Opinion Focus

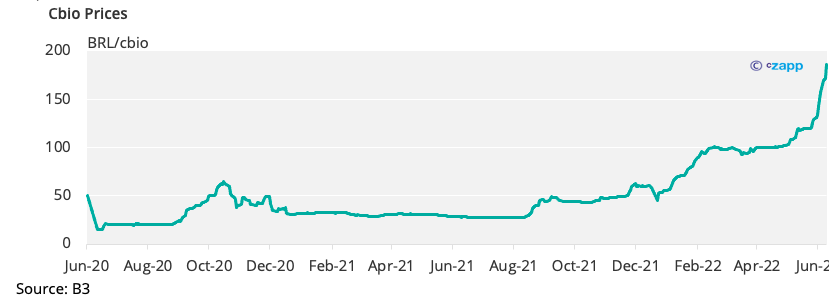

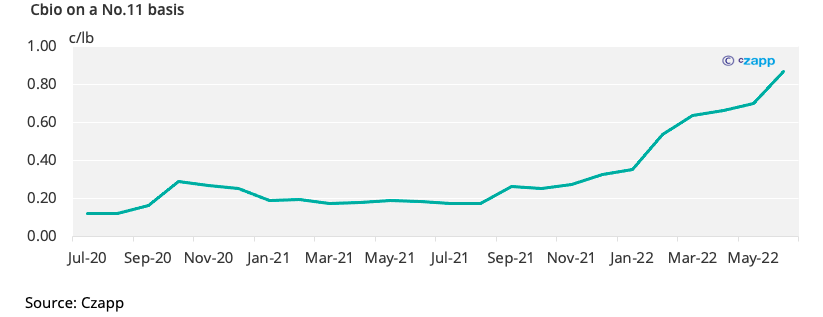

- Brazilian CBIO carbon credits have more than tripled since January.

- This means extra revenue for Brazilian mills that are certified in the Renovabio program.

- Are Cbio prices high enough to change the sugar mix?

Brazilian CBIO carbon credit has more than tripled since January due to uncertainties about their availability, greater participation in the market by speculative players and distributors looking to meet their mandatory requirements.

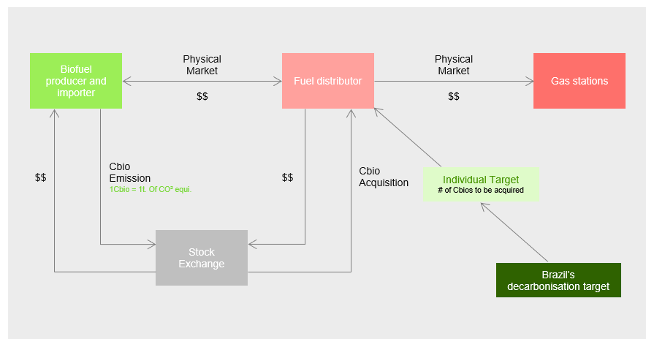

CBIOs are created once the certified mills in Renovabio sell a volume of ethanol. Depending on the efficiency of the mill (measured by its carbon intensity score), a certain amount of ethanol will result in the issuance of a CBIO. In Centre South Brazil), the average amount of hydrous ethanol production required to issue a CBIO is around 883 litres.

For example, a mill that sells 100m litres of hydrous ethanol each season, could issue around 120k CBIOs resulting in an average revenue of BRL11.6m (USD2.3m) – assuming the average CBIO price so far this year.

Higher Ethanol Parity

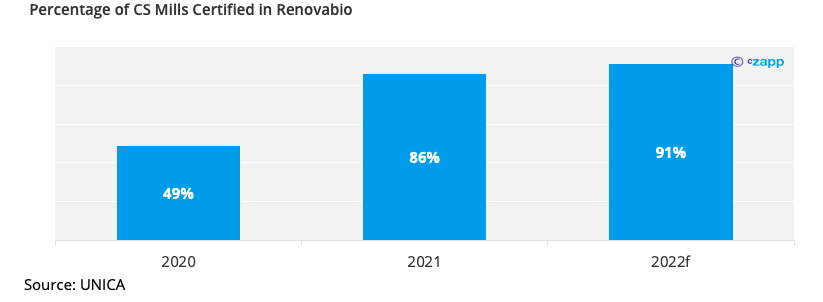

Certification for the Renovabio program began in 2020, and now almost all of CS Brazilian mills are a part of the program and eligible to issue and sell CBIOs.

This means that the parity calculation between sugar and ethanol now has one more component.

Virtually every mill in CS Brazil now adds in the CBIO price to ethanol when comparing sugar returns. And as CBIO prices rise, it makes ethanol even more attractive.

While until last year CBIOs represented and extra 20 points, they are now closer to 100 points.

Factoring in CBIOs, ethanol is now paying 100 points above sugar, but it is still not enough to divert most mills away from sugar production. Recent changes in fuel taxes are making the ethanol environment uncertain once again. Furthermore, the sector has priced over 80% of the sugar production this season having locked in favourable prices.

For the moment, we are sticking to our 43,8% sugar mix estimate for the 2022-23 season in CS Brazil.

You can follow CBIO prices and the new sugar and ethanol parity in our Sugar or Ethanol Report.

Reminder: What is RenovaBio?

- RenovaBio is the Brazilian national biofuels program launched in 2016

- The main instrument of the program, in accordance with the Paris Agreement, is the establishment of annual national decarbonization targets for the fuel sector.

- The national targets will be divided into mandatory individual targets for fuel distributors

- To meet their goal, fuel distributors will need to acquire CBIO certificates on the stock exchange

- Each CBIO corresponds to a tonne of carbon that is not released into the atmosphere.

- Biofuel producers voluntarily issue CBIOs, And the amount each mill can issue is based on their energy-environmental efficiency rating of the volume of biofuels sold.

Other Insights That May Be of Interest…

Why Brazil’s ICMS Tax Matters to the Ethanol, Sugar Markets

New Brazil Tax Proposals Could Be Bearish for Ethanol, Sugar

RenovaBio Brazil: Cbio Price Rises 225%

Explainers That May Be of Interest…