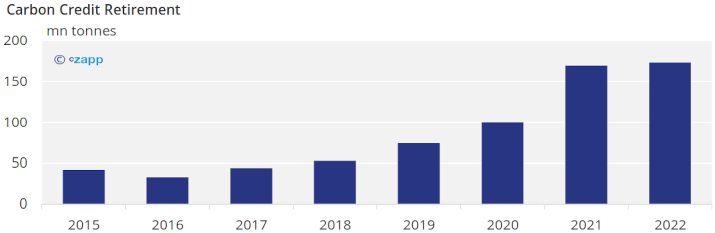

DEMAND/RETIREMENTS

Credit retirements in 2022 totalled 173 million, an increase of 2% from the previous year, despite global macroeconomic headwinds stemming from Russia’s invasion of Ukraine and the energy crisis.

A key feature of credit retirements in 2022 was that corporates chose to retire much younger credits than in previous years, according to Trove research.

“Generally, you might expect that the average vintage year of retired credits would increase by one year, every year,” company analysts said. “However, last year, the average retired credit vintage year increased by about three years, from 2015 to 2018.”

One of the fastest-growing sectors of demand in 2022 was for high-tech and permanent removals. Technologies such as direct air capture, biochar and mineralisation are moving towards large-scale deployment, and while purchases from these project types totalled just 590,000 tonnes in 2022, this was a five-fold increase over 2021.

“We should expect to see more pockets of those kinds of highly desirable projects coming to the fore, Trove founder Guy Turner said, highlighting the growing demand for “blue carbon” offsets generated by projects based in coastal and ocean ecosystems.

SUPPLY-DEMAND

The global surplus of unretired carbon credits grew by 27% to 751 million tonnes, Trove said, including around 150 million tonnes of offsets that are from older vintage projects that are regarded as less desirable by corporate buyers.

Critically, the volume of potential offsets from projects that have not yet been approved more than doubled last year, from 200 million to 529 million tonnes.

“This massive increase in capacity points to a growing investment in carbon projects,” Trove said, though it cautioned that not all these projects will eventually be completed.

PRICE

The average weighted price for all transacted credits in 2022 was $8.80/tonne, up 40% from 2021’s average $6.30, according to Trove research.

Despite the year-on-year average increase, prices for all classes of offset ended the year lower than where they began it, due primarily to the impact of the war in Ukraine.

A poll of more than 300 market participants on price expectations for this year, taken during the webinar, found that renewable energy credits are expected to end the year trading unchanged between $3-$6/tonne. Clean cookstove credits were forecast to reach $7-$10, REDD+ at $11-$14 and nature restoration between $15-$18/tonne.