Insight Focus

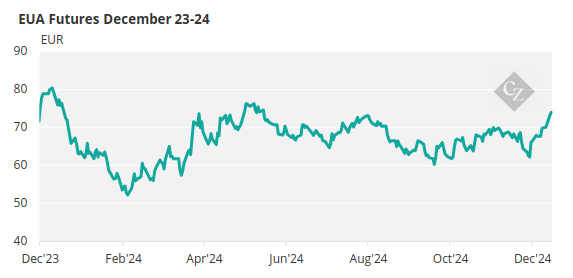

EUA prices rallied EUR 13/tonne over the second half of December. Lack of liquidity and speculative buying drive the market during holiday season. Weather and gas supply are expected to remain key price drivers

Carbon Prices Surge in December

EU Allowance prices rallied by as much as EUR 13/tonne over the second half of December, tracking strength in natural gas as traders fretted over the outlook for gas supply.

Source: ICE

December 2025 EUAs rallied from as low as EUR 64.67/tonne on December 16 to a seven-month high of EUR 76.35/tonne on January 3, boosted by speculative traders building positions in the new front-December contract. The holiday season meant that trading activity was quieter than normal, allowing buyers to push prices higher.

Prices have peaked for the short term, falling back to EUR 74/tonne on January 6 amid some profit-taking, and market participants are eyeing the resumption of daily EUA auctions on January 7, which many believe will cap the recent rally.

Europe will sell nearly 293 million EUAs at auction in the first half of the year, just 10 million more than over the same period in 2024, according to data from the EEX exchange, which carries out the sales.

The outlook for prices depends largely on developments in the gas market. With European stockpiles at their lowest January levels for three years, any spikes in demand for gas will likely trigger sharp price rises, which will in turn feed through to carbon.

Data show that the short-term correlation between front-month TTF gas and front-December EUA prices remains in excess of 0.8, with speculative flows maintaining the two markets’ close link. While carbon rose by EUR 13/tonne in the last two weeks of 2024, front-month TTF gas jumped nearly 25%.

The market will see some changes in 2025 that could shift the demand between supply and demand.

EU ETS Expansion in 2025

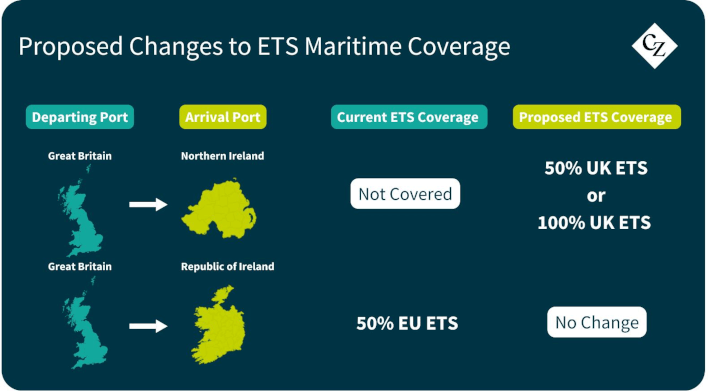

The expansion of the EU ETS to cover maritime emissions, which started in 2024, will deepen its influence this year, as shippers will be required to surrender EUAs covering 70% of their emissions, compared to just 40% in 2024.

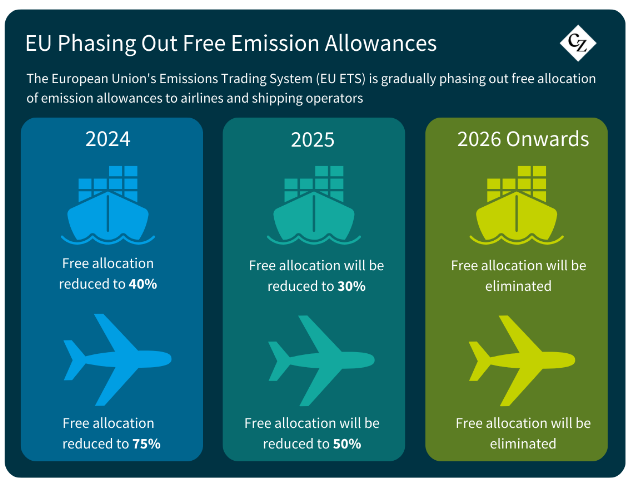

At the same time, airlines will continue to see their quota of freely allocated EUAs shrink further. The aviation sector saw its fire handouts cut by 25% in 2024, and this year will bring a further 50% reduction, leading to the elimination of all free EUA allocation in 2026.

Both these developments are expected to bring more marginal buying activity into the market, most likely through intermediaries such as brokers and aggregators rather than through direct futures participation.

The first evidence of this new demand may come in April, when verified data for 2024 is expected to be published by the European Commission, including maritime emissions for the first time.

REPowerEU Impacts on Market

Further ahead, some analysts are expecting early position-building in 2025 ahead of the end of the REPowerEU programme.

The initiative is selling the equivalent of EUR 20 billion worth of EUAs – initially planned to be some 250 million allowances – between 2023 and 2026 to fund the EU’s transition away from Russian fossil fuels and into renewable resources. These allowances are being taken from future member state supply and from EU-wide reserves set aside for modernisation.

The programme has so far generated around 40% of its goal, and estimates show that the EU may need to sell up to 300 million permits to achieve its funding target. The Commission is expected to update the schedule of sales late this year.

REPowerEU comes to an end in 2026, at which point member state EUA supply will drop sharply, and it is this sudden shift that many stakeholders are expecting to drive a steep rally in EUA prices. Some longer-term participants may see 2025’s market as an opportunity to build low-priced positions ahead of the expected upswing.