Insight Focus

- Electricity generation accounts for almost half of all demand for EU emissions allowances.

- Public power generation across the EU has fallen 3.5% year-on-year.

- ICIS expects EUA prices to end the year at €81 per tonne.

EU carbon price outlook for rest of 2023 depends on utility demand, says Independent Chemical & Energy Market Intelligence (ICIS).

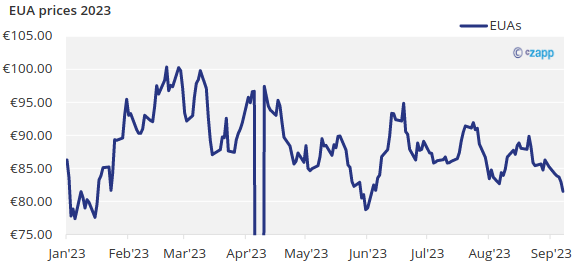

After briefly rising above €100 per tonne early in the year, European carbon prices have fallen back to trade largely unchanged compared to the final price in 2022. The benchmark December futures contract closed on 8 September at €81.52 per tonne, some 2.9% below the 31 December 2022 closing price.

Europe’s macroeconomic outlook has steadily darkened over the course of the year as industrial output has waned and inflationary pressures have eaten into demand for electricity.

Data from the Fraunhofer Institute in Germany show that between January and August, public power generation across the EU has fallen 3.5% year-on-year.

Within this total, generation from carbon-intensive hard coal and lignite has dropped by 33% and 24% year-on-year respectively. At the same time, power generated from natural gas was down 9.7%, while power from renewable sources was 4.7% higher.

With electricity generation accounting for almost half of all demand for EU emissions allowances, the impact of this decline is significant, particularly since coal and lignite generation emits twice as much carbon dioxide as natural gas.

Furthermore, power companies sell a large portion of the generation up to three years in advance, and in order to hedge these sales, utilities will buy fuel and carbon allowances on a forward basis as well.

Last year’s spike in energy costs led to a significant drop in the amount of forward electricity sales, which also means that demand for EU Allowances (EUAs) from utilities has fallen below levels seen in previous years.

Analysts at ICIS assert that utility hedging has fallen below pre-Ukraine crisis levels for the last three quarters.

“Open interest for the German Year+1 [electricity] contract in 2023 has remained stubbornly below the 3-year average and is still not back in line with 2022 levels,” the analysts wrote in a recent report, referring to the volume of power sold on a forward basis.

ICIS noted that a few major utilities have said they will ramp up forward hedging in 2023, since the energy market appears to be “normalising” in the wake of the 2022 energy crisis. But others, the company said, “appear to remain more prudent, with lower hedge ratios…amid an uncertainty energy market landscape.”

With activity in the German year-ahead electricity contract having slightly narrowed the year-on-year decline in June, the analysts suggested that demand for EUAs could increase in the coming months.

On the other hand, the prospects for industrial demand remains gloomy, with “no signs of recovery in Europe”.

The analysts calculated that industrial emissions are likely to fall by 5% in 2023, with three-quarters of this decline coming from the metals, chemicals and cement sectors.

“It is the demand outlook which continues to present the most significant downside risk for production levels in 2023,” they said. “According to reports from major EU producers, most expect either stable or suboptimal demand for their products in 2023 and a gradual recovery only from 2024.”

“Overall, we see limited prospect for a tangible recovery in industrial emissions in H2 2023. Furthermore, risk of slower industrial output/emissions recovery is on the table if we were to see credit conditions continue to tighten in the coming months.”

As a result, ICIS expects EUA prices to end the year at €81/tonne, a drop of 3.5% year-on-year. While prices may test levels below €80 in the short term, the fundamental shortfall of supply on an annual basis will prevent prices straying too far below this level.